-

A Toronto fintech is seeking share for distinct niche — and it thinks a three-year-old technology decision by Visa may be the ticket to its success.

April 18 -

CV Systems’ COO Randy Schmidt, BHMI Chairman Jack Baldwin and Mickey Goldwasser, vice president of Payrailz, discuss challenges and opportunities, for faster payments, back office gaps, and cross-industry cooperation.

April 17 -

Marqeta, which launched in 2010 with a payments platform to support payments through mobile and virtual channels, reportedly has attracted $250 million in a new funding round, which would bring its total funding amount to more than $350 million.

March 22 -

An executive at the Rhode Island company said the complexity of business lending remains an obstacle to switching to entirely automated, paperless operations.

March 20 -

Banks want to encourage innovation by extending access to outside developers, but customer data remains vulnerable while in use by an application.

February 15 -

Unauthorized exposure of any type of customer data, for any period of time, is a serious issue, writes Carl Wright, chief commercial officer of AttackIQ.

February 15 AttackIQ

AttackIQ -

London-based TrueLayer says its API is a cheaper, faster and more secure way to make online payments than using credit cards or manually-entered bank transfers.

February 12 -

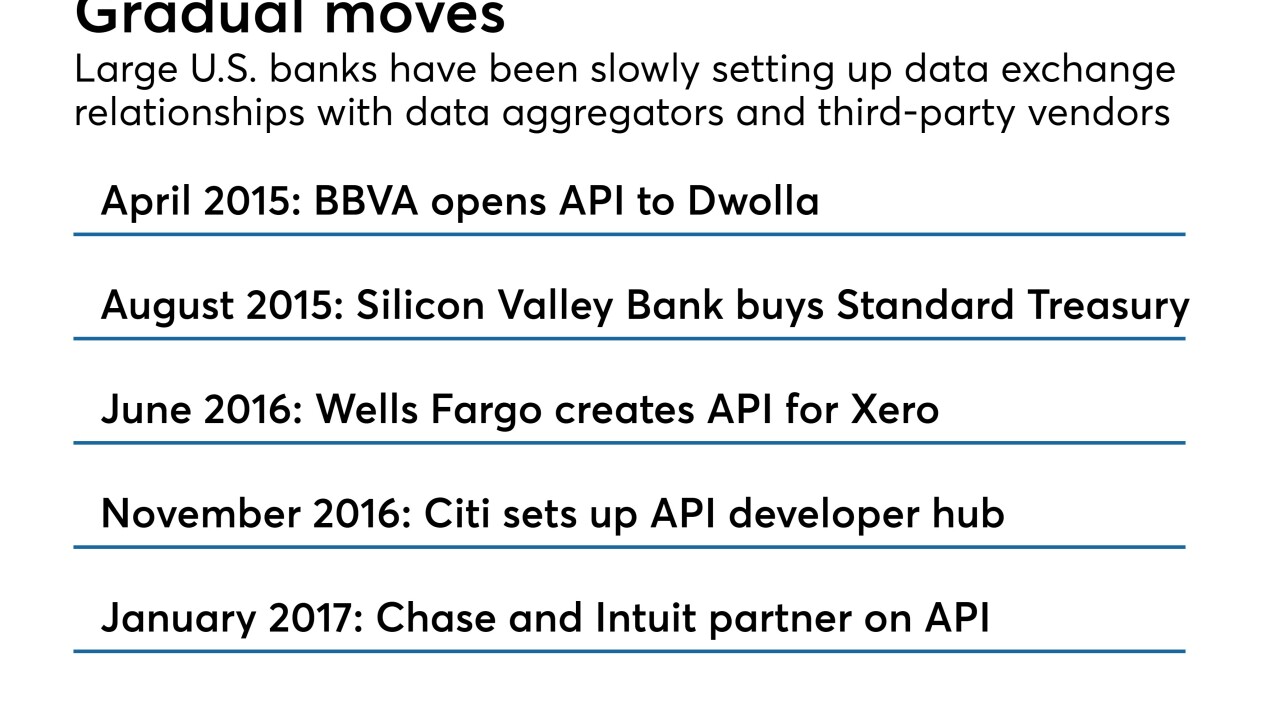

Thanks to big tech companies, the business world is moving to third-party platforms, or online marketplaces where buyers pull sellers' products off digital shelves. A growing number of financial institutions — including BBVA, Citi and community banks like Eastern — say they can't afford to sit out the trend.

January 31 -

Payment companies and businesses that want to leverage blockchain need to properly connect the decentralized platform they use to existing databases and back-end systems, writes IIya Pupko, chief architect at Jitterbit.

January 31 Jitterbit

Jitterbit -

The deal between the U.S. bank and the U.K. software firm adds another potential payments rival for Swift, and the two companies will offer banking APIs to U.S. fintechs.

January 30 -

As the e-commerce payments ecosystem rapidly changes, banks have to find a way to be part of that landscape. This is especially valuable to banks whose customers shop online and could benefit from a loan.

January 16 -

Members prize good customer experience so to meet this expectation institutions need to develop a strategy for APIs.

January 10 SmartBear

SmartBear -

Square has rolled out a software development kit for developers to add payments to their mobile apps, creating an end-to-end solution using only Square’s tools.

January 9 -

Providing access to accounts in a disorganized or incongruent manner could endanger PSD2’s opportunities for the entire market, according to Shahrokh Moinian, global head of cash products and cash management at Deutsche Bank.

January 7 Deutsche Bank

Deutsche Bank -

While the gig economy has become more prevalent in recent years, the traditional banking market has provided few innovations for tackling the various payment-related challenges faced by businesses which utilise these workers.

January 3 -

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

Despite years of advancements in mobile and online payments, the physical point of sale remains still ripe for disruption.

December 31 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Even the best technologies take time, making it necessary to rein in expectations about what will happen and won't happen in the coming year.

December 28 FIS

FIS