-

Ben Soccorsy, head of digital payments in Wells Fargo’s virtual channels group, explains how the bank's 15 data-sharing agreements with fintechs and aggregators and tools like Control Tower give customers visibility into and control over their financial information.

April 21 -

The best solutions consider both the user and the device, says says Fingerprints' Jonas Andersson.

April 17 Fingerprints

Fingerprints -

As phishing and other attacks mount, a personal ID number can act as a second authentication factor, says LogRhythm Labs' James Carder.

April 16 LogRhythm Labs

LogRhythm Labs -

Many credit union employees are currently working from home to slow the spread of COVID-19 but this can invite more attacks from cyber criminals.

April 15 -

PINs and passwords are increasingly viewed as insufficient to tackle this new standard, says Fingerprints' Jonas Andersson.

April 13 Fingerprints

Fingerprints -

The implementation of a digital dollar solution would quite likely precipitate future developments in the digital identity space, given the synergy of a dual-architecture solution, says Diginex's Mark Blick.

April 9 Diginex

Diginex -

The most effective way to avoid cloud payment breaches is by dramatically reducing access, says CloudKnox Security's Balaji Parimi.

April 6 CloudKnox Security

CloudKnox Security -

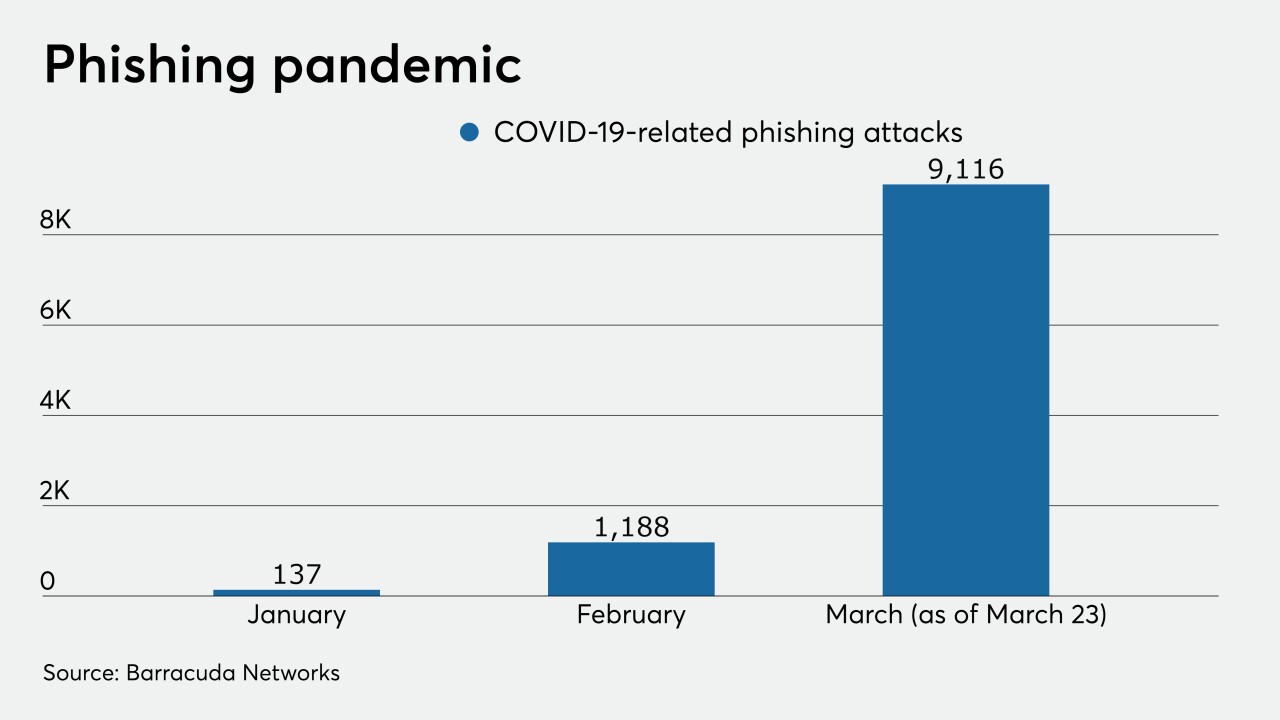

Hacker emails disguised as pleas for aid have surged in the past month, and they're targeting bank employees and the many others working from home.

March 30 -

Card fraud risks — already soaring prior to the coronavirus outbreak — are changing rapidly as the pandemic deepens, forcing issuers and merchants to rethink protective measures.

March 30 -

What banks need to know about the coronavirus stimulus package; tech vendor Finastra hit with ransomware attack; bank CIOs confront challenge of so many employees working at home; and more from this week's most-read stories.

March 27 -

As companies move work off-site because of the pandemic, a host of issues have arisen around remote access, network monitoring and cybersecurity.

March 24 -

The attack knocked out core and mobile banking systems at several U.S. banks, and Finastra is working to get them up and running.

March 23 -

As Americans embrace social distancing, institutions may be forced to rethink board and annual membership meetings. The change could be lasting.

March 23 -

The Comptroller's Office has provided banks with guidance on how to structure relationships with data aggregators. Now the bureau needs to focus on the bank-consumer connection.

March 20 Plaid

Plaid -

Fraudsters who claim they work for the agency are taking advantage of coronavirus confusion to try to con consumers out of bank account information and money.

March 18 -

Big data graph analytics allow you to “drill down” into complex interrelationships among organizations, people and transactions, says TigerGraph's Todd Blaschka.

March 18 TigerGraph

TigerGraph -

With coronavirus taking a significant chunk out of physical retail and services, the use of call centers and phone interaction with customers becomes even more important.

March 18 -

In a scenario where employees regularly and accurately track and report their business expenses, this continuously updated data helps businesses make intelligent decisions quickly, says Fyle's Yash Madhusudan.

March 17 Fyle

Fyle -

Digital fraud protection provider Kount has launched a security layer designed to prevent account takeover.

March 17 -

As smart device adoption continues to grow, users must be vigilant to not only change passwords but to take advantage of advanced security settings. By introducing 2FA, Google is adding necessary security measures to protect consumers, according to Pulse Secure’s Sudhakar Ramakrishna.

March 17 Pulse Secure

Pulse Secure