Cyber security

Cyber security

-

As retailers, banks and technology companies continue to suffer data breaches, issuers and merchants need to take extra care when selecting payment vendors.

December 19 -

Online shoppers can expect fraudsters to be at the height of their creativity during the 2016 holiday season.

December 16 -

By making tokenization available on each other's digital wallets, Visa and Mastercard are addressing the security concerns of merchants who are happy to accept both brands but nervous about how their wallets can be misused.

December 15 -

In response to a series of cyber bank thefts, Swift has developed new guidance. It's a necessary first step, though banks for now are still left to fend for themselves.

December 15 -

Yahoo! Inc. disclosed a second major security breach that may have affected more than 1 billion users, another blow to the company's reputation as it nears the sale of its main web businesses to Verizon Communications Inc.

December 14 -

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Both major brands are accelerating a move away from traditional checkout, and all retailers need to make adjustments for the future.

December 13 -

The payments messaging network Swift has told its client banks that the threat of cyberattacks "is very persistent, adaptive and sophisticated and it is here to stay."

December 12 -

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8 -

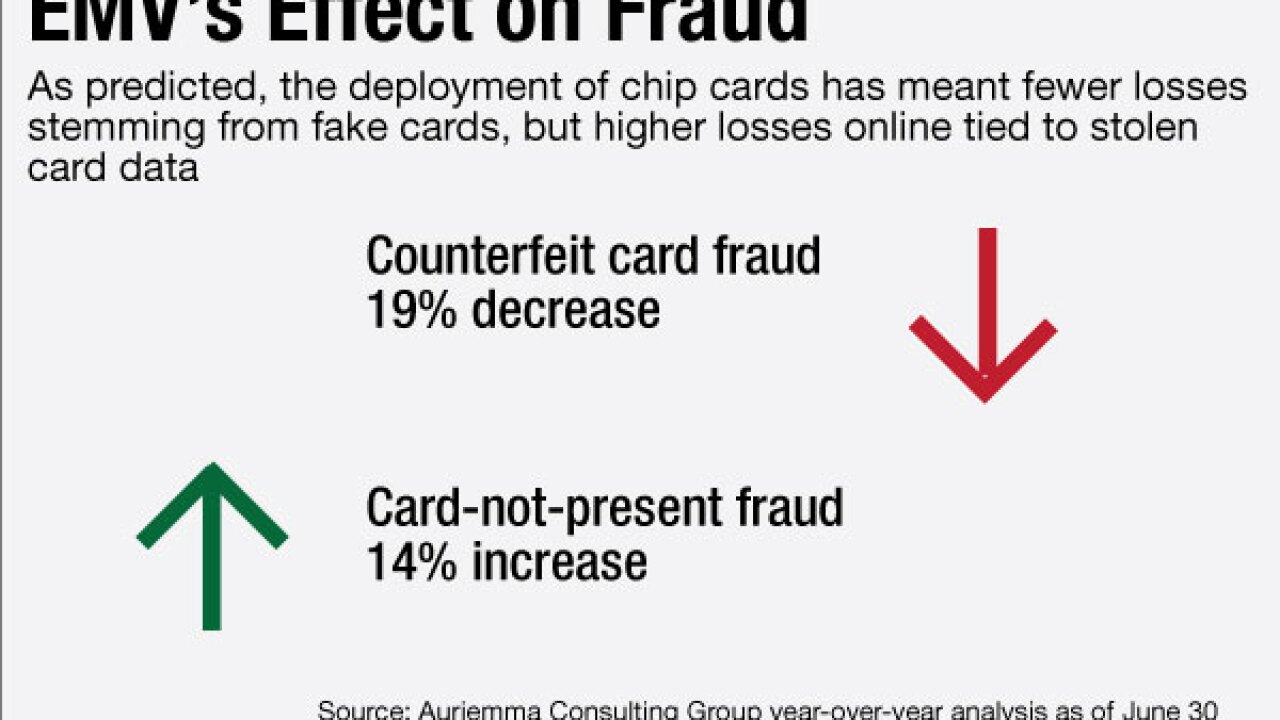

The opening of the 2016 holiday season, which marks the first full year since the country's major EMV fraud liability shift, is proving what data security experts feared all along.

December 6 -

Banks tend to respond to ATM and payment breach risks after an incident. They need to get more proactive.

December 1 -

Financial industry groups have rolled out a plan for keeping bank customers' data safe if a mega-disaster, like a massive attack or a natural disaster, strikes.

November 29 -

JPMorgan Chase seeks to reshape its business through technology, but there is a natural gap between the megabank and Silicon Valley startups. Larry Feinsmith's job is to bring the two together.

November 28 -

A full year into the EMV migration, crooks are expected to be even more aggressive about attacking soft spots in online and mobile transactions.

November 21 -

Distinct business plans in promising areas such as smart use of consumer data, cybersecurity and content creation, according to Bank of America Merrill Lynch commercial banking executive Scott Olmsted. And that is just the beginning of his list.

November 21 -

Behavioral biometrics has already stopped several million dollars worth of online banking fraud at National Westminster Bank in London.

November 17 -

As online fraud becomes more pervasive, merchants need to strengthen their defenses against would-be cyber thieves.

November 15 -

Any company that uses point of sale systems or technology is at risk.

November 11 -

The president-elect's policies on taxes, offshoring, surveillance and other issues will affect bank technology officers and their vendors in a variety of ways. The positives may slightly outweigh the negatives.

November 10 -

Tesco Bank in Edinburgh, Scotland, has refunded 2.5 million pounds (about $3 million) to 9,000 customers who were affected by a large-scale online banking cybertheft last weekend.

November 9