-

The president-elect's policies on taxes, offshoring, surveillance and other issues will affect bank technology officers and their vendors in a variety of ways. The positives may slightly outweigh the negatives.

November 10 -

A Trump presidency might very well accelerate recent efforts to adapt banking regulation to the rise of fintech.

November 10 -

The credit agencies played a role in the Great Recession, but marketplace lenders still need ratings oversight to make their businesses viable.

November 10 Blackmoon Financial Group

Blackmoon Financial Group -

To jawbone Mexico into paying for the wall, President-elect Trump has threatened to suspend remittances. Such a move would disrupt one of the busiest corridors of money in the world.

November 9 -

Bill.com has gained traction in recent years with a few large banks that market its electronic bill payment service for businesses, but reaching a wider audience has been tough because small businesses are a tough nut for banks to crack.

November 9 -

Kenny and Sean Salas, founders of Camino Financial in Los Angeles, have a pretty good idea of what it's like to be a Hispanic small-business owner who can't catch the attention of traditional banks. They have established an online marketplace, a credit-scoring model and relationships with online lenders to help fill the void.

November 9 -

Threats to the industry's control over payments were apparent before PayPal became popular. However, risks are even more visible and real today.

November 9

-

Tesco Bank, based in Edinburgh, Scotland, has refunded 2.5 million pounds (about $3 million) to 9,000 customers who were affected by a large-scale online banking cybertheft last weekend.

November 9 -

The only tactic for survival is brutal honesty. So let's accept the very real risk of disappearing and do the heavy lifting required to persevere.

November 9 Liberty Bank

Liberty Bank -

Donald Trump's stunning upset in the presidential race on Tuesday is likely to embolden his followers to push for changes to Internet law that could significantly alter how financial technology is conceived, built and delivered to market.

November 9 -

WASHINGTON The Internal Revenue Service's internal watchdog Tuesday called on the agency to develop a concerted strategy to address the possible use of virtual currencies in tax evasion or money-laundering schemes.

November 8 -

Designed for Japan's automotive industry in the 1990s, QR codes remain a common feature in the latest mobile wallets. They have pros and cons that banks need to carefully consider.

November 8 -

While regulators discuss a potential federal fintech charter, another possible solution for firms trying to avoid multistate licensing already exists: the trust charter.

November 8 -

Making customer experience consistently good is a priority, but it's not enough. Great experiences in the future will be tailored to individual needs and preferences.

November 8

-

Cultural issues, budget constraints and legacy technology often keep banks from converting their tech aspirations into a reality.

November 7 -

Tesco Bank has confirmed that over the weekend, some of its customers' accounts were subject to online criminal activity, in some cases resulting in money being withdrawn fraudulently.

November 7 -

Recipients of the 2016 FinTech Forward awards discuss the various factors that are keeping banks from fully embracing the digital world the way startups do.

November 7 -

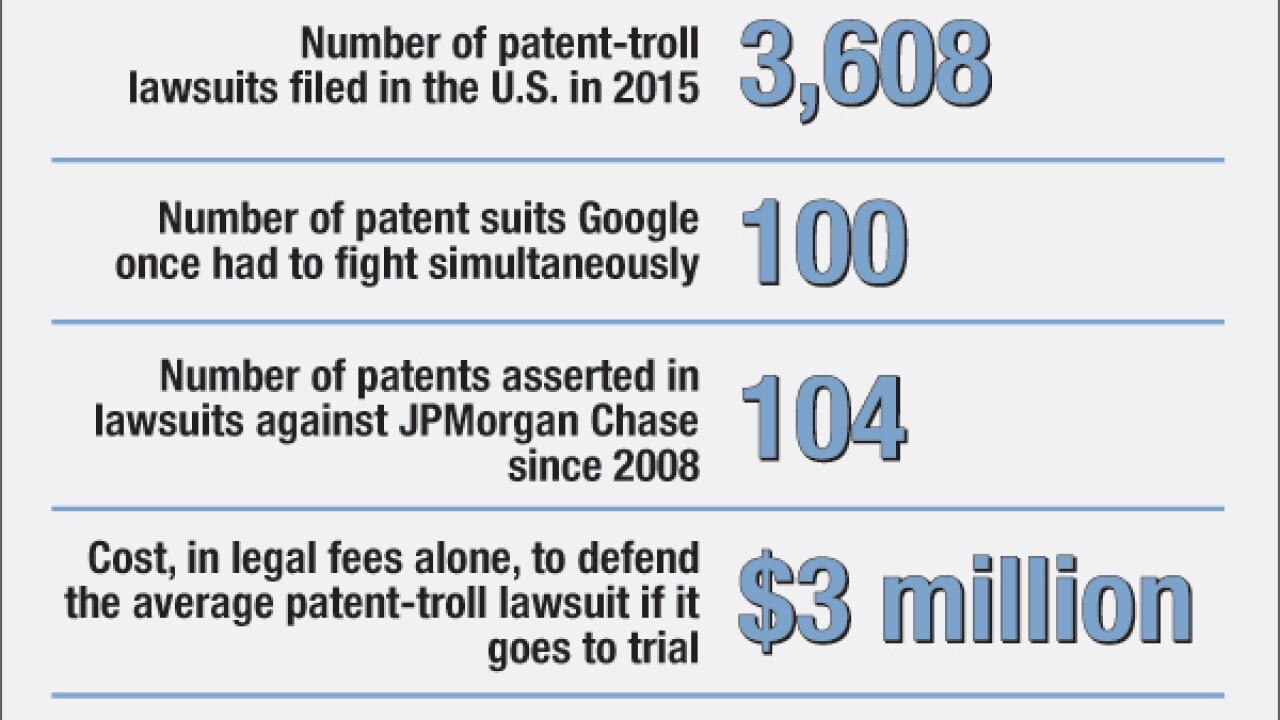

Patent-troll litigation costs American companies $29 billion a year, and fintech startups as well as big banks are now in the crosshairs. A growing number are banding together to defend themselves.

November 4 -

Although blockchain may ultimately solve a few problems really well, the notion of it having widespread application is being questioned.

November 4 -

Furthering a relationship that placed Walmart on the closed-loop ChaseNetprocessing platform, Walmart has committed to accepting the Chase Pay mobile wallet in its stores and in-app.

November 4