Community banking

Community banking

-

On Jun. 30, 2017. Dollars in thousands.

October 2 -

On Jun. 30, 2017. Dollars in thousands.

October 2 -

Another look at how credit unions are making a difference in the lives of those they serve.

September 29 -

With baby boomers moving into retirement and many young folks eschewing careers in banking, the industry could soon be facing a talent shortage. Are more banking degree programs the answer?

September 29 -

Washington Federal is the latest bank to pull an application after being flagged for insufficient Bank Secrecy Act compliance.

September 29 -

Stephen Sessler, the director of mortgage banking at the $4 billion-asset Camden National Bank, provides other lenders a peek at the benefits and pitfalls of digital mortgages.

September 29 -

Wondering who is new to the rankings of the Most Powerful Women in Banking and Finance? Here’s an overview of the changes. Plus we recap all of the stories so far, including the top team winners, a feature on CIT Group’s Ellen Alemany, and New York regulator Maria Vullo’s op-ed on the Fearless Girl statue.

September 29 -

Ned Handy, who will take the helm in March, wants to be more aggressive luring deposits in the company's home state. That should reduce its reliance on other funding sources to support loan growth.

September 28 -

Washington Federal has pulled its application to buy Anchor Bancorp after regulators flagged issues tied to its BSA systems and processes. The companies said they remain committed to the deal.

September 27 -

The company has agreed to buy Bay Bancorp for $129 million in stock.

September 27 -

Scholarships, workplace honors and other ways credit unions are making a name for themselves in the communities they serve.

September 27 -

The proposal is aimed at a simpler capital regime particularly for community banks, but some industry representatives and regulators themselves questioned whether the plan went far enough.

September 27 -

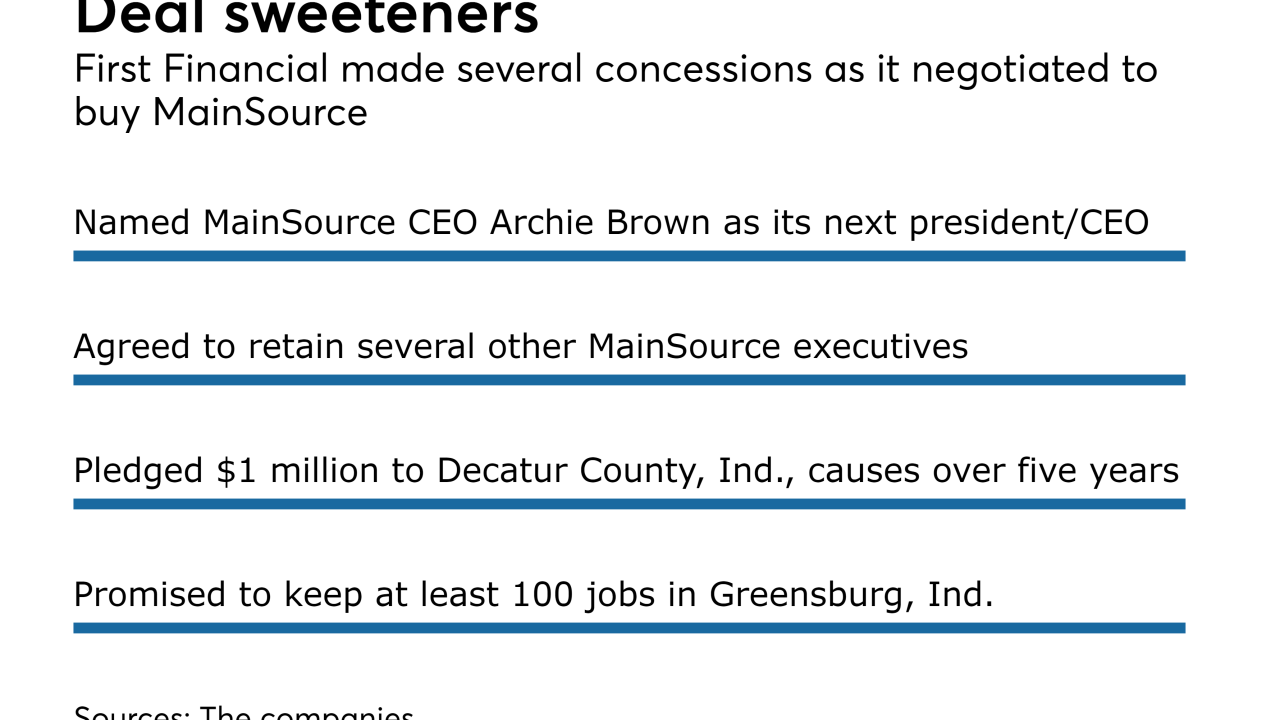

The Indiana company's board knew what it wanted from a potential buyer, and that helped it as it negotiated one of this year's biggest bank deals.

September 26 -

Joseph MarcAurele will retire as chairman and CEO in March. The company's president and chief operating officer, Ned Handy, will take the helm.

September 26 -

The company, which agreed to buy Independence Bancshares, also brought in $25 million by selling common and preferred stock.

September 26 -

The company is looking to raise about $115 million. A portion of the proceeds would help pay for Merchants' pending purchase of Joy State Bank.

September 26 -

Mark Thompson had previously been a CenterState regional president overseeing the South Florida market.

September 26 -

In a new book, Mehrsa Baradaran argues that the same forces of poverty that African-American banks were supposed to alleviate are now holding them back.

September 25 -

Chemical Financial and Fidelity Southern are the latest banks to curtail auto lending, blaming trends in auto sales and overheated competition.

September 25 -

Credit unions are getting lots of recognition for the good work they do, but they're also making sure to hand out plenty of awards of their own.

September 25