Citizens Financial

Citizens Financial

Citizens Financial Group is a retail bank holding company operating primarily in the New England, Mid-Atlantic, and Midwest regions of the United States. The bank operates through two segments: consumer and commercial banking.

-

Household debt is higher than ever, and delinquencies in credit cards and unsecured personal loans are edging upward. Bruce Van Saun, chairman and CEO of Citizens Financial, shares his views on the market and the business opportunities there.

May 10 -

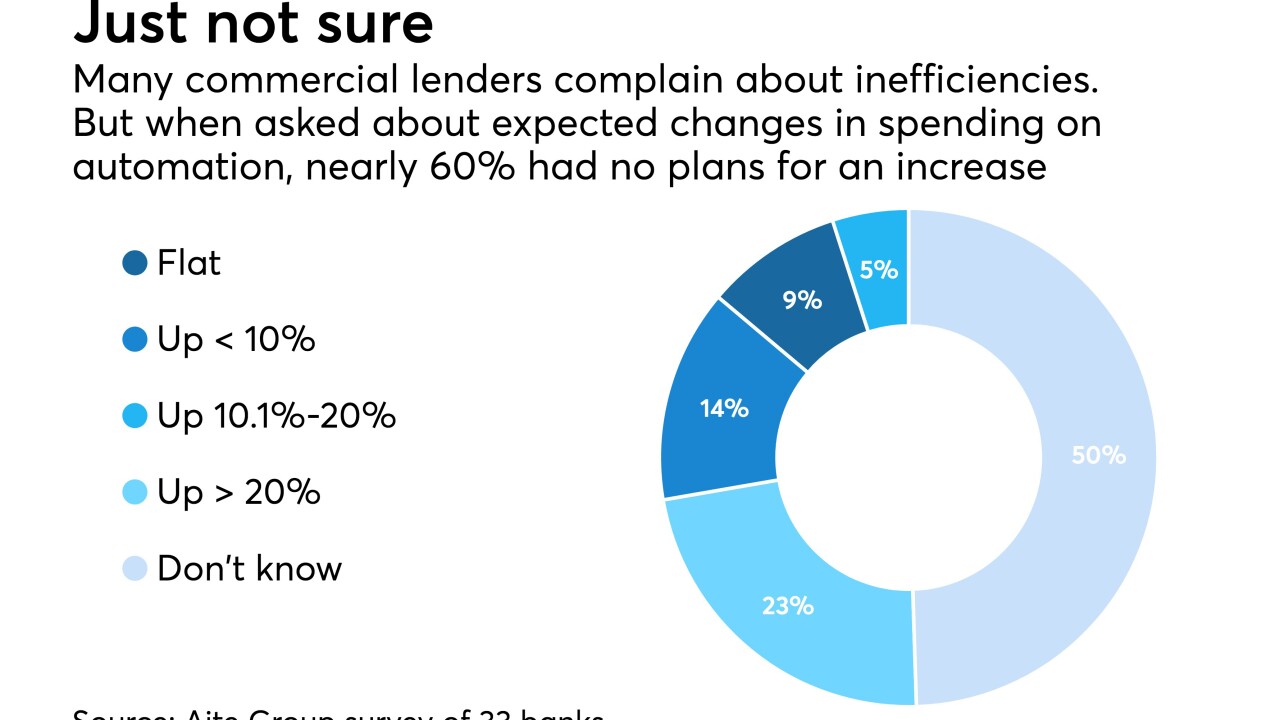

A bank that can deliver a loan decision a little faster, or ask a client to input information just once, could get a leg up on the competition. But some executives are skeptical of software sales pitches and fear overpaying.

May 3 -

Investments in analytics and a focus on courting midsize businesses have helped regional banks add non-interest-bearing deposits even as they struggle for other types of deposits. Can they keep it up as rates rise?

May 1 -

After nearly two years of sputtering commercial loan growth, regional bankers are counting heavily on expanding their portfolios of personal loans and other types of consumer credit.

April 20 -

The Providence, R.I., company reported a double-digit increase in quarterly profits despite a year-over-year decline in fee-based revenue.

April 20 -

The online giant has succeeded in disrupting every area of retail, but in banking it faces a high barrier to entry and fierce determination from banks like Citizens Financial and Bank of the West to keep upping their games.

March 13 -

Shares of the Providence, R.I., company plunged Monday after a news report that it faces possible legal risks from the latest charges filed against Paul Manafort, the former campaign manager for President Trump.

February 26 -

Banks are capitalizing on changing consumer habits - and satisfying a pressing need to diversify their loan portfolios - with a spate of instant point-of-sale loans for everything from iPhones to home improvements.

February 7 -

A plan by the largest U.S. bank to use part of its tax windfall to enter new markets (including Washington and Boston) could become a serious threat for banks of all sizes in those cities — or looked backed upon someday as a pricey overexpansion.

January 23 -

Citizens Financial, Regions and SunTrust reported strong gains in consumer banking, including loans made through partnerships with retailers and fintech lenders. They want to keep it up to compensate for slack in commercial lending.

January 19 -

For the second week in a row, the CFPB's leadership shakeout dominated readers' attention, while a regional banker discussed efforts to fight hacking and the impact of the tax cuts, and bitcoin's price soared.

December 8 -

During a sit-down interview, Bruce Van Saun, the CEO at Citizens Financial, explained how Washington policy changes could boost lending, why cyber threats keep him up nights and how fintechs and AI are changing the industry for the better.

December 4 -

It’s good to be a business lender with a long contact list. Loan growth is weak and the talent pool has been shrinking, so banks big and small are paying top dollar to get an edge.

November 16 -

Amid the rise of online lending earlier this decade, banks were derided as being too slow to adapt. But over time it's become clear that banks hold key advantages over lending startups.

November 6 -

Home equity lines could double over the next six years. Some banks are actively pursuing the consumer credit opportunity, whereas many still feel stung by the housing crisis, unimpressed by home equity’s comeback so far or fearful of nonbank competition and fraud.

October 30 -

The Providence, R.I., company surpassed its goal for return on tangible common equity that it had set for itself after its initial public offering.

October 20 -

The Providence, R.I., company said Wednesday that it has launched its robo adviser in an effort to make inroads in serving “mass affluent” customers.

September 6 -

Auto risks mounting. Mortgage market tightening. Are there any good risks these days in consumer lending? Regional bank executives insist partnerships with online lenders, unsecured personal loans and other niche efforts can work if done properly.

July 21 -

The Rhode Island bank plans to build out its fee income capabilities, expand C&I lending in the Southeast, renegotiate vendor contracts and take other steps to produce expense cuts and revenue enhancements of at least $90 million.

July 21 -

Michael Cleary, Santander's head of consumer and business banking, and Robert Rubino, a former executive vice president at Citizens Financial Group, will share duties while overseeing their own business units.

June 27