-

First Data's quest to be viewed as a diverse digital company means it can't just offer a product; it has to offer a platform that other companies can use.

February 16 -

The bank and cloud accounting platform will offer services to mutual customers via API.

February 15 -

British technology startups are beginning to stress out over Brexit.

February 14 -

The services that Kasisto, Personetics, North Side and Teller offer banks to automate interactions vary in their levels of personality and the workload they can handle.

February 9 -

Payment service providers and independent software vendors may find themselves on the outside looking in if they can't diversify to accommodate m-commerce.

February 8 Payworks

Payworks -

By partnering with Intuit, Wells Fargo is continuing its journey toward API-based data sharing, and away from screen scraping.

February 3 -

The wave of technology that's turned card swipes into dips, phones into wallets and micro merchants into global sellers will proliferate, says Andrew Rueff of Waud, a Chicago-based private equity firm.

February 3 -

Dorothy Savarese and Rebeca Romero Rainey now chair two important trade groups … Mary Lynn Lenz, Patti Husic and Terry Jorde weigh in; Barclays CEO Jes Staley talks hiring diverse leaders and how to keep them; and more.

February 2

-

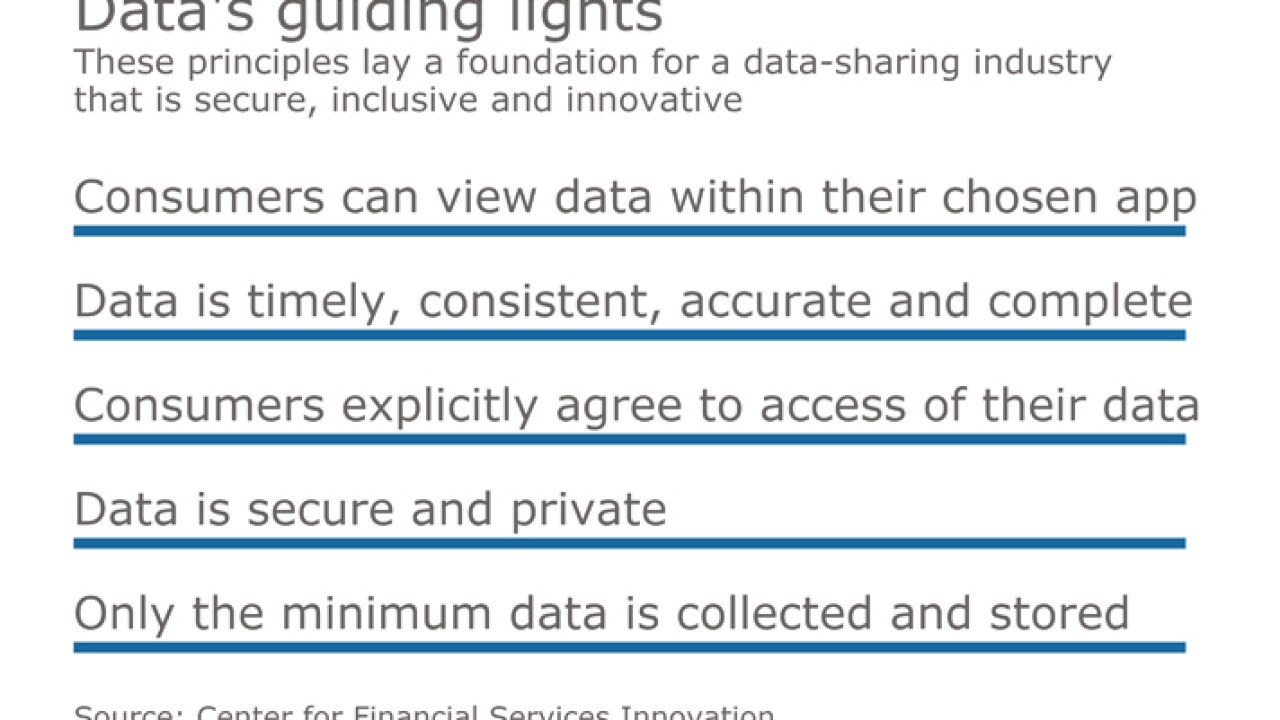

The long-running feud between banks and fintech companies over screen scraping is morphing into a more nuanced and important conversation about how to exchange consumers' financial data securely and fairly.

January 27 -

Big banks increasingly are developing application programming interfaces to make their customers’ data available to third parties. But discrete deals between banks and third parties would be a bad outcome for consumers and the industry as a whole.

January 27

-

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25 -

Regardless of what happens with the politically uncertain consumer bureau, consumer data access is an example of a CFPB issue that is apolitical.

January 25 Plaid

Plaid -

Customers of JPMorgan Chase will no longer have to surrender their bank credentials in order to use Intuit products like Mint, TurboTax or QuickBooks.

January 25 -

Technology toolkits such as application programming interfaces (APIs) have enabled small businesses to use simple programming to extend online payments to consumers, and the same technology can be applied to marketplace transactions.

January 20 -

A consortium of fintech companies have formed a new industry group to advocate for better data sharing via open APIs.

January 19 -

Quicken is working with PayNearMe's Prism RESTful API to allow customers to see real-time transaction data and historical account information from significantly more billers in the Quicken personal finance platform.

January 18 -

The processor has launched its Integrated Solutions Group, a new segment that focuses on software development tools for integration with First Data platforms.

January 13 -

Manhattan-based Municipal Credit Union has launched a cloud-based open API platform from Payveris that supports digital payments and commerce, including account-to-account transfers, bill payment and other services on desktop, tablet and mobile devices.

January 10 -

Chatbots, virtual assistants and the like may mean fewer direct interactions between banks and consumers, fintech leaders say. But branches will become self-service destinations.

January 9 -

Los Angeles fintech firm InvestCloud has acquired London-based Babel Systems for $20 million.

January 9