-

Senior managers at selling banks often get big payouts and move on. But some decide (or are allowed) to stay and can make major contributions. Here are examples of execs who famously became difference makers after sticking around, or of keepers from recent deals who could have a big impact.

September 18 -

It takes more than costumes and cook outs to make this list – though those don't hurt! Here's a look at what it takes for small and mid-size credit unions to make the grade as a top employer.

September 18 -

From burgers with the boss to bereavement leave, team outings, nonprofit partnerships and more, these are the best credit unions to work for with assets under $200 million, as determined by the Best Companies Group.

September 17 -

Executives from four companies—Worldnet co-founder John Clarke, Payrailz CEO Fran Duggan, CardFree CEO Jon Squire, and Sionic Mobile CEO Ron Herman— view Uber and Amazon as drivers of the shift to an "unattended" retail experience that removes human interaction from the process of making a payment.

September 17 -

Another look at how credit unions are giving back and making a difference in the communities they serve.

September 14 -

A new, 10-part podcast series examining housing blight; JPMorgan’s Jamie Dimon baits President Trump; U.S. Bank returns to small-dollar lending; and more from this week’s most-read stories.

September 14 -

Readers react to a new housing finance reform plan, weigh systemic risks posed by fintechs, debate the potential return of the Glass-Steagall Act and more.

September 13 -

Credit unions hiring and/or promoting vice presidents from within are taking a crucial step towards grooming senior executives down the line.

September 13 -

Highlights and insights from the Cornerstone Credit Union League's annual leadership conference in San Antonio.

September 13 -

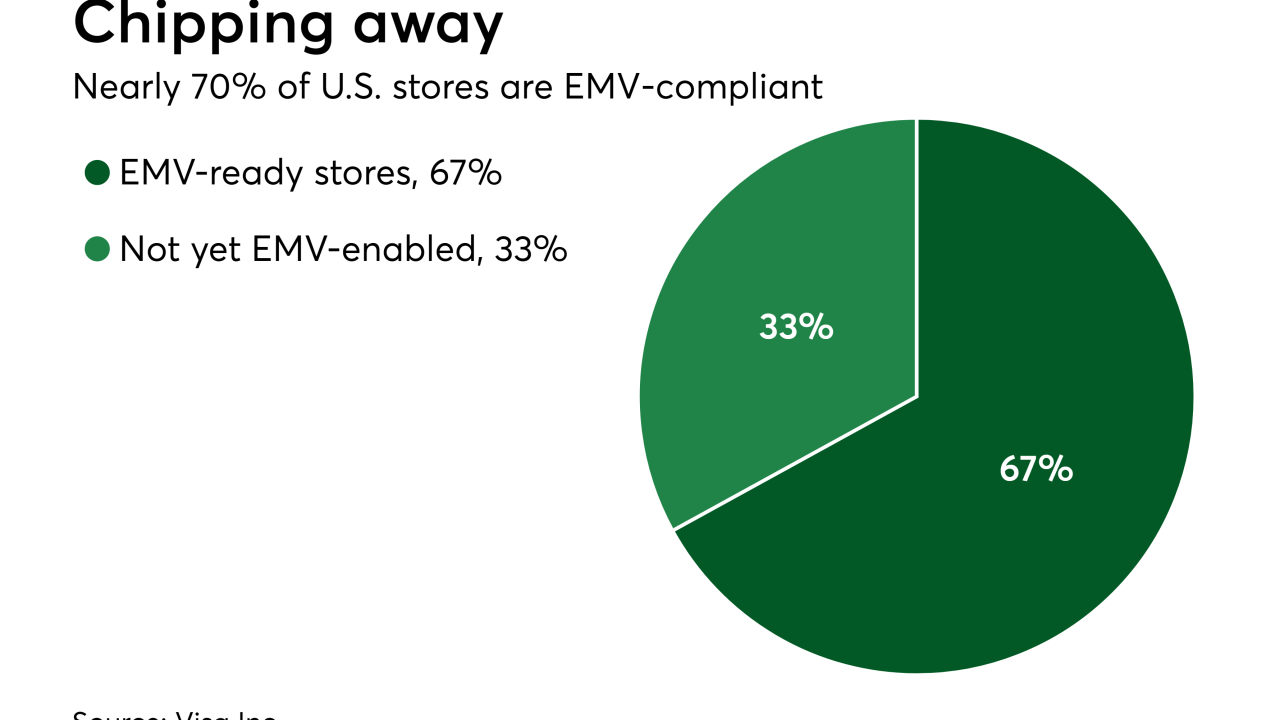

U.S. EMV coverage has gaping holes—including smaller financial institutions that haven’t fully converted to EMV and millions of merchant locations still not accepting chip cards.

