-

Bank of America is planning to open 165 new branches by the end of 2026. As brick-and-mortar locations remain critical for adding new customer accounts, JPMorgan Chase and Wells Fargo are also making targeted additions to their branch networks.

September 23 -

The suit was filed by three New Jersey residents who alleged that BofA froze their prepaid debit cards during a pandemic-era fraud wave, blocking them from accessing unemployment benefits.

September 23 -

After doing "some really intensive thinking," the Buffalo-area lender said it found the partner it was looking for in the Norwich, New York-based NBT Bancorp.

September 23 -

If companies want to keep partnering with banks to build innovative financial services, they need to stop thinking about regulation as their partner banks' problems and start being part of the solution.

September 23

-

-

-

A new academic paper dives into the key factors that have caused bank failures over the past 160 years.

September 20 -

-

After Republican presidential nominee Donald Trump said he intends to place a temporary cap on credit card interest rates, many felt the plan would create a large constriction of credit.

September 20 -

The Honolulu-based seller said it rejected a competing bid from an investor group and would stick with its plan to sell to Hope Bancorp for $78.6 million in stock.

September 20 -

In "Money and Promises," Paolo Zannoni, the historian, banker and executive deputy chairman of Prada, tells the tale of instances in which banks teamed up with governments to create financial instruments. Early bank innovations transformed debt into bank money, allowing cities and nations to thrive.

September 20 American Banker

American Banker -

Deposits rose by an average of 14% at each branch in counties where banks advertised on TV, a new academic paper finds. The results line up with the view of bank marketers that television remains essential even as digital options flourish.

September 19 -

Hundreds of thousands of Americans leave prison each year with little or no financial literacy. It's in the interest of banks and the communities they serve to educate them.

September 19

-

Policymakers signaled more reductions lie ahead, a development that could curb lenders' net interest income in the near term but support economic growth and credit quality.

September 18 -

Only two de novo banks have opened in 2024, while more than 100 launched annually prior to the 2008 financial crisis. Experts don't agree on how to solve the problem.

September 18 -

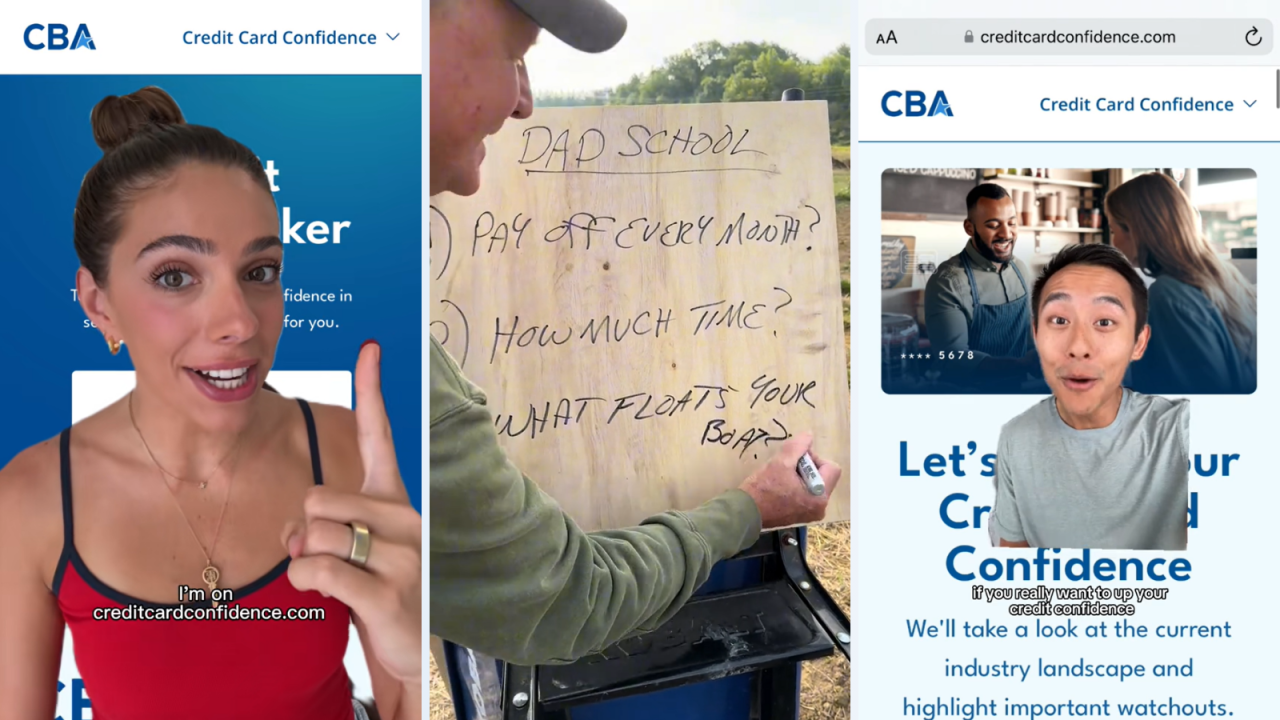

The Consumer Bankers Association launched its first campaign using social media influencers to promote credit card education, experimenting with a mix of personalities and refraining from specific card recommendations.

September 18 -

Overdraft fees continue to be in the spotlight, with the Consumer Financial Protection Bureau proposing a rule essentially to cap them. Certain credit unions are also now required to disclose additional information on this revenue stream.

September 18 Brookings Institution

Brookings Institution -

As the commercial real estate industry sputters along, lenders, investors and analysts are putting less stock in loan-to-value ratios, a longtime bellwether of risk.

September 17 -

CEO Colin Walsh believes his company is positioned to benefit from consumers that prize the convenience of technology opting for the safety of a "real bank."

September 17 -

The Consumer Financial Protection Bureau issued guidance reminding banks that they must be able to prove that consumers have opted in to overdraft services in order to charge overdraft fees.

September 17