Comerica Bank

Comerica Bank

Comerica Inc is a financial services company headquartered in Dallas. It is primarily focused on relationship-based commercial banking.

-

The Dallas company has extinguished talk of a potential sale after aggressively cutting costs over the past year. But concerns about its future — including its ability to find new sources of revenue — remain.

September 18 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

September 15 -

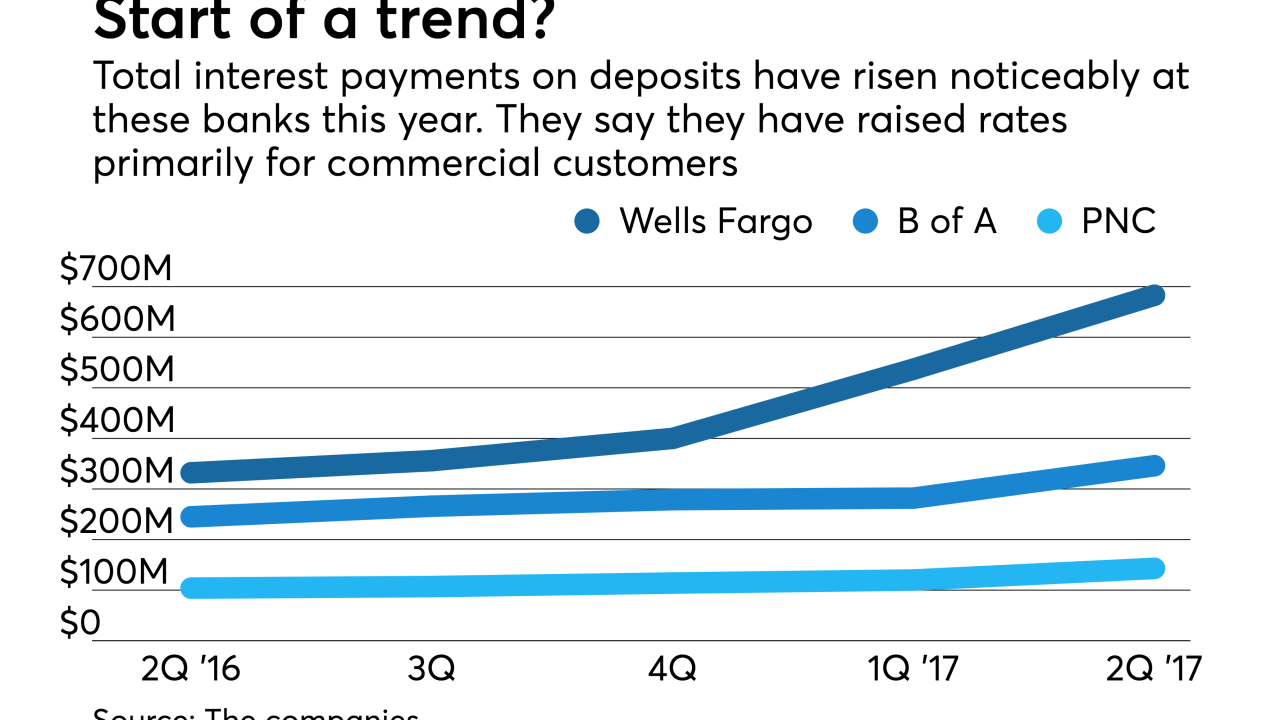

Now that the Federal Reserve has raised short-term rates four times in the past 18 months, all eyes are on deposit costs as banks seek to keep pricing low and fatten margins. But that effort is complicated by the fact that banks must prepare for the unwinding of the Fed's balance sheet and consumers' rapid adoption of mobile deposits.

July 21 -

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

A yearlong effort to slash costs boosted profits at the Dallas company.

July 18 -

Oil prices are dropping again, but some lenders think now is the time to recommit to energy lending as long as they underwrite them a certain way for certain borrowers in certain regions.

June 20 -

With the first half of 2017 drawing to a close, bank executives gathered this week at the Morgan Stanley Financial Services conference to discuss their companies’ performance thus far and, more important, outline their priorities for the rest of the year and beyond. Here are some of the highlights.

June 15 -

The hand-wringing over business lending has overshadowed the fact that consumer lending — particularly for regional banks — has become a strong and steady engine of growth.

April 18 -

Earnings at the Dallas-based company more than tripled because of a big improvement in credit quality, higher fee income and other factors.

April 18 -

Banks of all stripes are cheering what the Federal Reserve’s accelerated rate increases promise for net interest income, but big banks and small banks have conflicting notions about how they want to price deposits in the coming months.

March 15