-

President Trump's campaign to keep jobs in the U.S. could leave bankers worried about their outsourcing IT functions. They are an unlikely target.

January 24 -

Add package pickup to the growing list of things banks are doing with branches as foot traffic declines.

January 23 -

Banks are becoming more comfortable with robotic process automation and could use it overhaul everything from the payroll functions to advising customers.

January 23 -

Lloyds Banking Group was hit by a cyber attack that disrupted online services for customers two weeks ago, a person with knowledge of the matter said.

January 23 -

The Cincinnati bank will be advised by QED Investors on its fintech strategy .

January 20 -

Bank consortium R3 CEV, one of the most well-funded blockchain working groups, has endured criticism for its meticulous process. But if blockchains are most valuable with a network effect, maybe forgoing some agility is worth the long while.

January 20 -

As artificial intelligence makes analytics better, the question of who gets to benefit from the intel will come up more. Fintech startup wallet.ai believes customers should be told of propensities that might be hurting them.

January 19 -

A consortium of fintech companies have formed a new industry group to advocate for better data sharing via open APIs.

January 19 -

FIS is forming a network for the inaugural class of its VC Fintech Accelerator program.

January 17 -

HSBC has formed an advisory board to guide it on fintech, cybersecurity and IT infrastructure issues.

January 17 -

For banks, which stake their business on being trustworthy and reliable, there's a certain amount of risk to putting a chatbot out there that could make embarrassing or serious gaffes.

January 17 -

Corporate clients are increasingly asking their banks to help digitize back-office processes. Such a move can help both parties save time and money.

January 13 -

Some vendors have begun offering authentication platforms through which biometrics and other authentication tools can be plugged into any or all channels. TD Bank is sold on this concept, but others are not completely sure.

January 12 -

Larry Mazza, MVB’s chief executive, joined the board at BillGO.

January 11 -

The growth of digital channels is changing bank M&A values, forcing buyers to focus less on branches and more on the volume of customer data.

January 10 -

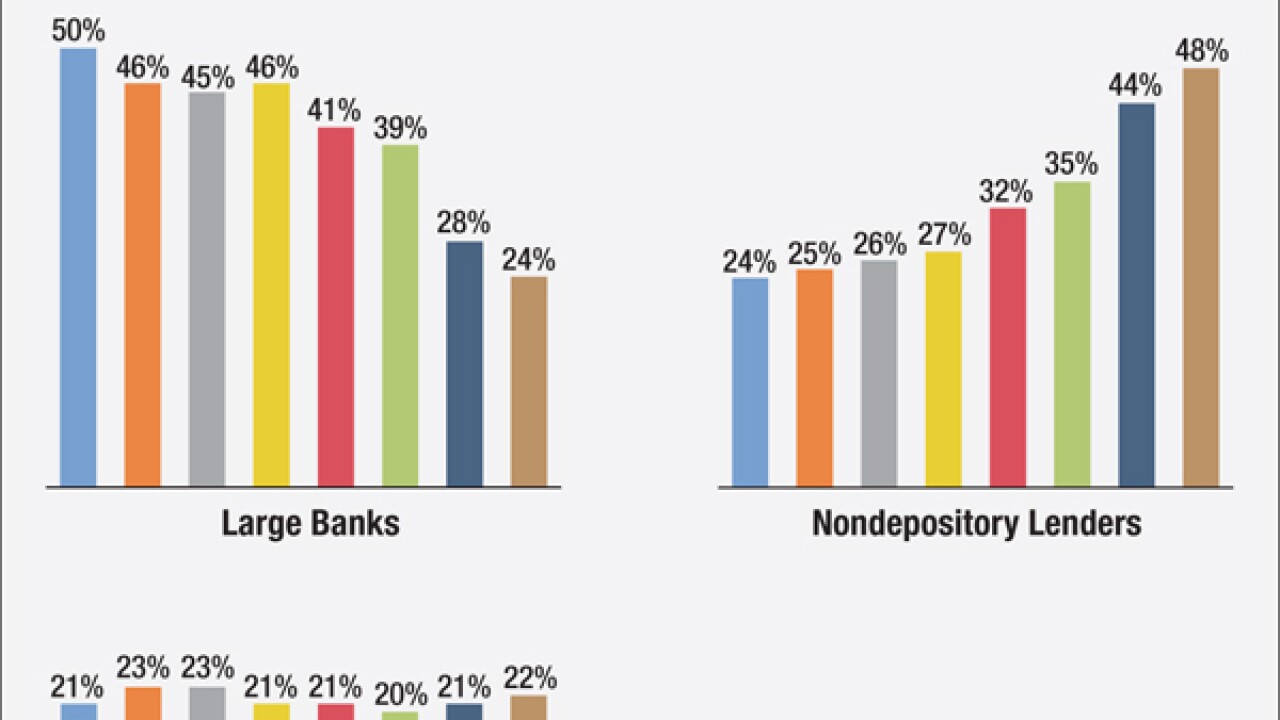

Nondepository lenders are beating their bank competitors when it comes to both digital innovation and market share in the mortgage industry. As interest rates rise, banks will need to move toward electronic closings and adopt other innovations if they want to stay competitive.

January 10

-

Joint accounts sometimes seem stuck in another era. Here's how to modernize them.

January 10 -

Though banks are bigger in peer-to-peer payments overall, Venmo is better at functionality and branding and millennials love it. Now banks are launching Zelle with high hopes and the advantage of real-time speed. Can they catch up? Should they even bother?

January 9 -

Artificial intelligence is moving from science fiction to practical reality fast, and it's in banks' best interest to gear up now for the changes ahead. Here are some strategies to consider.

January 8 -

Regulators here made strides to encourage innovation in 2016, while Brexit cast doubt on the London fintech boom. Yet the cross-Atlantic payments battle is just beginning.

January 6 K&L Gates

K&L Gates