-

The office and retail markets could look very different in the aftermath of the coronavirus pandemic. Here's what it could mean for lenders.

April 22 -

A backlog has formed since the first round of Paycheck Protection Program funding dried up, threatening to further strain a platform that struggled to handle the initial workload.

April 22 -

As part of our effort to probe the impacts of and responses to the coronavirus pandemic, Arizent has been conducting surveys of leaders in financial and professional services. We ask you to take part by completing our newest 10-minute survey, and look for results in upcoming editorial coverage.

-

Banks had an opportunity to delay compliance with the new accounting standard, but many opted to move forward to get ahead of credit issues that could arise from the coronavirus outbreak.

April 22 -

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

April 22 -

The Federal Reserve’s Main Street Lending Program is meant to be a lifeline for midsize businesses, but two weeks after its unveiling, those firms and their lenders remain on edge about what strings will be attached.

April 22 -

Canada's biggest banks have spent more than $71 billion on technology since the last financial crisis in a bet that clients would eventually become more digitally savvy. The pandemic is hastening that shift faster than they could've expected.

April 22 -

Firms that create virtual assistants for financial institutions are training their bots to answer questions about the pandemic and relieve phone lines from a barrage of customer calls.

April 22 -

The FHFA will allow Fannie Mae and Freddie Mac, for a limited time, to purchase loans for which the borrower has sought to postpone payments because of the economic effects of the coronavirus.

April 22 -

Businesses have turned to workarounds to accommodate the coronavirus’ impact on brick-and-mortar stores, emergency measures that will likely become permanent in order for these businesses to survive into the future.

April 22 -

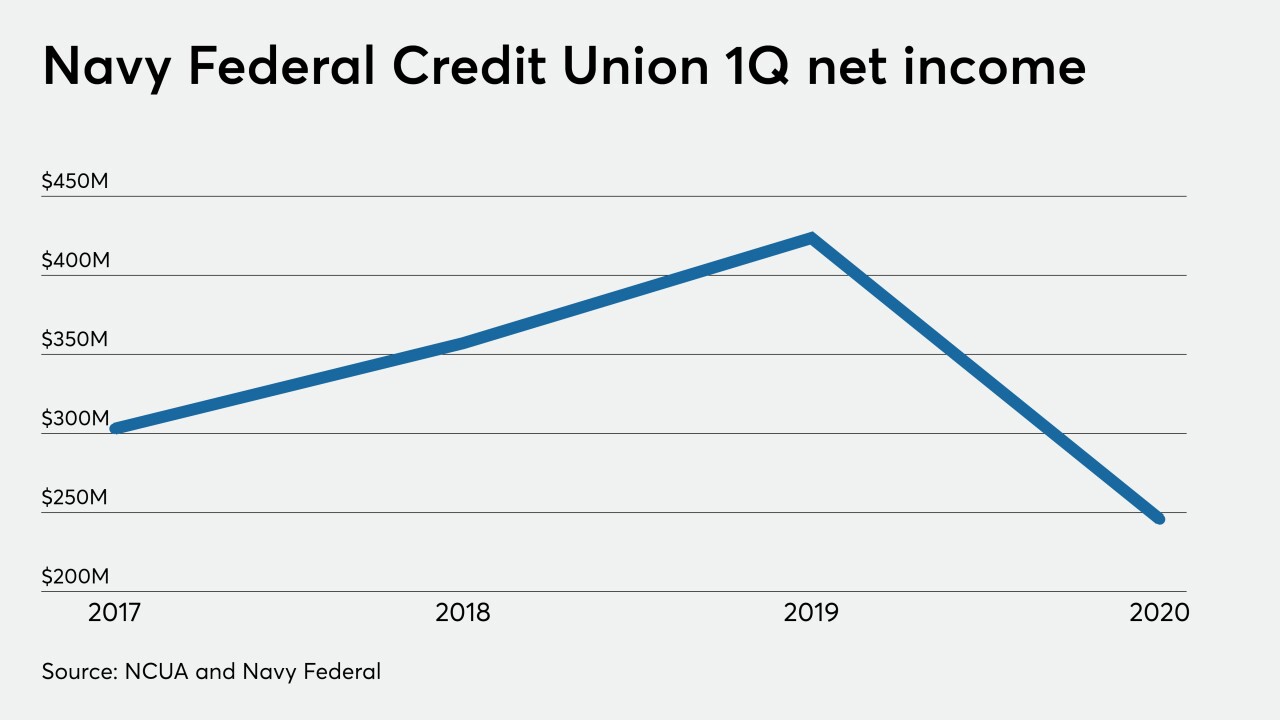

The largest credit union in the world increased its provision by 28% from a year earlier.

April 22 -

Veem specializes in cross-border payments, but when small-business customers clamored for help this month with emergency SBA loans, the fintech responded.

April 22 -

The online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

April 21 -

The House is expected to vote later this week on the bill expanding emergency relief for small businesses reeling from the effects of the coronavirus.

April 21 -

The House is expected to vote later this week on the bill expanding emergency relief for small businesses reeling from the effects of the coronavirus.

April 21 -

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

The pandemic won’t halt the Cincinnati bank's plan to open about 100 branches in the Southeast, but features could be added to accommodate social distancing.

April 21 -

In a rare show of unity, banking industry and consumer advocacy groups told congressional leaders that it is not too late to ensure individuals can access all of their coronavirus relief funds promised by the government.

April 21 -

Once it starts reopening offices around the world, it "will continue to prioritize the safety of our employees, customers and communities," Citigroup President Jane Fraser said.

April 21 -

"One of the advantages is that we can hear from shareholders in faraway places," John Dugan said at Tuesday's annual meeting, which was held entirely online as most of the country remains on lockdown to help stop the spread of the coronavirus.

April 21