Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

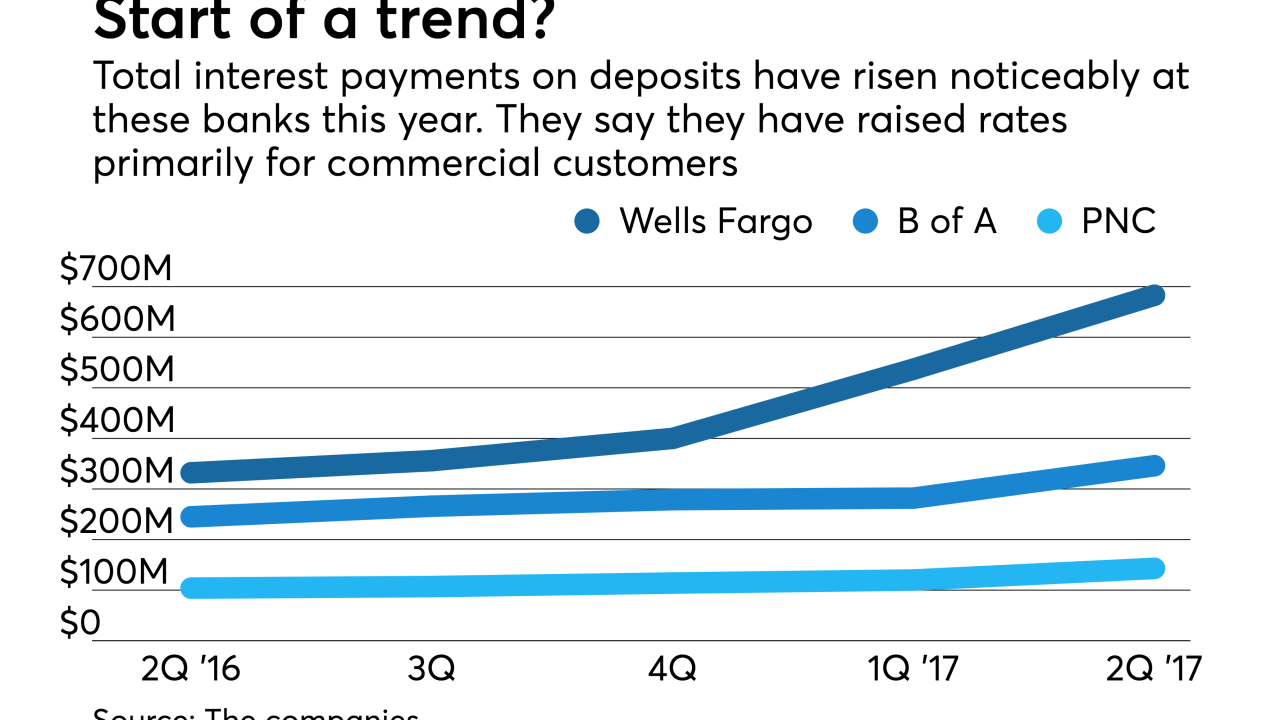

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

Investors blame Washington gridlock, lowered expectations for price drop; Wells Fargo looks to narrow its focus as it jettisons some units.

July 17 -

The phony-sales scandal forced a reckoning over an organizational structure that had long encouraged autonomy for the bank’s various business units.

July 14 -

On the first big day of 2Q results, bankers said their investments in middle-market lending have started paying off. JPMorgan Chase and PNC have added commercial loan officers in new markets across the country.

July 14 -

Wells Fargo's new car loans dropped by almost half in the second quarter, while its automotive portfolio fell to the lowest level in two years after the San Francisco-based company tightened underwriting standards.

July 14 -

JPMorgan Chase, Citigroup and Wells Fargo release earnings Friday; Cordray says acting comptroller’s claim that new consumer agency’s rule endangers banks has “no basis.”

July 14 -

What's more, loan officers' pay has dropped. At work behind these surprising trends is a blend of economic forces, technological change and pressure on banks and credit unions to pay entry-level employees better.

July 13 -

What's more, loan officers' pay has dropped. At work behind these surprising trends is a blend of economic forces, technological change and pressure on banks to pay entry-level employees better.

July 13 -

Federal Reserve Chair Janet Yellen said the central bank is prepared to issue further enforcement actions against Wells Fargo for its account scandal if “appropriate.”

July 13 -

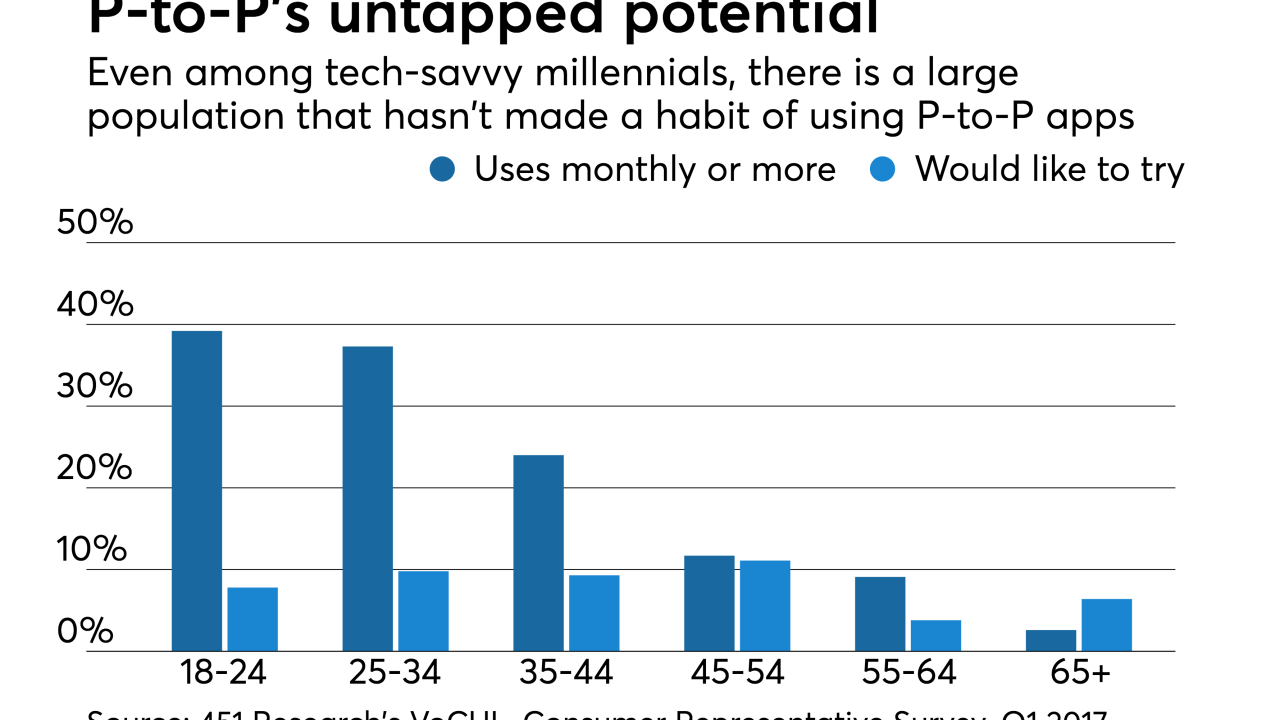

Many of Zelle's member banks and credit unions chose to migrate clearXchange users to the relaunched service. It's a potential convenience, but if executed without end-user awareness or consent it can irritate consumers.

July 10