-

It has been 15 years since the federal banking agencies issued guidance on an institution’s obligation to inform its regulator about a cyberattack. A proposal to be unveiled this week could establish a more specific notification deadline.

December 14 -

Capital One contends point of sale credit transactions are too risky to support, but competitors believe it's credit card debt that's falling out of favor with consumers.

December 8 -

Dean, who joined Capital One in 2014, succeeds Kleber Santos, who left the bank earlier this month to lead diversity initiatives at Wells Fargo.

November 10 -

Kleber Santos will be responsible for building a more inclusive workforce and designing products that meet the needs of a broader, more diverse range of customers.

November 2 -

Payment rates for auto lenders and credit card issuers have remained strong despite a spike in unemployment. Whether these trends continue into 2021 will depend largely on the actions of Congress and the pace of medical advances.

November 2 -

Lenders have spent months puzzled by the persistently low delinquencies on their credit cards. Now, they’re seizing the moment.

October 23 -

In her steady advance up the payments industry career ladder, Colleen Taylor has pursued a consistent theme of taking on challenging roles at pivotal moments, which has propelled her trajectory.

September 10 -

Capital One Financial is reining in credit lines to reduce its exposure while the nation’s largest card issuer, JPMorgan Chase, is rolling out a new card designed for travelers and diners.

September 1 -

Some customers have complained of limits being slashed by one-third to two-thirds, eroding their ability to borrow in an emergency during a pandemic or potentially hurting their credit scores.

August 28 -

Some customers have complained of limits being slashed by one-third to two-thirds, eroding their ability to borrow in an emergency during a pandemic or potentially hurting their credit scores.

August 28 -

John Collins comes to the credit union industry after spending 20 years in a variety of roles at the national bank, including helping integrate two acquisitions.

August 26 -

A year-old data breach, which earned the company an $80 million OCC penalty this week, continues to offer lessons to banks as they put more sensitive information in the hands of cloud vendors.

August 7 -

Regulators found fault with the bank’s cloud migration efforts in the years that preceded a 2019 hacking incident.

August 6 -

“We do not yet know when we’ll return to a more traditional operating model,” a company spokesperson said.

August 5 -

Delinquencies have been ticking up since the start of the coronavirus pandemic and Capital One is warning of more pain unless the government provides additional relief to tenants and landlords.

July 22 -

Since March, issuers have tightened their criteria for opening new accounts and closed millions of existing ones in hopes of avoiding waves of defaults.

May 29 -

The lender’s offices in the U.S., Canada and the U.K. will remain shut to all nonessential staff at least through the Labor Day holiday on Sept. 7, CEO Richard Fairbank wrote in an internal memo.

May 5 -

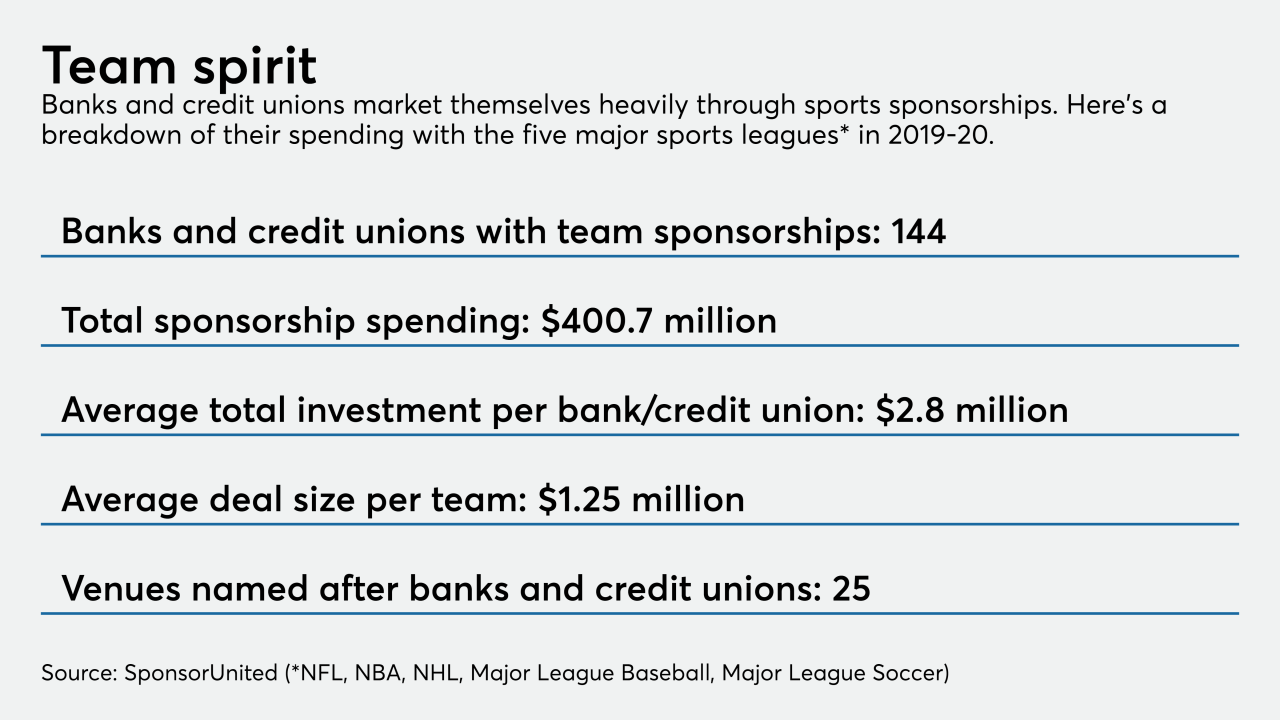

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

May 3 -

The ratings firm also took negative action with respect to Ally, Synchrony, Discover, Sallie Mae and Navient, citing the impact that the coronavirus crisis is having on their revenues and profits.

April 29 -

The company reported a loss of $1.3 billion in the first quarter after setting aside more than $5.4 billion for potential loan losses.

April 24