-

The creators of Dash, a bitcoin rival whose price has increased nearly 3,400% in 2017, plan to entice thousands of white-hat hackers to inspect the project’s code for flaws.

September 6 -

The first compliance deadline fell last week for the state’s strict new regulation. Banks are struggling with certain elements, such as multifactor authentication.

September 5 -

The agency awarded grants in three areas: digital security, leadership development and technology aimed at enhancing a CU's capacity to serve the underserved.

September 5 -

The internet wasn't built to accommodate identity, which challenges initiatives to balance security with user efficiency.

September 5 -

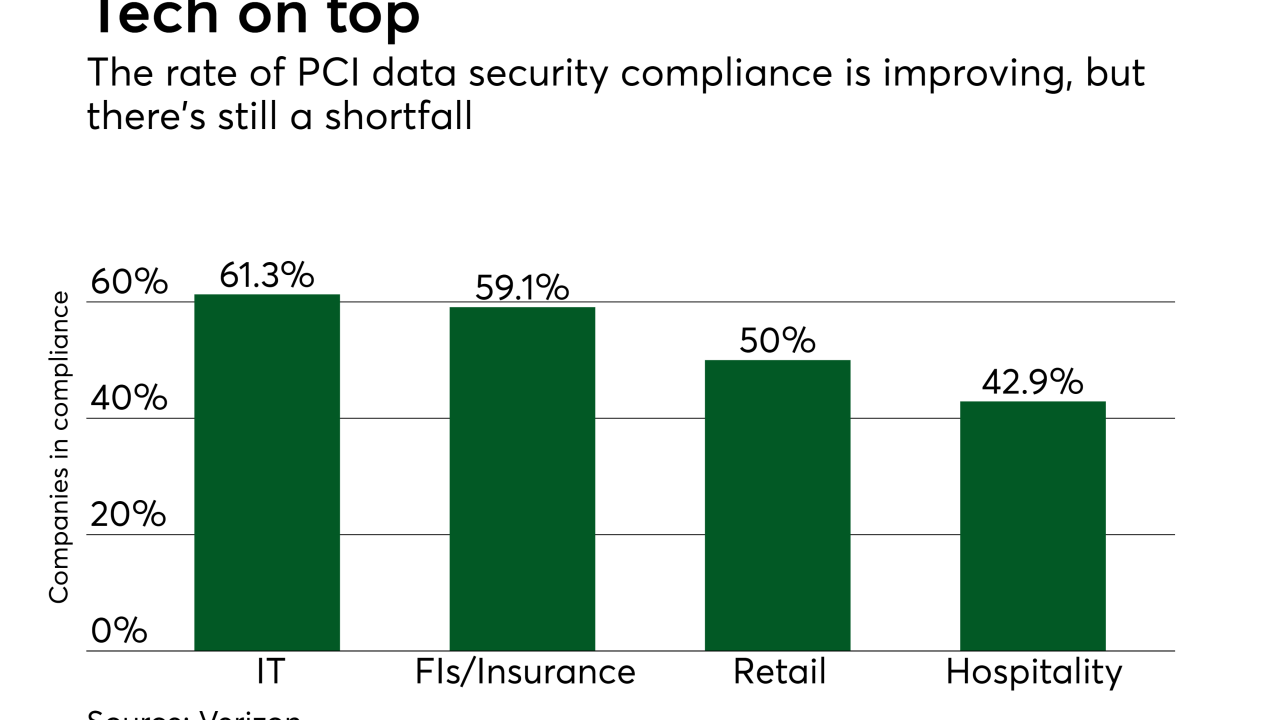

Compliance is improving, but more than 40% of companies still have work to do, according to a new Verizon report.

August 31 -

London-based Jumio has partnered with Plynk, a consumer messaging app available to consumers in Europe, for verifying new customers’ identities during the onboarding process.

August 30 -

First Tennessee took a leap of faith to hire a young digital services company for its overhaul of mobile and online operations, and it says its decision has paid off.

August 30 -

A data-driven approach to money laundering prevention can help increase profits and improve regulatory compliance, writes Edmund Tribue, risk and regulatory practice leader at NTT Data Services.

August 30 NTT Data Consulting

NTT Data Consulting -

Can the internet giants peek at bank data, or eavesdrop on conversations with customers, sent over their gadgets? Here are the facts and the fuzzy areas.

August 29 -

Consumers who either are tiring of the password overload, or those who understand that passwords are antiquated security, are driving the fair amount of biometric adoption, writes Michael Lynch, chief strategy officer at InAuth.

August 28 InAuth

InAuth -

Passwords are widely distrusted for verifying identity and have been blamed for more than 80% of data breaches, but with biometrics and other approaches not yet ready for broad adoption, many innovators are rushing in to fill the gap.

August 28 -

The National Institute of Standards and Technology is telling agencies and companies that collect or store data to change the way they have been protecting their networks — and its guidance is likely to soon spill over to financial services and payments.

August 24 -

From preparing for the next recession and digital disruption to better planning and what millennials want, CUNA Mutual Group’s 2017 Online Discovery Conference covered a lot of ground.

August 24 -

Some banks are experimenting with virtual assistants that, going beyond the routine tasks they perform today, could offer investment advice or make mortgage loans 24/7. But will they ever be able to talk a nervous client through a market crash?

August 23 -

OnlyID, a joint offering from FIS and Equifax, is meant to become consumers’ single sign-on for bank and retail websites and apps. Longstanding relationships may give it a better shot at achieving network effect than previous attempts.

August 23 -

OnlyID, a joint offering from FIS and Equifax, is meant to become consumers’ single sign-on for bank and retail websites and apps. Longstanding relationships may give it a better shot at achieving network effect than previous attempts.

August 23 -

For high-value, low-volume transactions, that is. Big Blue formally launched the platform Tuesday, but the custody bank has been using it for months, as has a group of Canadian institutions.

August 22 -

Like many financial companies, the brokerage wants to go where customers are. Since that means communicating with them via a third-party platform, it is working through privacy and security issues.

August 22 -

All business categories are vulnerable to breaches, but hotels seem to attract the most attention.

August 22 -

The Japanese exchange bitFlyer has processed $30 billion in bitcoin trades so far in 2017. Now it has its sights set on American crypto enthusiasts.

August 18