-

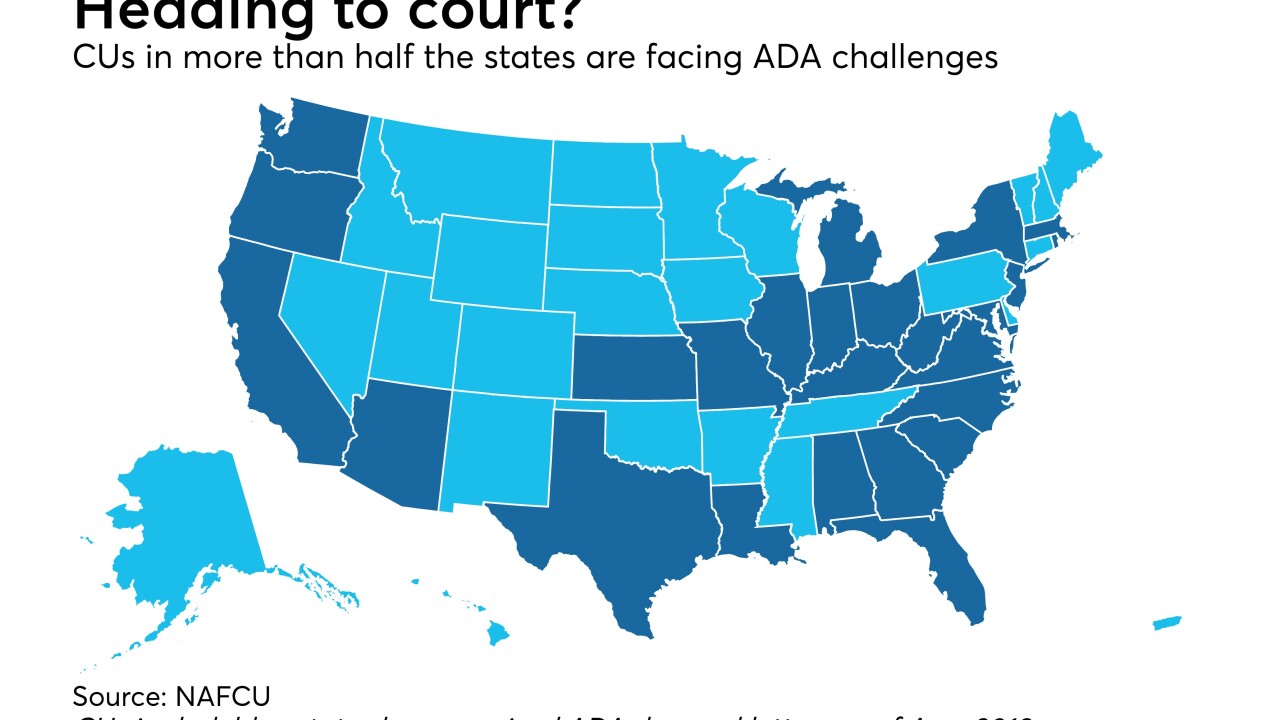

The trade group hopes appropriations legislation for fiscal year 2019 will address confusion over websites being compliant with the ADA, among other concerns.

January 8 -

Now the third-longest shutdown in history, there are few signs the government will reopen anytime soon, and that's causing problems for lenders.

January 7 -

Industry trade groups, which have been active in fighting lawsuits that allege violations of the Americans with Disabilities Act, hailed the decision.

January 3 -

Both CUNA and NAFCU have responded to the bureau's request for input by raising concerns about cybersecurity, public complaints and more.

January 3 -

As the 20-year anniversary of the passage of the Credit Union Membership Access Act draws to a close, one insider reminds that today's fights aren't as dissimilar as they might seem.

December 31 DMA Group

DMA Group -

CUNA and the credit union leagues of Illinois and Wisconsin filed a brief in support of an institution that is embroiled in litigation over whether its website meets the requirements of the Americans with Disabilities Act.

