-

The Detroit company's charge-offs on consumer auto loans rose sharply last quarter. Its CEO said he's confident losses will decline, but the next few quarters "will be choppy."

October 18 -

A top executive at the auto lender said that more borrowers struggled to repay their loans over the summer amid inflation and a tougher job market. Late payments on auto loans rose by more than Ally expected in July and August.

September 10 -

The Detroit-based auto lender has been dealing with an imbalance in deposit costs and loan yield since rates rapidly rose. Now, the bank's fixed-rate loans from before are maturing.

July 17 -

The Detroit-based company is exploring ways to make more consumer auto loans without running afoul of stricter capital standards that are expected from the Federal Reserve. Possible approaches include more securitizations and the use of credit risk transfers.

April 18 -

JPMorgan Chase's board has announced the slate of candidates to replace Jamie Dimon if he ever retires. The bank is just one of several large institutions that have recently decided on who will take over the top job.

April 10 -

Some online banks that offer high-yield savings accounts are making those products a little less high-yielding. Banks are also shortening the duration of new CDs, hoping that anticipated rate cuts by the Fed will enable them to start paying less to consumers.

April 9 -

Ally Financial ended a six-month search for its next chief executive by hiring Discover CEO Michael Rhodes. The move adds a new wrinkle to Discover's pending sale, though Discover said that Rhodes hadn't been expected to have a long-term role at Capital One following the merger's completion.

March 27 -

Investors drove up the stock prices of both companies after Ally Financial said it's selling its point-of-sale lending business to Synchrony Financial. The deal is expected to help Ally focus on its bread-and-butter auto lending business, while also aiding Synchrony's efforts to gain market share.

January 19 -

Douglas Timmerman, the company's president of dealer financial services, will step in when Jeffrey Brown departs at the end of January. Ally continues its hunt for a permanent CEO.

January 12 -

Scott Stengel, who has been Ally's general counsel since 2016, will succeed Ellen Fitzsimmons, who is retiring after four years as head of legal affairs at Truist.

December 13 -

The Detroit-based firm said the job cuts will occur across divisions and aren't isolated to a single line of business.

October 3 -

Brown has been with the online lender almost since it was spun off from General Motors, helping it broaden its product offerings and take a stand on overdraft fees. Now he must help Ally confront a looming recession.

November 21 -

Women focused on environmental, social and governance issues are seeing career opportunities open as sustainable finance initiatives become more critical to a bank's success.

October 9 -

Though quantum computing is not quite ready, banks are testing it for portfolio optimization, index tracking, options pricing and other tough mathematical problems.

September 22 -

By taking the manual labor out of data management and upkeep, experts can reach new clients and better serve their existing ones.

July 7 -

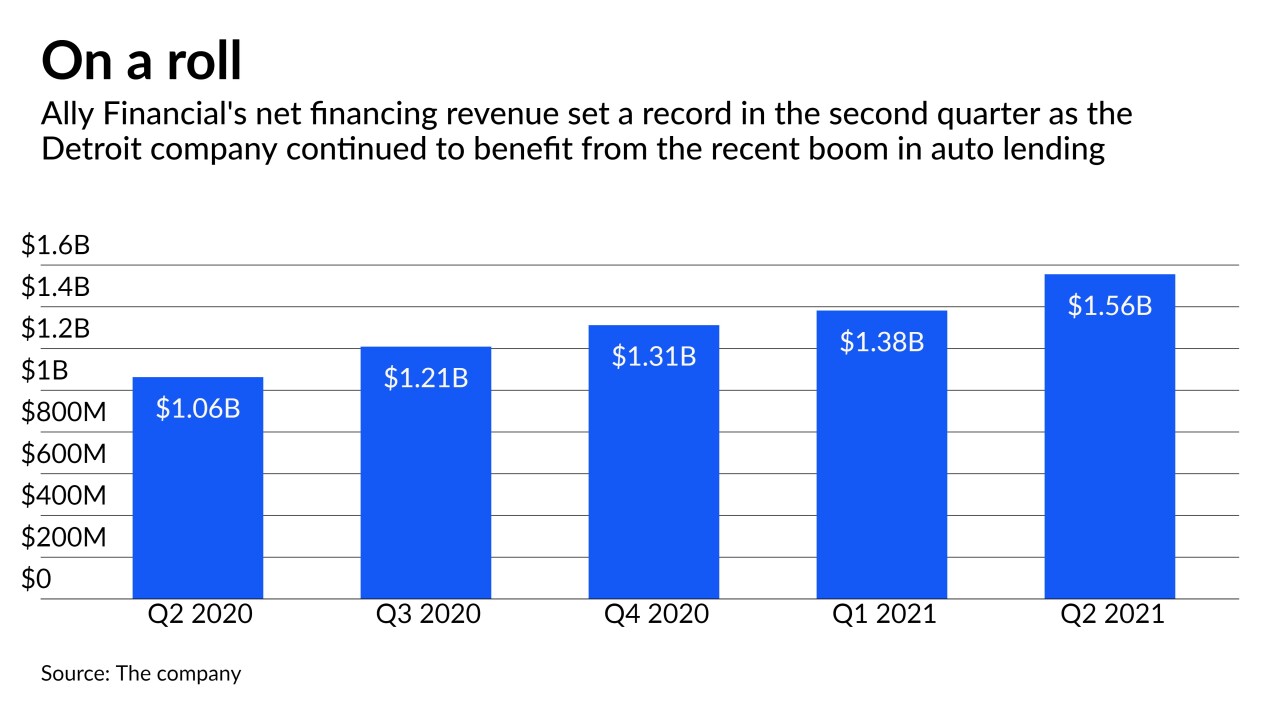

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Ally and Huntington are the latest banks to take steps that will reduce revenue from customers who spend money they don’t have. The moves come at a time when technological, regulatory and social forces are converging to encourage change.

June 3 -

The online bank's decision to stop charging the fees is part of a broader reassessment across the industry. Ally had waived overdraft fees early in the pandemic and has historically been less reliant on them than many other institutions.

June 2 -

Other banks soured on their AR experiments, but Ally Financial says the technology has yielded higher-balance deposit accounts — and heavier social media engagement — in marketing campaigns.

May 10 -

At the brokerage and wealth management arm of Ally Financial, Bell leads the team responsible for shaping the insight on investing and the global markets that is shared with customers.

May 5