-

Some firms are investing in technology to help insurance clients shift to paperless payment processing.

December 14 -

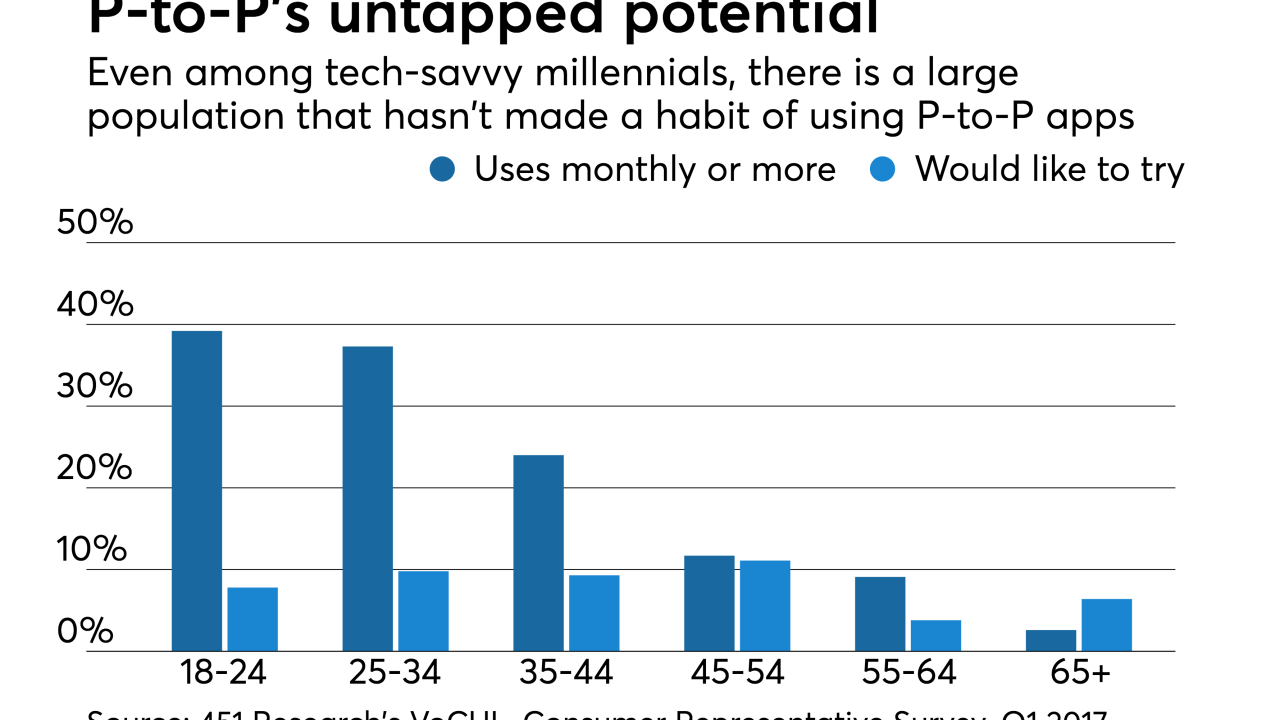

Apple Pay Cash is chasing peer transfer share in a maturing market, going up against long-established services like Venmo, Square Cash and the bank-powered Zelle.

December 7 -

Some of the most successful recent innovations in payments started with peer-to-peer services before evolving into other products, writes Amitaabh Malhotra, chief marketing officer at Omnyway.

November 20 Omnyway

Omnyway -

The bank-powered P-to-P app Zelle officially launched in June with a mostly consistent brand across all of its bank partners, but it still struggles with awareness over PayPal's Venmo, which doesn't share its advantage of living inside banks' mobile apps.

October 31 -

With Apple’s WWDC, Zelle, PayPal’s Venmo and Square Cash, competition in the consumer payments space is about to kick into high gear, writes Josh Hawkins, vice president of marketing for the Boston-based digital payments company Circle.

