Community banking

Community banking

-

Out-of-control email chains, long meetings, haphazard approaches — that was project "management" at Exchange Bank in California. It took five years, but those things have changed.

September 25 -

Grand Mountain Bank raised $7 million to help it exit the crisis-era capital program.

September 25 -

Sound Community Bank CEO Laura Lee “Laurie” Stewart has made a career of going against the grain, and her bank’s investors, employees and customers are all better for it.

September 25 -

American Banker on Sep. 25 announced its 15th annual ranking of the Most Powerful Women in Banking and Finance.

September 25 -

The millennial advisory board at Centric Financial is far from being symbolic. CEO Patricia Husic, who aims to be on the leading edge of engaging with millennials, is making decisions based on its recommendations.

September 25 -

A "transformational" capital raise led by CEO Mary Ann Scully set the stage for Howard Bank's largest-ever acquisition.

September 25 -

The Most Powerful Women in Banking are reshaping not only their institutions, but also their industry. And each is doing so in her own unique way.

September 25 -

Mr. Smith has nothing on Dorothy Savarese when it comes to fighting for a cause in Washington.

September 25 -

By investing in technology and talent development, Julieann Thurlow is positioning her community bank for the long term.

September 25 -

Some of these leaders are new to their roles, while others have been in theirs for years. But one thing they all have in common is that they are commanding attention.

September 25 -

Janet Garufis has spent of the past year working to ease the regulatory burden on community banks.

September 25 -

After she saw statistics showing that over the last 10 years the number of women on Fortune 1000 boards has not changed significantly, Centric's CEO decided to take action to increase the visibility of female leaders in her area.

September 25 -

As president and CEO of Citizens Bank of Edmond, Jill Castilla has become a master of social media and an internationally recognized voice for community banking.

September 25 -

Readers chime in on debates about ILCs, the CFPB’s arbitration rule, the financial services ambitions of tech firms and more.

September 22 -

From gelatin Olympics s to raise money for sick kids to a record-breaking scholarship distribution, here's the latest round-up of how credit unions are giving back to the communities they serve.

September 22 -

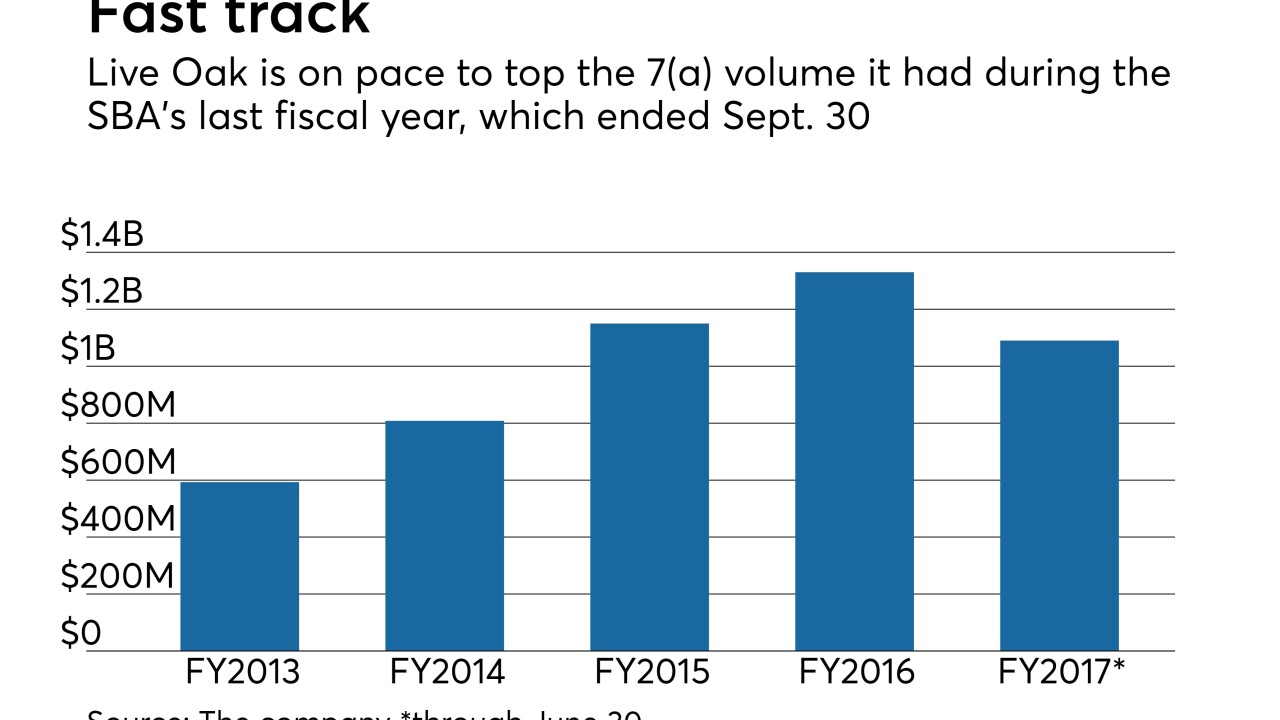

Live Oak Bancshares is used to finding ways to make small-business loans, but its new M&A operation was formed after two bankers pitched the plan to Live Oak's management.

September 22 -

Why Square says banks have nothing to fear in its bid for an ILC charter and IEX's Sara Furber explains why you should not fear the big jobs. Plus, workplaces women like and Lena Waithe on using your superpowers.

September 21 -

First Green Bank in Florida started researching the business after its chairman saw how medical marijuana had helped his wife cope with a severe injury. The bank is now turning a profit a year after adding its first pot-related client -- and there could be lessons there for credit unions.

September 21 -

Brookline will pay $56 million in cash and stock for First Commons in a deal that will add $324 million in assets.

September 21 -

The Florida bank started researching the business after Ken LaRoe, its chairman, saw how medical marijuana had helped his wife cope with a severe injury. First Green is now turning a profit on this business a year after adding its first pot-related client.

September 21