-

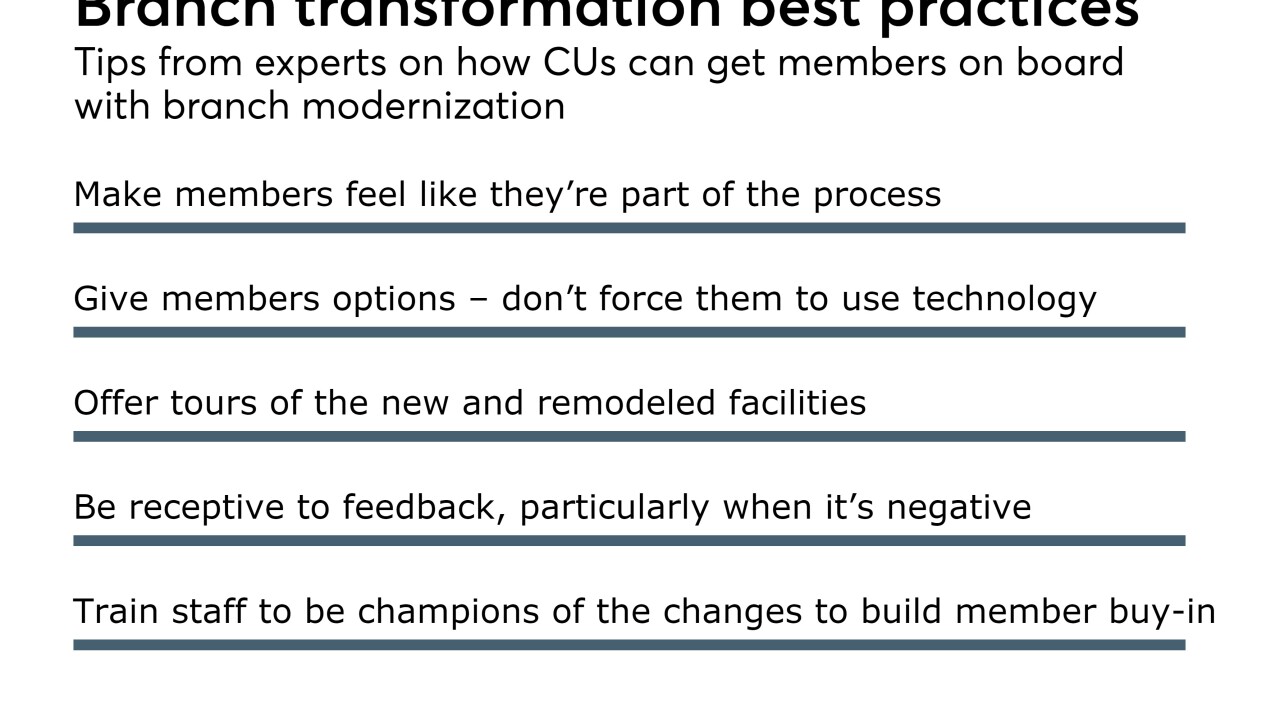

The key, experts say, is ensuring that staff makes members understand the reasoning behind the changes and making them feel like a part of the process.

December 6 -

In our quest to solidify and improve customer satisfaction, we should not set up systems that have our teams more focused on manipulating scores than actually earning them.

December 6

-

Washington State Employees Credit Union has reduced staff by attrition by 16 percent since 2013, saving enough money to pay the costs of modernizing at least one branch.

December 5 -

During a sit-down interview, Bruce Van Saun, the CEO at Citizens Financial, explained how Washington policy changes could boost lending, why cyber threats keep him up nights and how fintechs and AI are changing the industry for the better.

December 4 -

U.S. payments consultancy FIME has added Discover's payment application specification (D-PAS) accreditation to the Pulse ATM network, allowing it to provide guidance and support services on EMV chip technology for acquirers and issuers unfamiliar with D-PAS.

November 29 -

Jane Fraser, chief executive of Citigroup Latin America, explains how changes the company has made to its business model in that region are working so far.

November 28 -

The Michigan company, which lost more than $1.4 billion in the aftermath of the financial crisis, is trying to become more of a commercial lender. Its recent agreement to buy a deposit-rich franchise in California could help it get there.

November 21 -

The Tennessee branches are being sold as part of First Horizon's deal to buy Capital.

November 20 -

While technology will let many banks cut staff and reduce the size of branches, factors such as geography, customer demographics and strategic direction will ultimately shape the look and feel of future offices.

November 16 -

The company, which had launched an at-the-market offering in late May, plans to use the proceeds for organic growth.

November 16