-

As chief operational risk officer, Carrie Lichter played a key role in bringing to life Fifth Third's high-tech war room, also known as the cyber fusion center.

May 1 -

Credit unions have measures in place to assist members hit by fraud but many smaller institutions are challenged when it comes to an effective response.

April 23 -

What the FIS-Worldpay deal means for banks; behind the OCC's public rebuke of Wells Fargo; ripple effect feared as Fed mulls lifetime bans for two bankers; and more from this week's most-read stories.

March 22 -

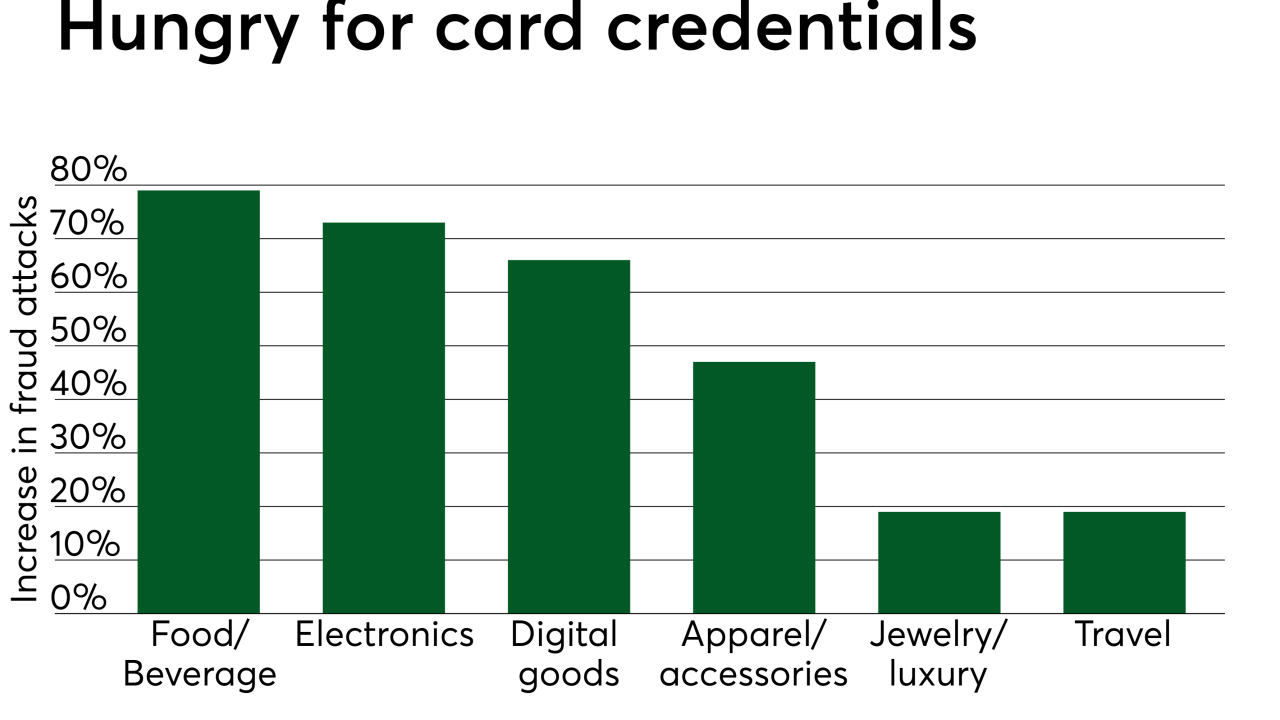

Fraud attacks against online food and beverage businesses in the U.S. increased by nearly 80 percent in the past year, as fraudsters have decided that dining establishments are the perfect places to test stolen card credentials.

March 20 -

Reports of improper charges by perpetrators who know the victim soared last year. Issuers and card networks are failing to tighten security, clearly label transactions and police chargebacks, critics say.

March 19 -

Given the size of the deal — which includes about $9 billion of Worldpay’s debt on top of a $34 billion bid — the pressure’s on to build a global powerhouse that can counter other major fintech mergers announced in the past weeks. FIS must also emerge as a nimble rival to the startups that threaten the old order.

March 18 -

Merchants are often the last in the payments ecosystem to know when card fraud occurs, and their losses tend to escalate in the meantime.

March 13 -

Criminals attempted to defraud five credit unions – including two of the nation's largest – of at least $1 million.

March 1 -

Former Managing Director Timothy Fletcher banished for role in referral hiring; Apple-Goldman collaboration shows banks fear missing out.

February 25 -

The senator wants Treasury to enhance fraud protection in the Direct Express prepaid program — now a partnership with Comerica Bank — when its contract is rebid in 2020.

January 10