September 12 -

A host of board elections, executive promotions and special recognition at credit unions across the country.

September 12 -

Bankers in the East Coast hurricane's path — and everyone else — can learn from those who have survived natural disasters.

September 11 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

From financial education for all ages to scholarships for students and expansion efforts to make membership more accessible, here's how credit unions are making a difference in their communities.

September 10 -

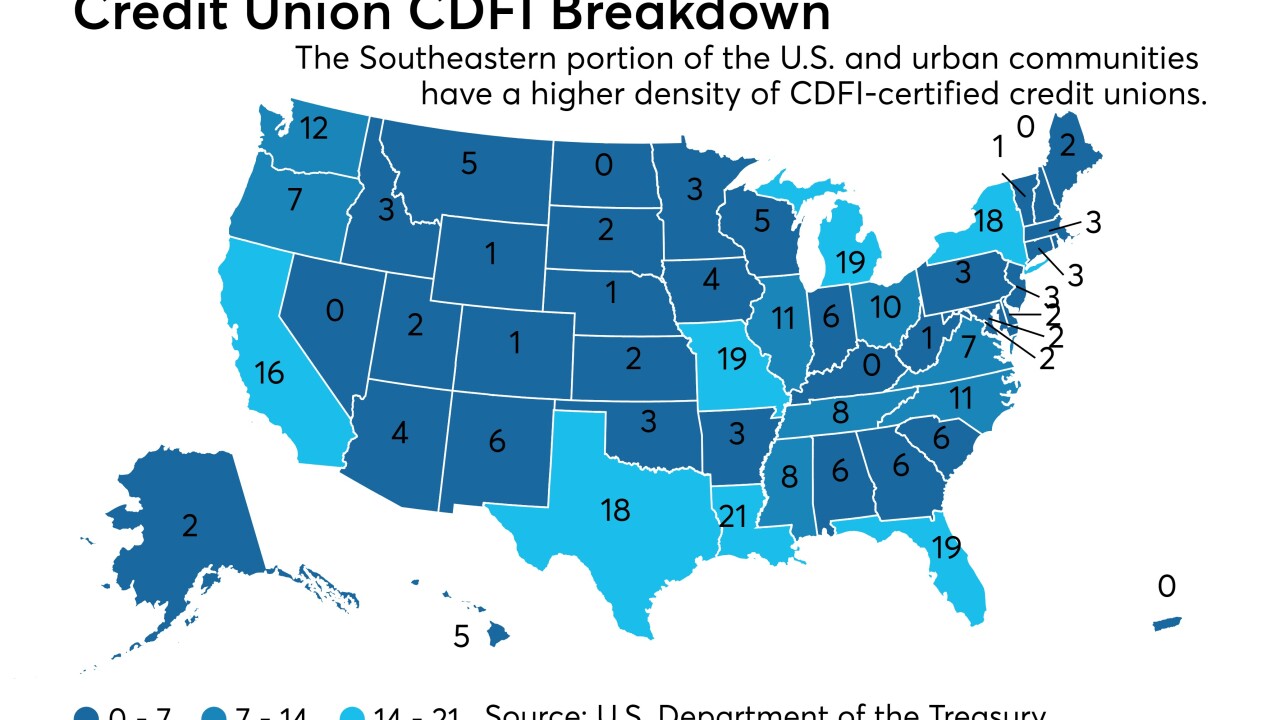

Some of these states may surprise you.

September 10 -

Many workers get extra days off to celebrate all kinds of things, from their birthdays to a good regulatory exam score, or as a reward for charitable giving and other community involvement.

September 9 -

Tuscon Federal Credit Union taps three new chief-level executives and more new hires, promotions and appointments.

September 7 -

The never-ending saga of Fannie and Freddie; CEO of Santander Holdings USA outlines long-range vision; Fifth Third seeks to regroup after fatal shootings at HQ branch; and more from this week's most-read stories.

September 7 -

New architecture for real-time payments went live in recent months in key global markets, expanding B2B payment options for financial institutions and their corporate customers.

September 7 -

Readers debate reforms to the Community Reinvestment Act, weigh in on the fate of Fannie Mae and Freddie Mac, react to Kathy Kraninger's potential confirmation as head of the Consumer Financial Protection Bureau and more.

September 6