December 21 -

The industry spent a good portion of 2018 fighting ADA and overdraft lawsuits, and experts say despite some progress, next year could hold more of the same.

December 20 -

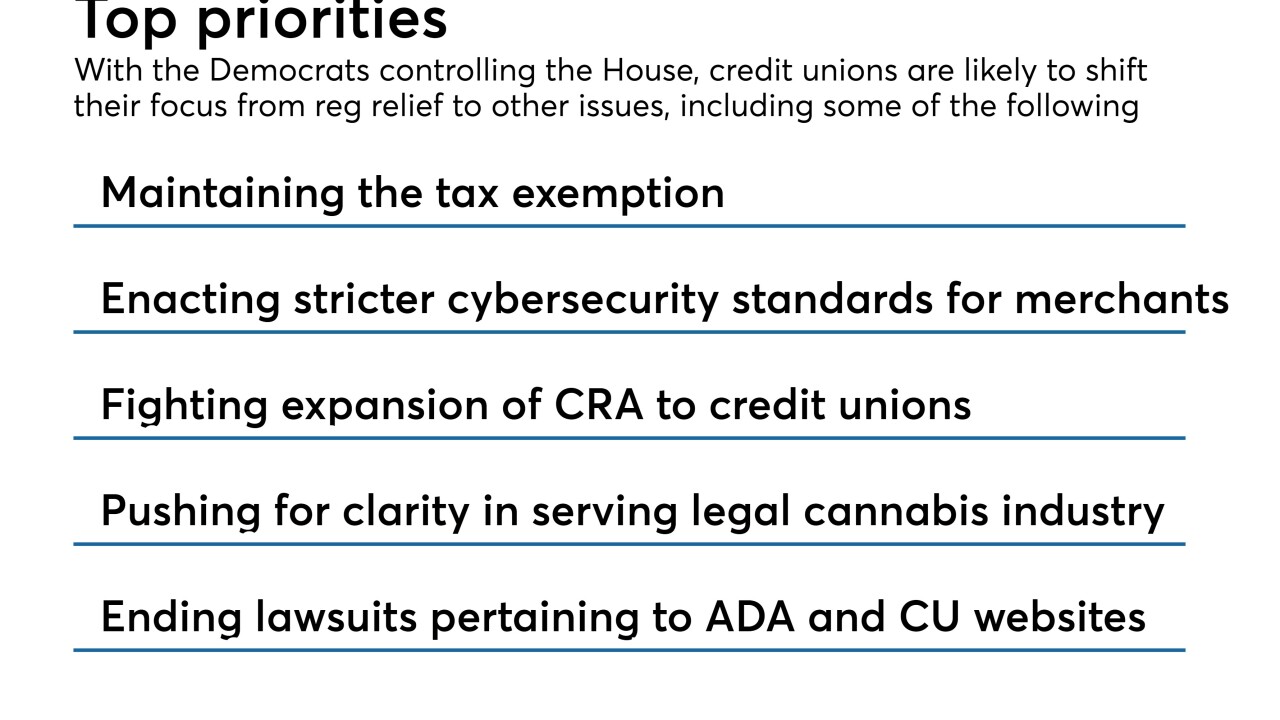

With control of the House changing hands in January, credit unions are set to shift their focus from regulatory relief to cybersecurity and fighting CRA.

December 18 -

As Congress races to fund the government, a criminal justice reform bill could also include the STATES Act, which would provide safe harbor for credit unions serving the legal marijuana industry.

December 17 -

One week after NCUA filed its own appeal brief, three major organizations banded together in support of the expanded field-of-membership rule

December 14 -

The legislation follows passage of a similar bill in the House and would push back implementation of NCUA’s risk-based capital rule to 2021.

December 13 -

The newly sworn-in director’s first public remarks seemed to contrast with the approach of her predecessor, Mick Mulvaney, who at times questioned the role of the agency.

December 12 -

The National Credit Union Administration will hold its final open board meeting of 2018 this week, amid a host of other regulatory and legislative activity.

