-

Banks will have to re-engineer a number of systems to meet the eclectic demands of the generation born roughly in the last 10 to 20 years.

October 11 -

The three credit unions from Connecticut will receive a variety of services from the credit union service organization, including bill pay.

October 10 -

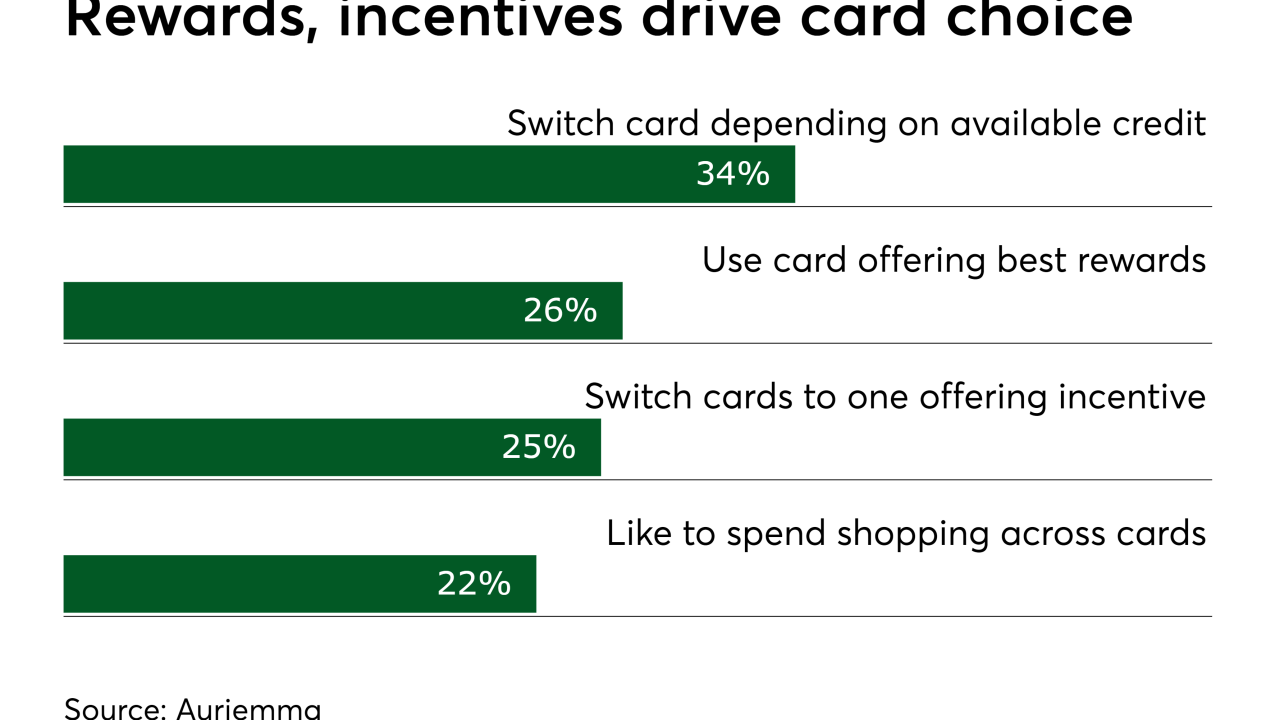

A growing number of credit unions are balancing whether to offer points or other perks as a thank you for member loyalty and spending.

October 4 -

Visa is working with the on-demand delivery network Postmates to deliver real time payments through Stripe’s Instant Payouts feature, running on its push payment platform, Visa Direct.

October 3 -

Consumers who own multiple cards often use them as budgeting tools — a credit card for entertainment, a prepaid card for groceries, etc. — but that method typically can't be applied to any purchases that are paid in installments.

October 3 -

Wells Fargo has numerous mobile banking and card account apps in the works, including Control Tower and Greenhouse, and those will inform its Pay with Wells Fargo project, according to Beverly Anderson, the bank's executive vice president of cards and retail services.

September 27 -

Even among the experts in the payments industry, people still use cash. Banks can't ignore this, according to Paul Amisano, senior vice president for enterprise digital and payments strategy at BB&T.

September 26 -

If a merchant seeking to avoid credit card fees turned to cash discounting, it was at least partly because the other option — putting a surcharge on credit card use — was complicated and illegal in many states.

September 26 -

Acorns is about investments, but its debit card is about something else: instilling pride in the act of making a payment

September 25 -

Fiserv will buy the business, once known as Elan ATM and Debit Processing, for $690 million.

September 25 -

Visa, Mountain America Credit Union and Fingerprints AB were thrilled with their biometric card test, but also faced the grim realization that real world infrastructure may not be as accommodating.

September 25 -

Just as Green Dot leveraged partnerships with the likes of Uber and Apple to expand its reach, Netspend also is looking to its retail partners including Kroger, CVS and Kohl’s for new digital payment use cases.

September 24 -

It's a testament to Piepszak's ability to get things done that the bank picked her last year to run one of its most consequential business lines.

September 23 -

Regional banks are in a much better position to offer a more flexible customer-centric proposition and better service to mid-market corporate and small business players than national issuers, according to Henry Pooley, chief commercial officer at Fraedom.

September 20 Fraedom

Fraedom -

The payments, which total more than $10 million, stem from a 2017 settlement with the Federal Trade Commission. The agency charged that NetSpend deceived consumers by advertising that they could get immediate access to their funds.

September 17 -

Uber’s corporate existence has jumped from one PR crisis to another, but the company has always been lauded for how seamlessly it handles payments. Until now.

September 17 -

SynapseFI is engineering banking to work as digital parts that connect so easily an amateur developer could potentially build a functioning bank.

September 14 -

Each major disaster is a real-world testing ground for payments technology, but it can also be a stark reminder of the limits of these advancements.

September 14 -

Highlights and insights from the Cornerstone Credit Union League's annual leadership conference in San Antonio.

September 13 -

While the card networks have greatly benefited by the global boom in e-commerce, they are confronted with the corresponding growth in digital advertising. This will increasingly lead them to seek out data-sharing deals like Mastercard's reported arrangement with Google, which could prove vital to the networks' future survival.

September 5