Digital payments

Digital payments

-

The buy now, pay later lender is carving out a lane for itself with exclusive deals with Intuit's Quickbooks Payments and Expedia's websites. It also will be the default BNPL provider for Bolt's one-click checkout.

February 3 -

The year was marked with six state regulations, new entrants, product and market expansion from existing EWA providers and buy-in from investors.

December 30 -

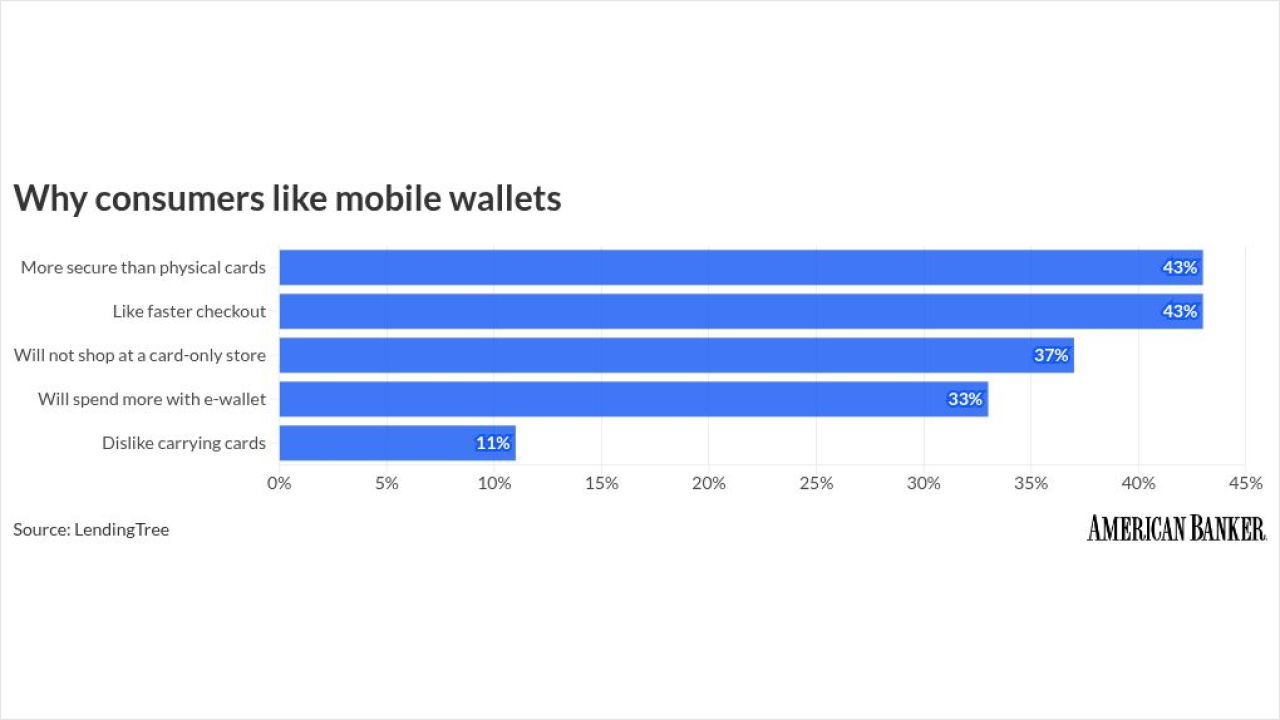

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

Articles about stablecoins, scams, fintechs, premium credit cards and open banking were just some of the topics that struck a chord with American Banker subscribers in 2025.

December 26 -

The bank is betting on demand from resource-challenged companies.

December 23 -

The card networks have entered a series of partnerships in Europe and Asia amid signs of growing demand and Apple's waning control over the underlying technology.

December 19 -

Early Warning's online checkout tool signed a multi-year partnership with NYCFC to be the official online checkout and digital wallet of the Major League Soccer franchise and a founding partner of its forthcoming stadium, Etihad Park.

December 16 -

Visa launched its Stablecoin Advisory Practice, a value-added service from its consultancy arm Visa Consulting & Analytics, to help financial institutions, fintechs and merchants deploy stablecoin technology.

December 15 -

As shoppers embrace new forms of AI, crypto and alternative financing, payment experts say financial institutions will need to reassess traditional payment products.

December 12 -

-

The payments firm is taking another step to attract younger customers, a strategy that CEO Jack Dorsey has said will promote long-term network growth.

December 8 -

The state is requiring merchants to accept cash denominations of $20 and under and prohibits them from charging extra to accept cash. The law, which goes into effect in March, comes as merchants are responding to the Trump administration's abrupt cancellation of penny production.

December 5 -

The card network is making a digital wallet push following the Digital Markets Act, which dilutes Apple's control over mobile payments technology.

December 4 -

Tariffs and inflation are pressuring consumers' wallets, but that's not deterring them from spending. It is pushing purchases earlier into the shopping season.

November 25 -

As banks change layouts to focus more on customer experience, the ATM company is leaning into AI-powered management and simplified technology sales to keep self-service kiosks relevant.

November 24 -

The U.K.-based banking giant will add a fintech that enables it to compete with Apple Pay, while Global Payments has added Uber Eats as part of its Genius-branded point of sale rollout. Plus: Visa has advanced account-to-account payments in the U.K. and more in the global payments and fintech roundup.

November 19 -

The payments company is expanding the transfer app in an effort to entice more consumers to use the service as their primary banking relationship

November 14 -

The payment and commerce company's stock fell as much as 12% in afterhours trading on Thursday after the fintech missed Wall Street's earnings estimates, despite posting growth in all lines of business and increasing its full year guidance.

November 6 -

Zelle's parent Early Warning Services said Friday it was planning to take its peer-to-peer payments network international through a new stablecoin initiative. It says the details will come later.

October 24 -

The number of states with earned wage access legislation doubled in 2025 with six states passing new laws. Connecticut regulators have been particularly strict, creating conflict between lenders and the government.

October 20