Digital banking

Digital banking

-

Among other things, Kai, the insurance firm's AI assistant, will tell customers how to avoid the bank's monthly fee.

June 27 -

Challenger banks promote the concept of empathy in banking, which sometimes means forgoing revenue to build up customer goodwill.

June 26 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

Many people still distrust banks, but many also look askance at the social media giant, making it an unlikely savior of the unbanked.

June 25 -

As lawmakers meet this week to discuss artificial intelligence, they should work with regulators to create universal and workable definitions.

June 25 -

The ATM manufacturer has added mobile banking integration, document signing, biometric authentication, video banking and a cash recycler to its DN Series.

June 25 -

Bruce Van Saun, CEO, shares details of the new digital channels the bank is building for consumers and small-business customers.

June 25 -

Nearly half the nation's state regulators have agreed to a new multistate licensing business for money servicers, including fintechs.

June 24 -

At the recent Digital Banking conference, a pair of credit union executives offered insights into how the shift toward digital services has impacted their branching strategy and vice versa.

June 24 -

In a hyper-competitive job market, credit unions are finding creative ways to keep staff engaged and sweeten the deal for potential new hires.

June 24 -

Facebook's plans to launch its Libra cryptocurrency dominated much of the discussion at American Banker's Digital Banking conference last week, but attendees also debated what big tech company might strike next and what future digital innovations are in store.

June 23 -

Google explored the OCC's fintech charter, then walked away; the biggest changes in digital banking could be just ahead; 'Truist' rebrand prompts lawsuit by N.C. credit union; and more from this week's most-read stories.

June 21 -

Executives and directors from across the industry discussed their concerns for the industry and priorities for the next year during this year's NAFCU and CUNA annual conferences.

June 21 -

Banks are increasingly turning to outsiders like Nikki Katz, a former Disney executive now at Bank of America, and Joel Kashuba, formerly of Procter & Gamble and now at Fifth Third, to help build their digital experiences.

June 21 -

While global banks have been pouring money into information technology — to the tune of $1 trillion over three years — only a handful appear to be fully committed to a digital transformation and are therefore reaping the benefits, according to an Accenture study.

June 21 -

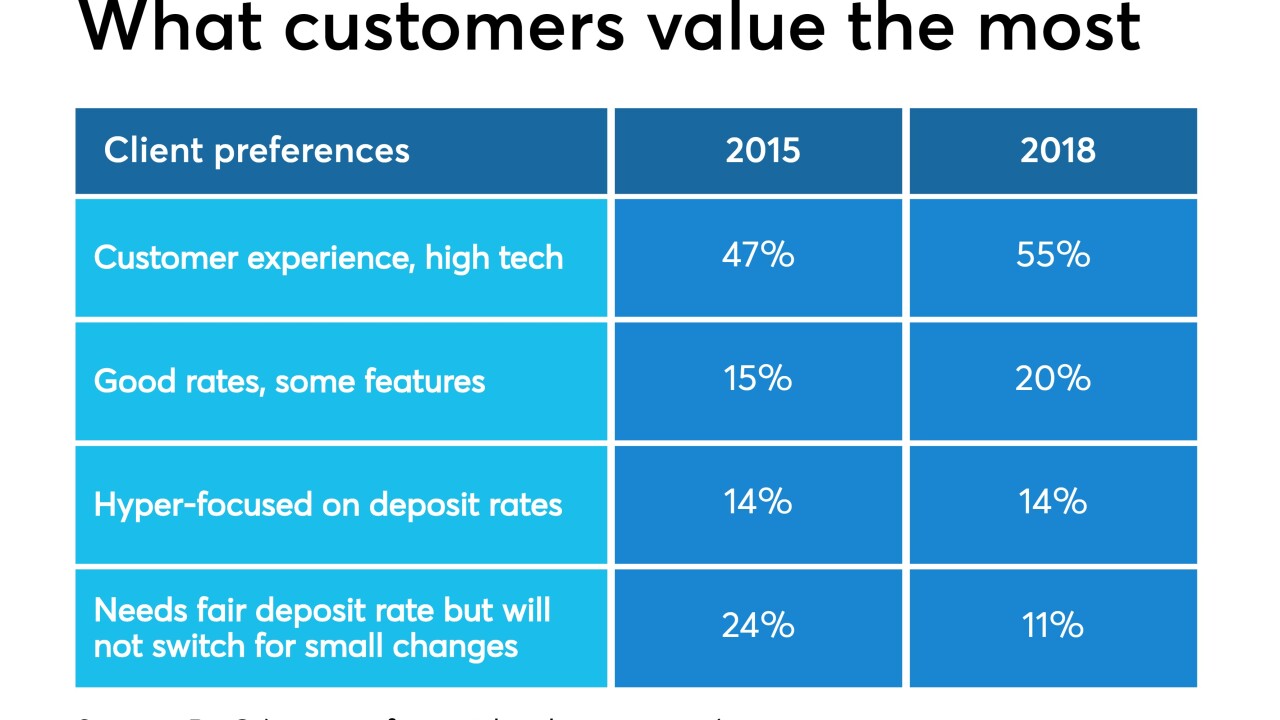

Customers of Marcus, the consumer lending arm that launched in 2016, defy easy categorization, according to an executive at the Wall Street bank.

June 21 -

Community bankers want to cut the time it takes for customers to establish digital accounts to mere minutes, but it's hard to do that and make other improvements without increasing fraud risk.

June 20 -

Whether it’s applying for a loan through a mobile app or building an investment portfolio via robo adviser, users want to know they can quickly and easily speak to a human being if they run into problems, top executives said at American Banker’s Digital Banking conference this week.

June 20 -

Community bank executives, payments officials and others said Libra faces an uphill battle amid heavy competition and regulatory scrutiny.

June 20 -

The first full day of America's Credit Union Conference in Orlando hit on a variety of topics, including narrowing the gender gap and ongoing attacks from banks.

June 19