-

By taking the manual labor out of data management and upkeep, experts can reach new clients and better serve their existing ones.

July 7 -

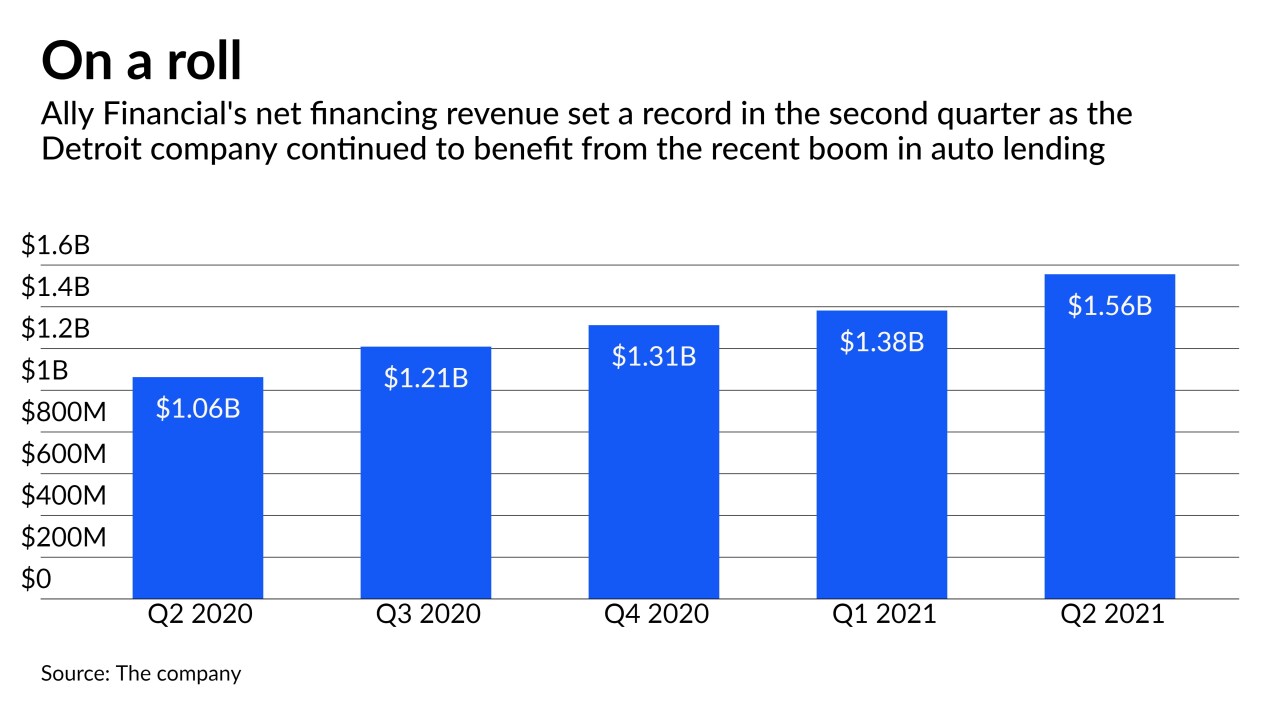

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Ally and Huntington are the latest banks to take steps that will reduce revenue from customers who spend money they don’t have. The moves come at a time when technological, regulatory and social forces are converging to encourage change.

June 3 -

The online bank's decision to stop charging the fees is part of a broader reassessment across the industry. Ally had waived overdraft fees early in the pandemic and has historically been less reliant on them than many other institutions.

June 2 -

Other banks soured on their AR experiments, but Ally Financial says the technology has yielded higher-balance deposit accounts — and heavier social media engagement — in marketing campaigns.

May 10 -

At the brokerage and wealth management arm of Ally Financial, Bell leads the team responsible for shaping the insight on investing and the global markets that is shared with customers.

May 5 -

Surging used-car prices — brought on by a combination of strong consumer demand and limited new-vehicle supply — are boosting loan yields and profits at the Detroit company.

April 16 -

The auto finance company, which had stumbled in forays into the credit card business, is now seeing rapid growth in mortgage and unsecured consumer lending.

January 22 -

The digital-only bank is running a new promotion in which it will set up and fund, with $250, an online savings account for any baby born on New Year’s Eve.

December 16 -

The automaker is reportedly planning to apply for a bank charter so it could collect deposits and grow its own auto-finance business. That could create more competition for Ally, which was spun off from GM in 2006 but remains a key lending partner.

December 9