October 10 Circle

Circle -

Many bank-driven responses to fintech startups are "force fitting" traditional services, and don't fully meet new consumers' demands for social interaction, writes Ted Bissell, global director for digital consulting at Axis Corporate.

October 5 Axis Corporate

Axis Corporate -

The person-to-person payment service, the big banks’ answer to Venmo, is scheduled to launch a stand-alone app next week.

September 8 -

The bank is also working with Fit Pay Inc. to allow its customers to make contactless payments with their credit or debit cards through connected devices.

September 7 -

Barry Rodrigues most recently was head of digital payments for Citigroup.

August 11 -

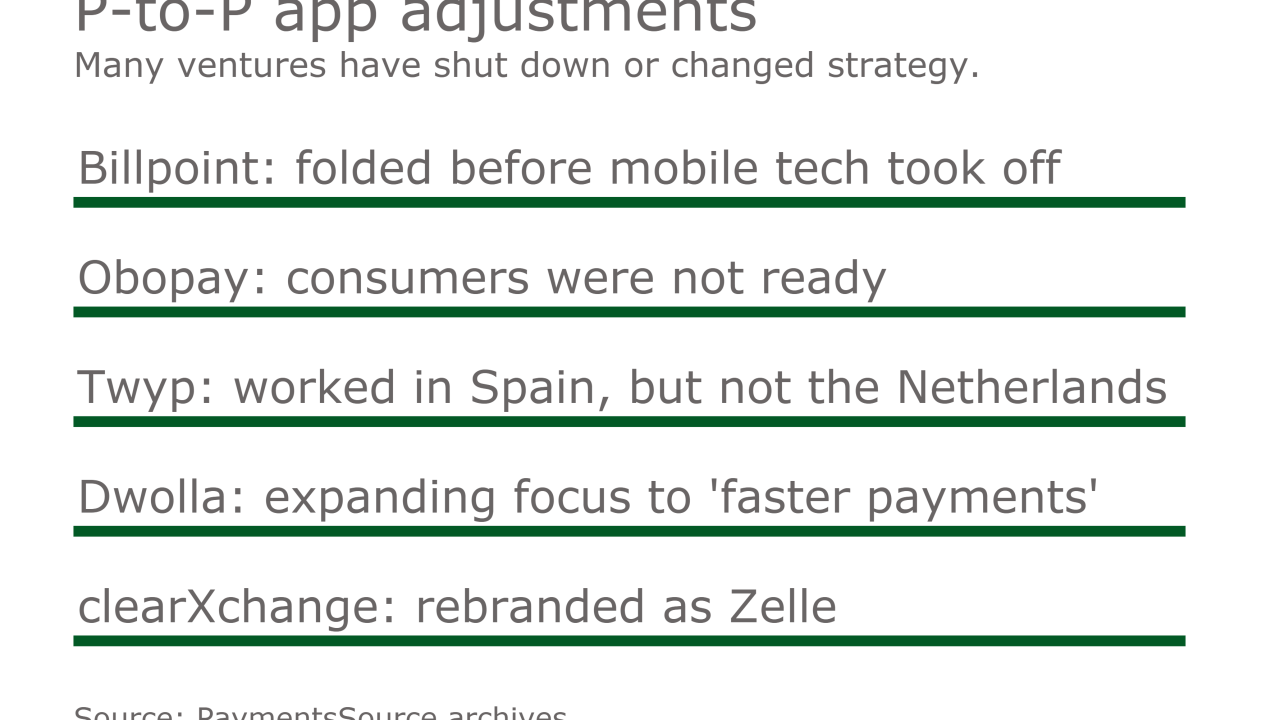

Many of Zelle's member banks and credit unions chose to migrate clearXchange users to the relaunched service. It's a potential convenience, but if executed without end-user awareness or consent it can irritate consumers.

July 10 -

Many of Zelle's member banks chose to migrate clearXchange users to the relaunched service. It's a potential convenience, but if executed without end-user awareness or consent it can irritate consumers.

