Credit cards

Credit cards

-

Rising wages and savings rates resulted in a decline in past-due payments in the second quarter, the American Bankers Association said in its quarterly report on delinquency trends in consumer lending.

October 4 -

The firm hopes to distinguish itself from other lenders by analyzing customer cash flow to determine the likelihood that borrowers will repay.

October 2 -

Now that consumers have come to accept metal cards, issuers are looking to do more with the format.

October 2 -

As Wall Street keeps a wary eye on Amazon.com Inc.’s possible foray into finance, Discover Financial Services’ new chief executive officer isn’t too worried about technology-based invaders.

October 1 -

It seems that every year, at least since Apple Pay launched in 2014, it’s the “year of the mobile wallet.” And each year, like clockwork, the banks end up disappointed in the lack of traction in mobile wallet usage and adoption.

September 28 -

An examination of industry sales tactics conducted after the Wells Fargo scandal found that credit card accounts (not checking or savings) were the largest source of account openings without customer permission.

September 24 -

Offereins led to Discover's payments business to another year of strong growth while setting in motion a bold plan to disrupt the point-of-sale experience.

September 23 -

When many of Synchrony's employees in Puerto Rico where unable to work after Hurricane Maria struck the island last year, CEO Margaret Keane made sure that their paychecks kept coming.

September 23 -

Before Hurricane Florence hit the U.S. this month, certain merchants prepared by stocking up on an unlikely item in the digital payments era: 1970’s-era carbon paper credit slips.

September 21 -

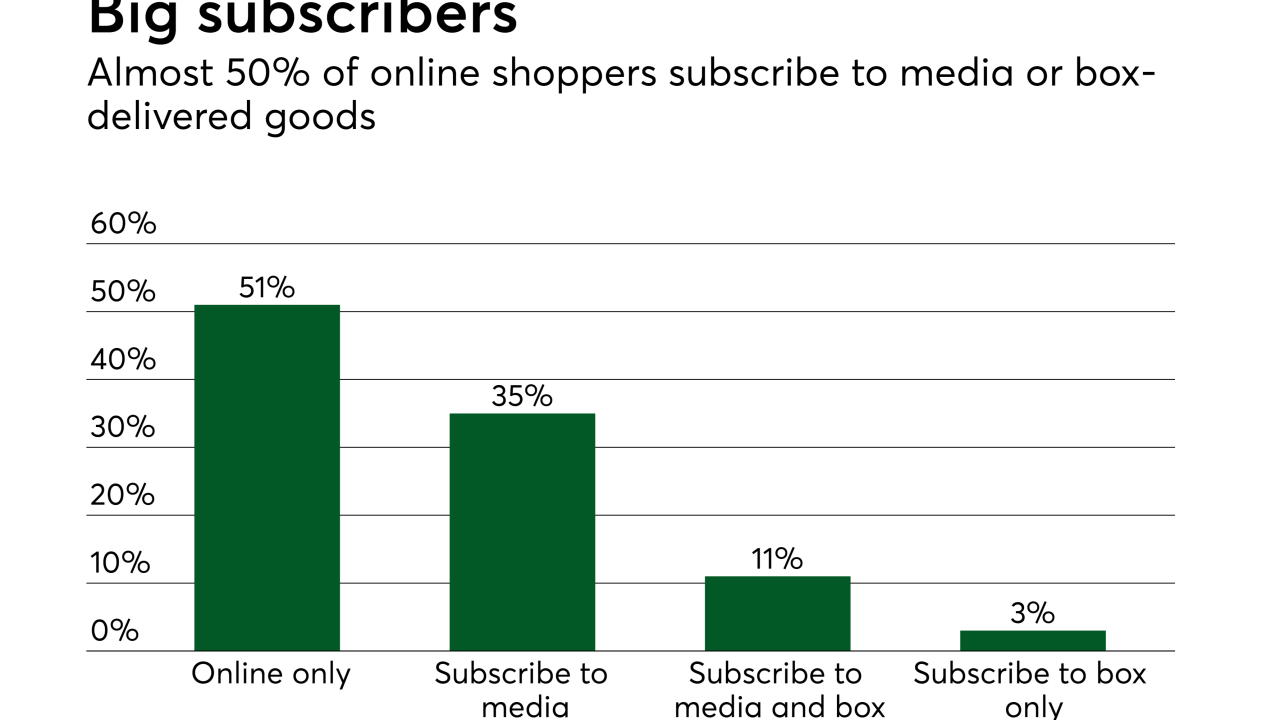

Subscription payments are supposed to happen in the background with little or no effort. But what happens when another “automatic” and constantly changing product is tossed on top of the subscription?

September 19 -

Discover Financial Services has launched a version of the Discover "it" card for entrepreneurs whose rewards and features compete more directly with small-business cards offered by Amex and Chase.

September 18 -

In a continued effort to expand beyond China's borders, China UnionPay will reportedly work with a U.K. company to issue issuing virtual corporate cards next month in Europe.

September 17 -

The broadening of JPMorgan's Sapphire Reserve brand is emblematic of the niche expansion megabanks must rely on since bank M&A is not an option.

September 13 -

The Minneapolis bank is betting that it has the heft — and the brand recognition — to compete for deposits in states where its biggest rivals already dominate.

September 13 -

BofA Merrill Lynch will extend Apple Pay, Google Pay and Samsung Pay support for business cardholders, covering corporate, commercial and purchasing cards in the U.S.

September 12 -

Canada’s biggest grocery chain is beating the banks at their own game.

September 10 -

British Airways is investigating the theft of data including personal and credit-card details from customers who used its website and mobile app to make reservations.

September 6 - PSO content

Discovery Ltd. is on track to start a South African bank by the end of this year after agreeing to buy FirstRand Ltd.’s stake in a credit-card venture, a transaction which had delayed the lender’s launch.

September 4 -

Payments CUSO said it converted a ‘record number’ of credit, debit accounts in 4 months.

August 30 -

Small and midsize banks are most at risk as commercial loan volume fails to ignite; the cutbacks are partly the result of lower origination volume.

August 27