-

The activist investor, which has pressured the company in the past to find a buyer, fell short in an attempt last year to gain representation.

January 16 -

The Tennessee company has been buying banks in smaller markets and college towns where it rarely has to compete with financial giants.

January 16 -

After two century-old community institutions merged in 2010, they never suspected it would take seven years before their operating systems got along.

December 6 -

Readers weigh in on Amazon as a bank threat, claims that big banks are poor fintech partners, whether there are too many banks in the U.S. and more.

October 26 -

Consolidation has led to too few community banks, which is amplified in areas where capital is needed most.

October 25 Calvert Advisors LLC

Calvert Advisors LLC -

For community bankers, the current environment is more challenging than ever, with high regulatory burden and tough competition. Four bank CEOs sat down to discuss the future of the industry, and what they are hoping may change.

October 24 -

The current regulatory focus drives the growth of ever-larger, harder-to-manage and harder-to-regulate megabanks, while community banks have been left to be picked up by acquirers.

October 17 University Bank

University Bank -

Deutsche Bank AG plans to consolidate its global wealth management operations, despite the negative effect on client assets in some locations.

September 15 -

The CEO of Keefe, Bruyette & Woods, a top matchmaker for bank mergers, explains why large banks will soon return to dealmaking after a long absence, the case for starting new banks and the enduring value of branches.

July 18 -

While industry consolidation remains slow compared with previous years, certain regions are humming along with strong volume and improved pricing. Here’s a look at each region based on June 30 data from KBW and S&P Global Market Intelligence.

July 14 -

The $487 million deal would be OceanFirst's fourth, and largest, acquisition in its home state since 2015.

June 30 -

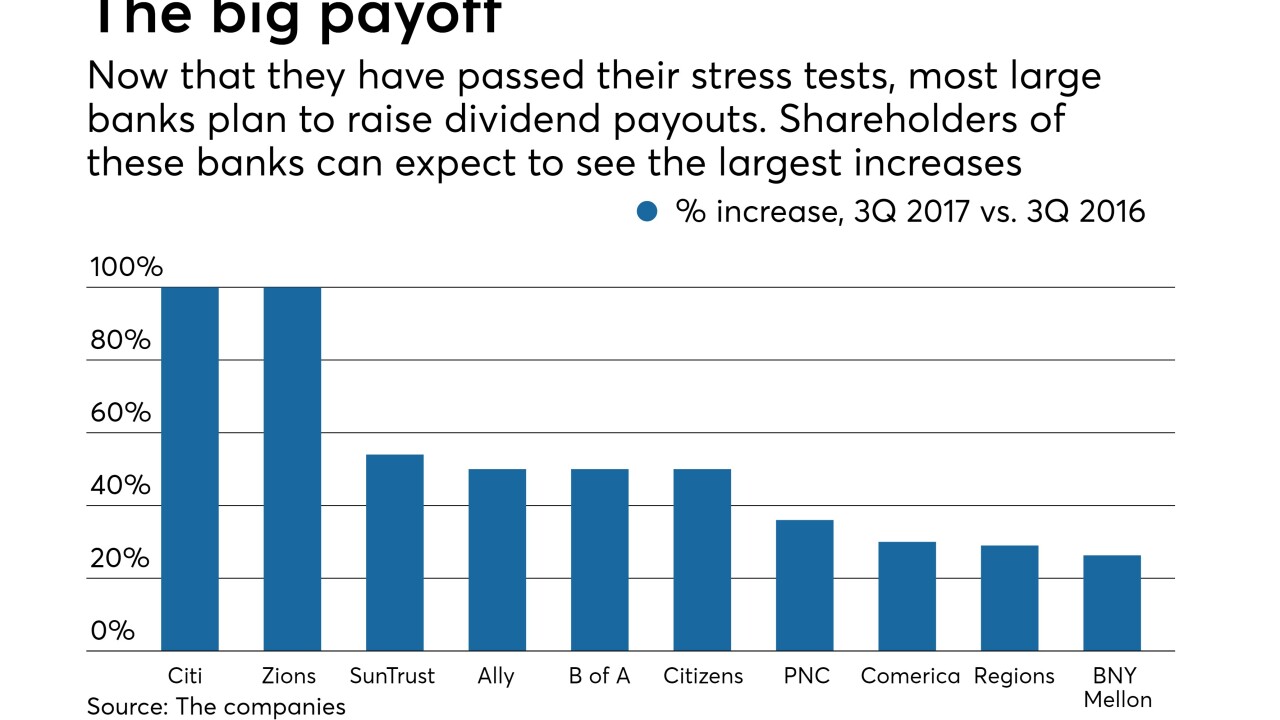

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Despite the digitization of transactions, customers still need personal bankers. But financial institutions must adapt to specialize in problem-solving instead of sales.

June 1 Resurgent Performance

Resurgent Performance -

Thanks to the Federal Reserve's unwinding of post-crisis policies, the next wave of mergers will be driven in part by a drop in deposits.

May 26 Adjoint

Adjoint -

JPMorgan Chase has some advice for regional banks: A deposit drain is coming, so merge while you can.

May 9 -

The biggest bank M&A agreement of the year might not have happened if the buyer, Sterling Financial, had refused to prove to Astoria Financial that it had thoroughly vetted the deal with regulators.

April 26 -

The number of U.S. banks has fallen by 24% since the end of 2010, a result of mergers, failures and a dearth of de novo activity. Here are the 10 states with the biggest declines as a percentage of total banks headquartered in the state, according to Federal Deposit Insurance Corp. data.

April 13 -

It took several offers for First Busey to seal a deal to buy First Community Financial Partners, and the details in a recent public filing of the back and forth between the two Illinois banks show how patience in merger negotiations is a must.

March 23 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

March 10 -

Regulators ought to make it easier for smaller institutions to merge, the CEO of the country's largest said Tuesday.

February 28