With banks digitizing nearly all aspects of their businesses, recruiting software developers has become a top priority. Some large banks like JPMorgan Chase are offering coding training even for employees not in technological roles.

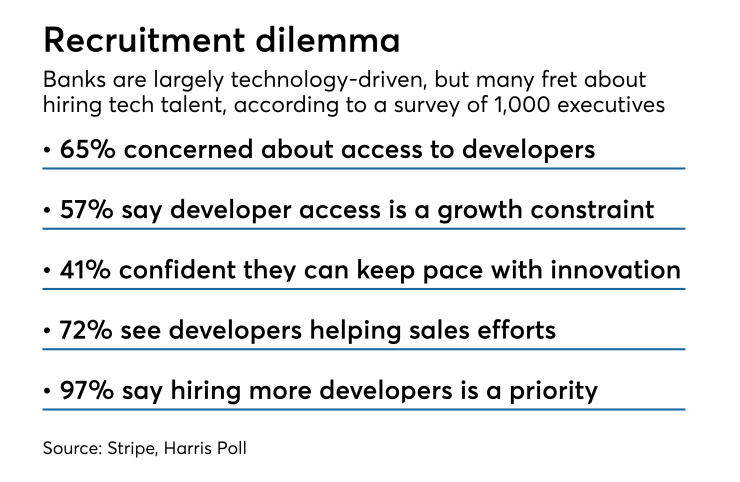

A new global survey of 1,000 executives, sponsored by the payments fintech Stripe and conducted by Harris Insights & Analytics, highlights the anxiety in having to compete with big tech for top talent: Sixty-five percent of executives at banks and financial firms worry about access to enough skilled software engineers, a higher percentage than those concerned about either access to capital or corporate tax rates.

The tussle for tech talent has even reached the recruitment of summer interns, as BlackRock now offers $5,400 a month to compete with Google’s $6,000, according to a recent CNBC news report.

But banks stumble in their appeal for skilled workers because they aren’t offering the type of innovative work that ambitious programmers are seeking, the survey found.

The same executives overwhelmingly said they are not deploying their existing tech teams as efficiently as they could. Top developers are mired in wrangling with layers of legacy IT infrastructure and bad code instead of creating innovative products that can increase banks’ bottom line.

“About a third of developers’ time, 17 hours, is devoted to legacy IT and bad code. All that stuff is not productive. That’s a huge chunk of productivity that is lost,” said Richard Alfonsi, head of global revenue and growth at Stripe, citing the study. “I call it tech debt. That’s a huge amount of money left on the table.”

Stripe calculated that these inefficiencies are costing companies around the world around $300 billion a year or $3 trillion over the next decade.

Alfonsi suggested banks need to outsource the “boring stuff” to cloud infrastructure companies like Amazon Web Services or invest in more application programming interfaces, so that outside innovation can help solve legacy IT issues.

“You can outsource to a third party and have the developers you hire focus on your core business,” he said.

The survey also polled 1,000 software developers. “Nearly two-thirds of developers agree" that time spent fixing bad code "is 'excessive' and believe that clear prioritization, responsibilities, and long-term product goals would improve their own productivity,” the report said.

Besides drags on productivity, another challenge that banks may overlook is the lack of diversity on tech teams, said Mark Schwanhausser, director of digital banking at Javelin Strategy & Research.

“To create great products, you need a diversity of opinion,” said Schwanhausser, who pointed out that diversity as a concern is not touched in the survey. “If you have a gender imbalance, you are missing a potential huge market. If everybody is coming at something with a single view, you are probably missing something.”

-

There are ways for banks to gain an edge against the likes of Google and Facebook for the best software developers.

September 5 -

Acquiring fintechs can be a smart way for banks to access needed tech talent, but they must be careful not to stifle innovation in the merger.

September 7 -

With competitive pressure mounting from trendy software companies, banks are trying out new ways to attract the most-sought-after technical talent and modernizing their career websites' interfaces to better showcase their cultures.

July 31 -

U.S. banks lag the technology, telecommunications and energy sectors in what they pay employees, according to new data. The gap suggests that the industry may not be the acting aggressively enough to remake itself for the digital age.

March 30

Schwanhausser noted the downward, nationwide trend of women graduating with computer and information sciences degrees. In a report, the U.S. Department of Education said that about 18% of individuals receiving degrees in computer and information sciences were women in 2016, versus in 1984, when 37% were women.

“Do we have the right makeup of a team?” is a question banks need to ask, Schwanhausser said. “Do we have what we really need in order to be truly innovative?”

The relatively recent explosion of coding clubs and coding boot camps for underrepresented demographics may help. One Boston nonprofit for at-risk youth counts Bank of New York Mellon among the firms that snatch up its

“With the pace of digital disruption these days, we’re seeing a high demand for engineers of all levels to help deliver digital initiatives. This includes software engineers with years of experience to those that do a ‘code in 21 days’ course,” said Matthew Markham, a partner at the consulting firm Capco.

Training and recruiting tech talent is crucial if banks are compete in the future, said Emily Steele, president in North America for Temenos, a software financial services company.

“What we’re seeing in the industry matches Stripe and Harris Poll’s finding that 87% said software development is a core competency of their business and the majority see it becoming more of a core competency in the next 10 years,” Steele said. “The need for ongoing and innovative development will only continue to grow.”