December 10 -

The regulator claimed Congress has already granted it the authority to define field-of-membership areas.

December 7 -

Hearings of interest to credit unions have been postponed as the government prepares to close for a day of mourning following the death of President George H.W. Bush.

December 3 -

CUNA and NAFCU have asked lawmakers to include a variety of specific provisions in an update to the 2017 tax reform package.

November 29 -

The Credit Union National Association will not ask Mississippi Republican Cindy Hyde-Smith to return its campaign contribution, even as a number of major corporations have asked for their money back.

November 27 -

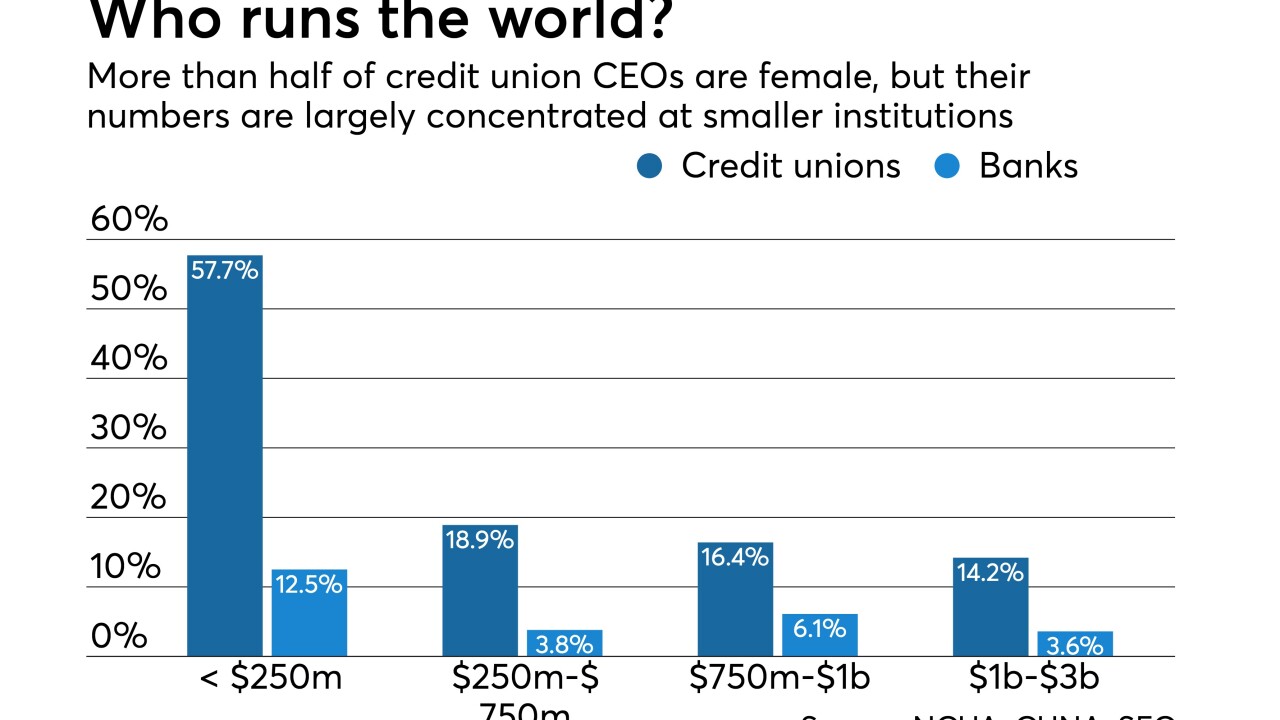

The majority of credit unions are run by women, according to a recent study, but that positive news doesn't paint the full picture.

November 26 -

Winners of the Maxwell, Herring and Desjardins awards will be feted at the Credit Union National Association's 2019 Governmental Affairs Conference.

November 16 -

Tester is the only Democratic supporter of the recent regulatory relief package sitting on the Banking Committee to win re-election this fall.

November 7