Digital banking

Digital banking

-

The online lender has already branched out into facilitating payments and analyzing cash flow for small-business customers. Its new checking account is meant to round out those services.

July 22 -

Jamie Warder, head of digital banking at KeyBank, says alliances with companies like HelloWallet have helped him and his team adapt to changing conditions during the coronavirus crisis.

July 21 -

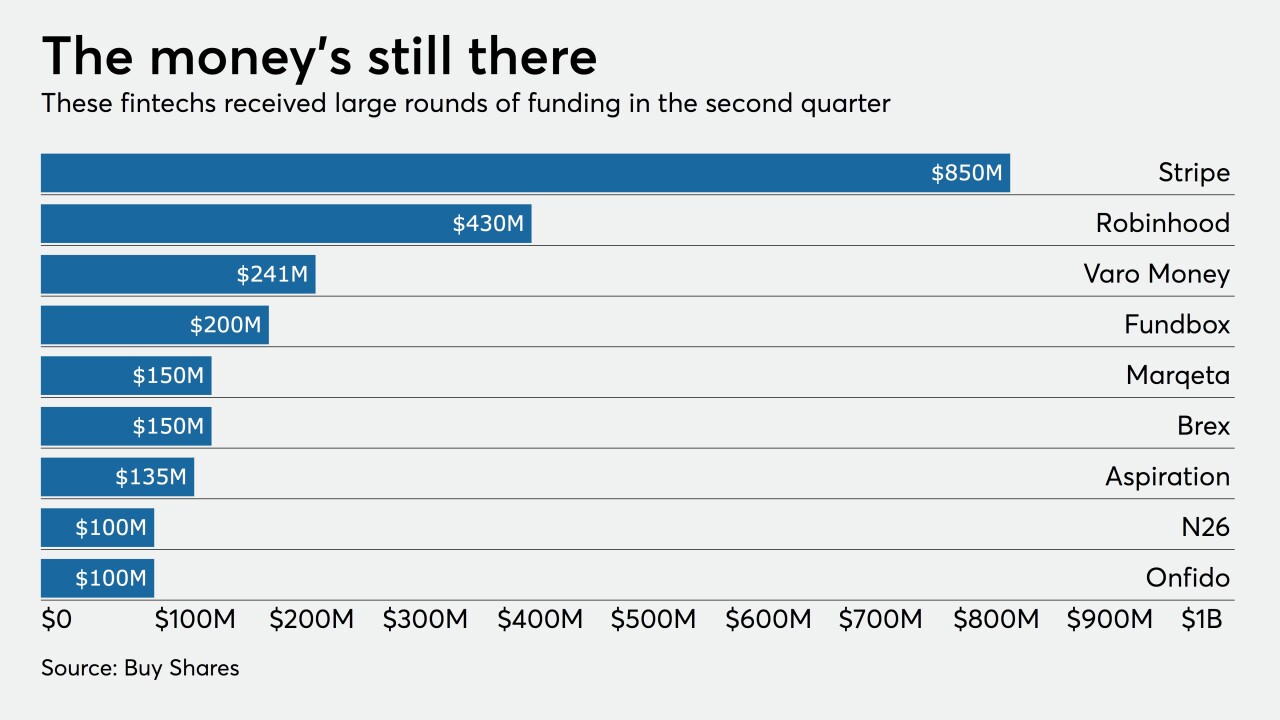

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20 -

The Warsaw, N.Y., bank said it will close 10% of its branches and lay off 6% of its staff in response to customers’ growing preference for remote banking.

July 17 -

Fintechs like Greenlight and gohenry have drawn millions of teens with features like savings goal tracking and customizable debit cards.

July 16 -

Rho initially focused on startups, but now it’s targeting businesses with 100 or more employees.

July 16 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

Video banking can be safe and effective but members and staff need to be reminded of common-sense precautions to guard against cybercriminals.

July 15 -

Consumers now have more control over their own financial decisions and loan options.

July 14 -

Nationwide lockdowns forced banks to close brick and mortar outlets and rely heavily on drive up windows, mobile and online access. BBVA has proven that even in the middle of crisis and chaos, retail still fits into the banks overall strategy.

-

Nationwide lockdowns forced banks to close brick and mortar outlets and rely heavily on drive up windows, mobile and online access. BBVA has proven that even in the middle of crisis and chaos, retail still fits into the banks overall strategy.

