-

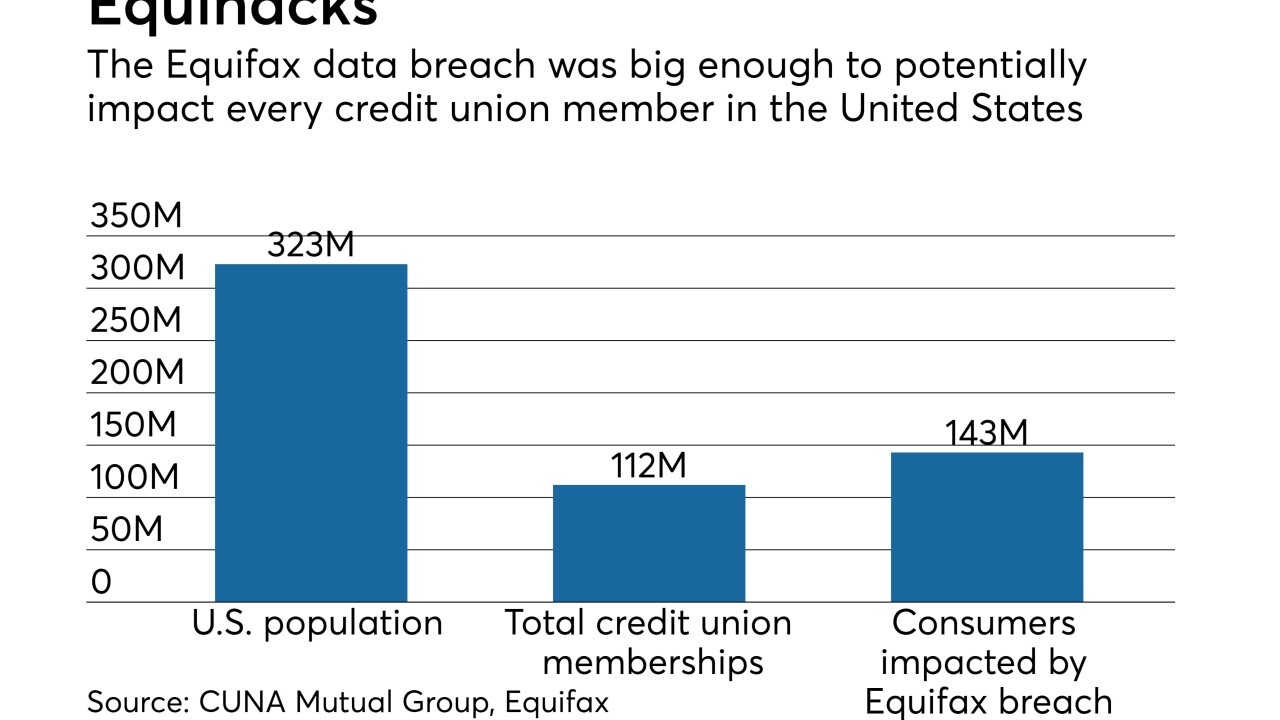

The recent Equifax breach wasn't just a failing of one company's digital defenses — it exposed a fundamental weakness of how the entire financial services industry handles consumer identity. What's surprising is how deep the problem goes.

October 3 -

Equifax Inc.’s former chief executive officer said the credit-reporting company didn’t meet its responsibility to protect sensitive consumer information, confirming that the failure to fix a software vulnerability months ago led to the theft of more than 140 million Americans’ personal data.

October 2 -

Canada's banking industry has issued a warning to government about giving Canadians more control of their own banking data: proceed with caution.

October 2 -

The explosion of interest in digital assets this year, and the multiplying of their market value, are making cryptocurrency debit cards newly attractive. Banks could partner with intermediaries or issue the cards directly, but obstacles remain before that day can arrive.

October 2 -

Equifax mismanaged its recovery by asking for personal information to determine if a user was affected and then issuing a predictable PIN code to those who requested a credit lock, moves that diluted confidence in the company, writes Timothy Crosby, senior security consultant for Spohn Security Solutions.

October 2 Spohn Security Solutions

Spohn Security Solutions -

Though many of its policies were in place before news of the Equifax breach came out, Mountain America Credit Union is doubling down on its approach to protecting member data.

October 2 -

A number of banks and business groups sue to block prohibition on mandatory arbitration; credit bureau weighs how far back to look in denying compensation.

October 2 -

Mastercard is unveiling an anti-fraud tool that’s been in development for more than three years, bringing a new way to pinpoint cards and accounts at the highest risk of fraud following data breaches.

October 2 -

The week of Oct. 2 is shaping up to be a significant one for the financial services industry on Capitol Hill, as lawmakers grill the top executives of Equifax and Wells Fargo, as well as the top regulator of Fannie Mae and Freddie Mac.

September 29 -

Points about various exam and regulatory credit union issues were raised

September 29