July 7 -

The financial institution-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. FIs. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

The bank-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. financial institutions. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

Innovators offer speed, but banks retain customer relationships and a vast product range that can add services to payments.

May 4 Omnyway

Omnyway -

When Zelle launches, it will not allow users to share information about their payments with other folks in their network. That decision puts the P-to-P service on a different course than Venmo, its fast-growing rival.

February 22 -

When Zelle launches, it will not allow users to share information about their payments with other folks in their network. That decision puts the P-to-P service on a different course than Venmo, its fast-growing rival.

February 21 -

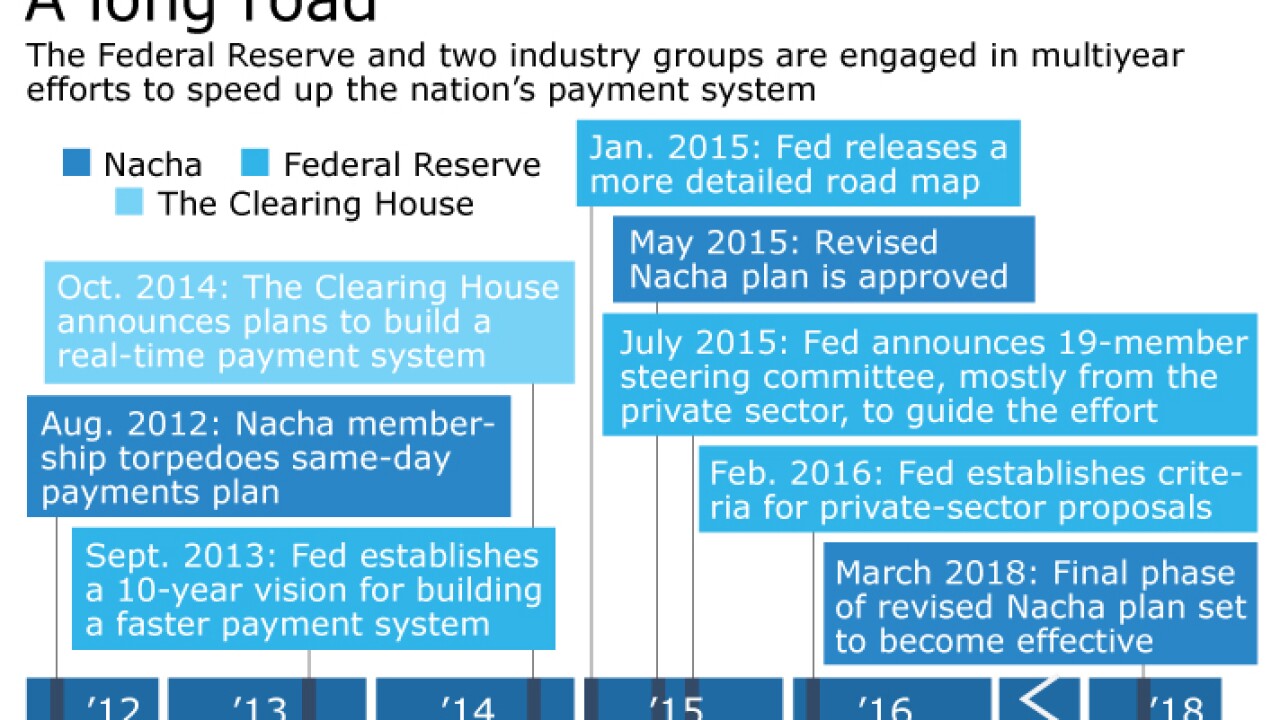

Several groups are developing real-time payments systems for the U.S., and most everyone agrees success is inevitable, but how quickly they can make enough progress to satisfy consumers is a point of contention.

February 1 -

The upcoming launch of Zelle gives Chase, B of A, Wells Fargo and other large banks an opportunity to correct their past mistakes.

January 27 -

Consumer tastes for person-to-person payment apps differ widely from one market to another, and also change rapidly over time.

December 8