JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

The 72% backing was the lowest approval rate for the resolution since 2015. An advisory firm criticized the bank's policy as too subjective.

May 21 -

JPMorgan Chase is buying InstaMed, a cloud-based health care payments platform that’s seen significant growth in recent years from consumer medical payments.

May 17 - Software development

The company offers an operating system for financial applications akin to Apple's iOS, and more than 1,000 applications run on it.

May 16 -

Royal Bank of Scotland and JPMorgan Chase were also among the five banks that agreed to pay fines for colluding on foreign-exchange trading strategies.

May 16 -

Under the Treasury Department's Financial Agent Mentor-Protégé program, JPMorgan Chase is advising two black-owned banks on working with the agency in ways that could boost their fee income.

May 15 -

The total includes donations to community groups helping low-income people, support for the development of financial coaching programs and investment in the creation and testing of fintech tools that can help underserved people.

May 15 -

Digit's savings app, relying on JPMorgan Chase's new real-time payments service, will offer customers an instant withdrawals feature that uses savings as a cushion against checking overdraws.

May 14 -

The Clearing House's Real-Time Payments Network has been slow out of the gate, but it's getting some much needed adoption via a collaboration between personal financial management fintech Digit and JPMorgan Chase.

May 14 -

New posts for two women executives at JPMorgan Chase spur a fresh round of speculation about the race to succeed CEO Jamie Dimon someday. And Comerica's heir apparent finally gets the call.

May 13 -

Some banks have backed away from the technology, but Northern Trust, State Street and JPMorgan Chase are among those actively working on blockchain projects.

May 13 -

To help pull off the biggest media deal of the year, JPMorgan Chase embraced a Wall Street practice that fell out of favor after the financial crisis.

May 10 -

ECGS urges investors to oust the chairman and three executives; financial companies using AI to help adults manage their elderly parents’ finances.

May 9 -

Cushion uses AI to help consumers negotiate refunds of overdraft and other fees. But it argues there's a bank play in its technology if bankers take the long view.

May 7 -

Exploring the rise of the next-gen bank CEO; backlash over JPMorgan's snarky tweet; TD Bank's calculated shift to the cloud; and more from this week's most-read stories.

May 3 -

The bank is hoping the venture will encourage more companies to use Quorum, the Ethereum-based blockchain it built five years ago.

May 3 -

When a tweet drew backlash from customers and politicians on Monday, it brought into question how banks should couch their messages on social media.

May 2 -

CEO Solomon says the bank has not yet begun discussions with DOJ about its role in the scandal; the $1 billion buyback would be its first in 20 years.

April 30 -

Bank critics and some lawmakers quickly seized on a tone-deaf posting by JPMorgan Chase that was designed to tout the virtues of saving money.

April 29 -

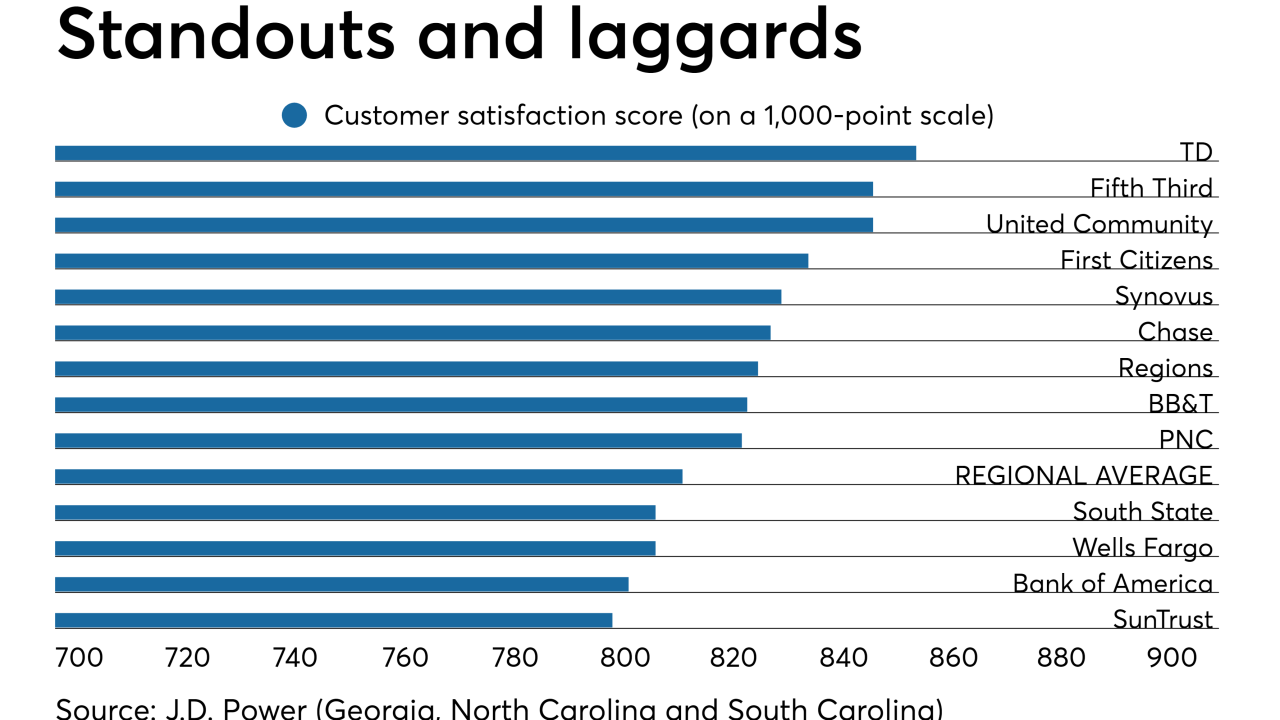

Larger institutions in particular have made banking so convenient that customers see little reason to move their accounts, according to a new report from J.D. Power.

April 25 -

Bank of America investors on Wednesday voted against pressing the company to disclose more insightful data about disparities between men's and women's compensation. Shareholders at Wells and Bank of New York Mellon recently rejected similar measures.

April 24