-

John Drechny, the CEO of the Merchant Advisory Group, talks to PaymentsSource Associate Editor David Heun about how merchants are looking beyond the coronavirus crisis — and how every choice merchants make today will have consequences that last well beyond the pandemic.

August 11 -

The Small Business Administration began accepting applications Monday, but lenders such as JPMorgan Chase are holding off in hopes that Congress will grant blanket forgiveness for smaller Paycheck Protection Program loans.

August 10 -

More than a third fear the fallout from the coronavirus pandemic could drag into 2022 or later, and they are most worried about commercial real estate loans, according to a Promontory Interfinancial Network survey.

August 10 -

Trade groups are still pushing for the industry's priorities, such as temporarily lifting the member business lending cap, as negotiations over the next round of aid continue.

August 10 -

Many will need to ramp up security protocols and reconsider which services require a high-tech versus human touch.

August 10 CCG Catalyst

CCG Catalyst -

Under a rule issued in March, banks will build an additional capital cushion that is determined by their performance in the annual tests.

August 10 -

Schools are still figuring out how they will open this fall, with some districts providing online education while others try a hybrid approach of online and in-person instruction. This complicated structure also upends how schools handle fees and payments.

August 10 -

At its inaugural hearing, the committee appointed by lawmakers to oversee CARES Act implementation pressed for answers about why the Main Street Lending Program is off to such a slow start.

August 7 -

As more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

August 7 American Bankers Association

American Bankers Association -

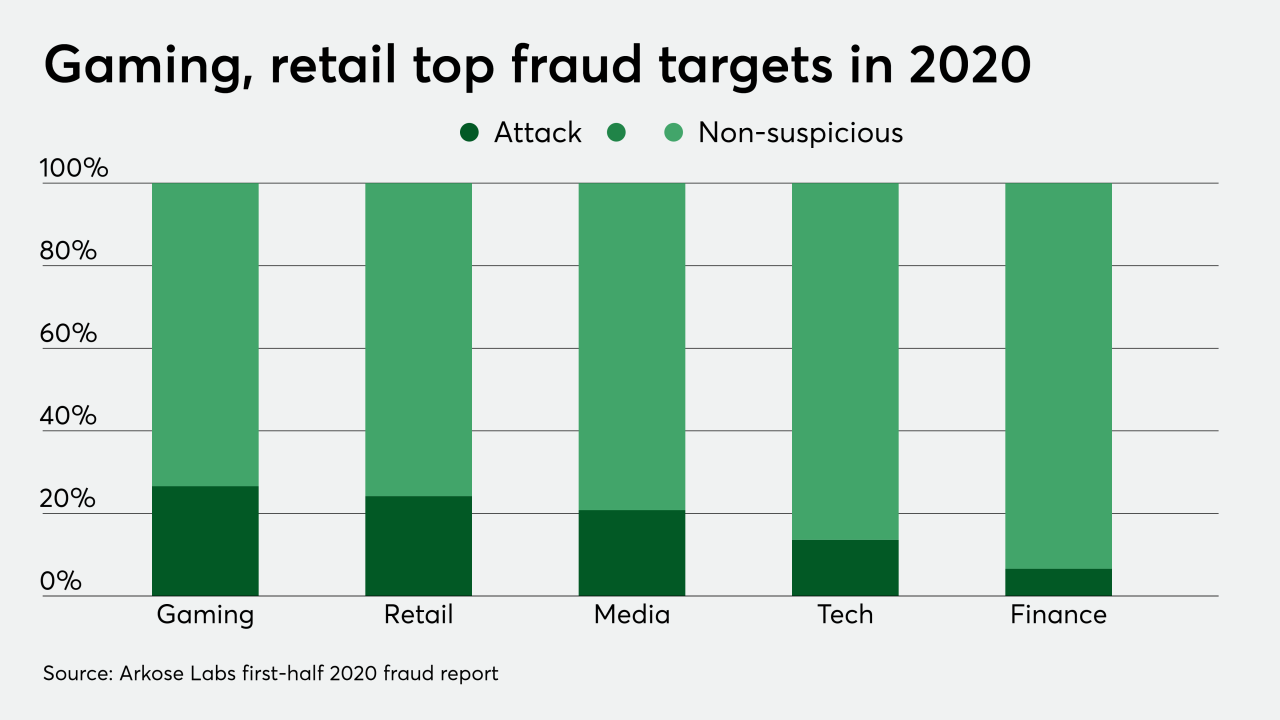

Video games provide a rare escape to locked-down consumers, and many modern games are so sophisticated that they support their own digital storefronts — with the potential for real-world losses if fraudsters find a way in.

August 7 -

The regulator announced in June it would use call report data from before the crisis to calculate bank assessment fees in September, a one-time change.

August 7 -

A handful of credit unions have embarked on co-location strategies, sharing branch space with coffee shops and other businesses, but the social distancing era may force some institutions to rethink those plans.

August 7 -

Now that the U.S. is five months into the COVID crisis a new victim is emerging. Caught between small businesses furloughing their staff landlords needing to collect rent are millions of hourly workers.

August 7 -

s part of a global financial community, we must consider the long-term impact and see financial inclusion as a fundamental priority as we look to rebuild a fairer, more sustainable world, says Icon Solutions' Darren Caprehorn.

August 7 Icon Solutions

Icon Solutions -

Just eight loans had been made as of late July, six of them through a single community bank in Florida, according to new data on the federal rescue program for small and midsize companies hurt by the pandemic.

August 6 -

The central bank released new details about FedNow, which officials hope to get off the ground before a 2023 or 2024 target launch date.

August 6 -

Credit card balances declined most sharply as consumers cut back their spending due to the coronavirus pandemic and associated shutdown orders, the New York Fed said Thursday. But delinquencies also fell across all debt categories, thanks to government and lender relief efforts.

August 6 -

A survey of companies that received funding from the Paycheck Protection Program also showed that respondents on average have cut their payroll costs by more than half.

August 6 -

The agency said property owners can enter into new or modified forbearance plans if they have a hardship due to the coronavirus, but the landlords must agree not to kick out renters solely for nonpayment of rent.

August 6 -

One of the few clear implications from the initial two months of the lockdown with the changes to consumer behavior and the uncertainty ahead is the imperative for organizations to regain clarity on credit risk by obtaining a more complete picture of consumer creditworthiness, says LexisNexis Risk Solutions' Ankush Tewari.

August 6 LexisNexis Risk Solutions.

LexisNexis Risk Solutions.

![“Why [have] relatively few borrowers ... participated in this program?” said Sen. Pat Toomey, R-Pa. He added that he was interested in knowing "why it appears not to have a tremendous amount of demand."](https://arizent.brightspotcdn.com/dims4/default/8ddebb8/2147483647/strip/true/crop/5441x3061+0+283/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Ffa%2F0d%2F81c080b543599e2611e02a1cf8cb%2Ftoomey-pat-bl-080720.jpg)

![“The urgency with which the emergency [stimulus] payments were spent underscores the importance of rapid access to funds for many households and businesses that face cash flow constraints,” said Federal Reserve Gov. Lael Brainard.](https://arizent.brightspotcdn.com/dims4/default/cf7d7c5/2147483647/strip/true/crop/3998x2249+0+209/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F90%2F99%2F26dab0f84aad919e2f91c299ab1b%2Fbrainard-lael-bl-080620.jpg)