Digital banking

Digital banking

-

SoFi's experience shows that the most prominent names in fintech, while generating massive financial support, still operate in a very volatile world.

January 23 -

A plan by the largest U.S. bank to use part of its tax windfall to enter new markets (including Washington and Boston) could become a serious threat for banks of all sizes in those cities — or looked backed upon someday as a pricey overexpansion.

January 23 -

Millennials are more bank-savvy than they’re given credit for, according to a new survey sponsored by Bank of America.

January 23 -

As customers become more tech-savvy, the bank said it no longer needs to prod them to use its digital products by offering discounts. Account holders can avoid fees by enrolling in direct deposit.

January 22 -

Wells Fargo joins the list of banks recently hobbled by tech outages. Is there a better response than "Sorry for the inconvenience"?

January 19 -

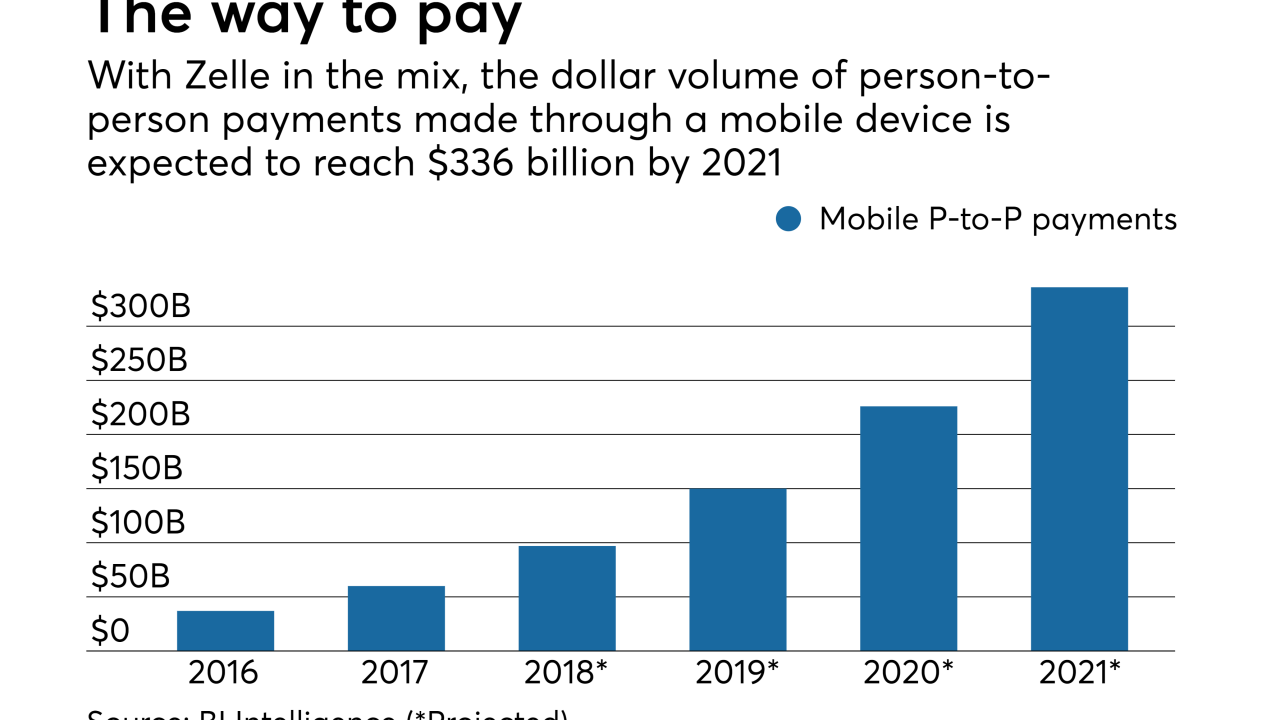

The P-to-P payments service promises to clear transactions in near-real time, but many consumers have complained that they have been unable access their money or even open accounts. Zelle has acknowledged the delays and says they are a result of its rigorous enrollment process.

January 17 -

Executives at U.S. Bancorp and Bank of America plan to use their tax savings to ramp up spending on new technology to stay competitive — but they sought to reassure investors that they would not abandon cost control.

January 17 -

Providing the default card in digital subscription services is one way banks can win back bill-pay business, save customers time and help them manage their data.

January 17 -

The move comes at a time when banks are becoming more aggressive in acquiring or investing in financial technology companies.

January 17 -

The New York bank has begun marketing Marcus loans as a way to pay for home improvements, while also raising the maximum loan size to $40,000.

January 16 -

Banks are increasingly investing in technology that will enable them to deliver highly personal and customized communications with customers.

January 12 -

The San Francisco startup behind the cryptocurrency XRP claims it can send money around the world faster, cheaper and with greater transparency.

January 11 -

Bank of America has opened a flagship branch downtown and plans several so-called robo branches across the city. It has used a similar strategy to enter new markets in the past year.

January 11 -

The agreement marks the latest example of the banking giant teaming with a fintech to speed up delivery of services to its customers.

January 11 -

Capital One became the latest bank to feel customers' online wrath last week after reports that some customers were being charged twice for debit card activity. But it was hardly alone.

January 10 -

From a focus on integration to increased fintech cooperation and more, here's a preview of some of the tech trends that will shape how credit unions do business in the coming year.

January 9 -

Several women are viewed as possible successors for a retiring William Dudley. Pam Codispoti has plans to up the millennial appeal of Chase’s 5,200 branches. What’s hot in fintech for 2018? Plus, the year of #MeToo in review.

January 5 -

Customers saw transactions recorded multiple times and experienced drained accounts and long hold times. It’s a warning to all financial institutions as they head further into mobile-only banking — glitches are more visible and painful and need to be addressed faster than ever.

January 4 -

Banks are working hard to reshape their businesses to meet new demands, but leaders must be careful not to alienate their best workers in the process.

January 4 -

Rep. Emanuel Cleaver, D-Mo., has emerged as one of the most outspoken members of Congress when it comes to fintech, both embracing its potential and calling for regulatory guardrails.

January 3