-

Several big bank mergers fell apart after the coronavirus hit. But Bryan Jordan, First Horizon's CEO, said the pandemic validated plans to cut costs and invest more in digital upgrades.

July 9 -

If it’s approved, the charter is expected to lower the fintech’s cost of funds and allow for more product offerings. It comes nearly three years after SoFi pulled the plug on an earlier effort to open an industrial bank.

July 9 -

The Wall Street firm is jumping into a market dominated by a handful of big U.S. banks, betting that superior technology can lure companies with complex cash-management needs.

July 8 -

Consumers now have more control over their own financial decisions and loan options.

July 8 -

Collecting the right data and understanding the nuances to which channels customers are using and why, can go a long way in delivering experiences that customer loyalty is built on, says Adobe's Mark Masterson.

July 8 -

Some financial institutions are using emotion AI, which picks up subtle signals over text, audio and video, to help their customer service agents do their jobs better.

July 7 -

Jane Gladstone, new president of Promontory Interfinancial Network, says the recession will accelerate the shakeout among the nonbank disruptors and that small banks have an opportunity to forge new bonds with the survivors.

July 6 -

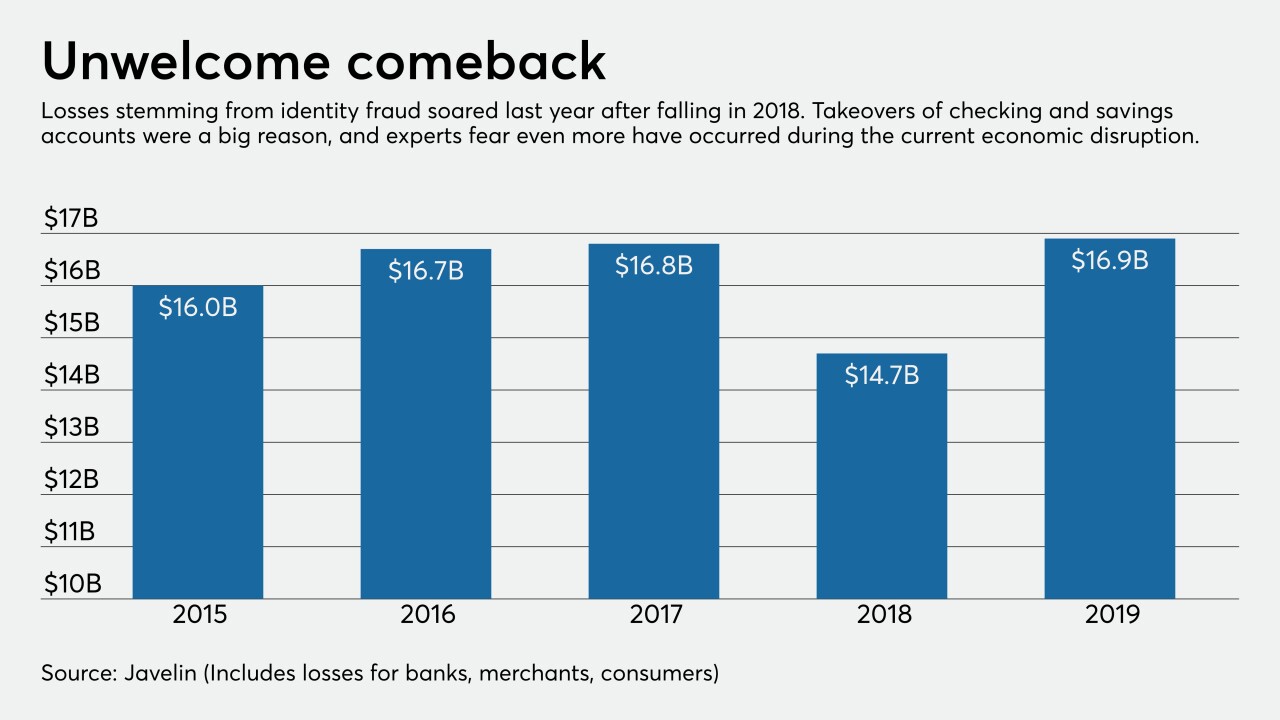

Axcess Financial is using stronger authentication, studying up on bad actors and planning to use a federal service that automates verification of Social Security numbers.

July 2 -

Thanks to their close relationship with the card networks, banks stand to benefit most from deals like Mastercard’s agreement to buy Finicity and Visa’s pending purchase of Plaid. The prospects for fintechs and consumers are dicier.

June 29