-

At the recent Analytics and Financial Innovation Summit in Minneapolis, attendees weighed in on whether credit unions have have what it takes to effectively dig into big data -- and, if they don't have it, what will it take to get it?

June 15 -

Not all data providers are created equal, and credit unions must carefully evaluate any new partner’s technology, processes and more.

June 14 LexisNexis Risk Solutions

LexisNexis Risk Solutions -

By making it easier and safer to share data with third parties, Wells Fargo's Brett Pitts says he is strengthening the bank's relationships with customers.

June 7 -

Europe is debating whether to ban screen scraping, a practice that fintechs count on as a last resort. Innovation is at stake.

May 24 -

MIT professor Maria Loumioti has studied loans made strictly using hard data and loans where a loan officer clearly was influenced by personal connections or feelings about a borrower. The results shed light on the value and limitations of "soft" information.

May 9 -

Big data is a key for banks to better understand what financial products underbanked consumers and small businesses need.

May 1 Accion

Accion -

With the reversal of Obama-era rules requiring user consent for data collection, it is more important than ever for U.S. banks and fintechs to demonstrate a robust and consistent approach to data privacy.

April 17 DemystData

DemystData -

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

Readers sound off on airing political opinions at the office; putting banks and fintechs under the same regulatory umbrella; putting consumer needs first regardless of tech advancements; and more.

March 31 -

The credit bureaus will change the way they include information about tax liens and civil judgments in credit reports. This could spur lenders' use of alternative credit data.

March 30 -

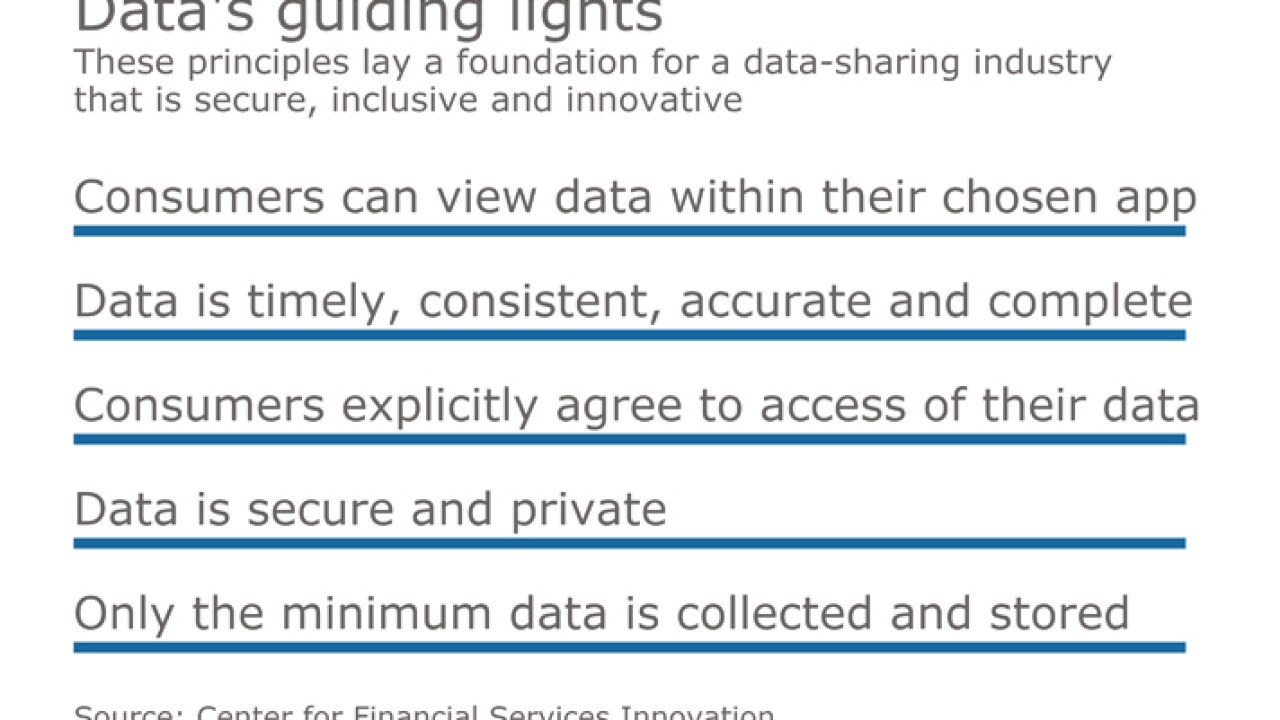

The industry needs to establish a clear set of rules and standards so safe and secure financial data access and sharing continues unrestricted.

March 27Financial Data and Technology Association of North America -

By partnering with Intuit, Wells Fargo is continuing its journey toward API-based data sharing, and away from screen scraping.

February 3 -

The president's executive order reflects a lack of trust in the identity information shared between countries. In theory, blockchains are tailor-made to solve this problem, but current systems may not be up to the task.

January 31 -

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25 -

Customers of JPMorgan Chase will no longer have to surrender their bank credentials in order to use Intuit products like Mint, TurboTax or QuickBooks.

January 25 -

Financial innovation will stall unless we, as an industry, collaborate on a universal data gathering standard.

January 12 Finicity

Finicity