Digital payments

Digital payments

-

VCs have been devoting more attention — and funding — to U.K.-based digital remittance providers such as TransferWise, Revolut, WorldRemit and their smaller rival Paysend.

August 13 -

The San Francisco-based fintech is using JPMorgan Chase’s real-time payments service to power the new overdraft prevention tool.

August 13 -

-

As the competition mounts to increase adoption rates for person-to-person payment apps, PayPal's Venmo is adding a way for users to quickly move money from the app to their bank account.

August 12 -

Mexico is considering a ban on the use of cash for purchasing gasoline and to pay for tolls as a way to fight tax evasion and money laundering, according to people with direct knowledge of the discussions.

August 12 -

Lightico is focusing on how users engage with institutions on a mobile device, something the company believes is a shortcoming among card issuers.

August 9 -

Know Your Customer and open banking create tough barriers for 'near real-time' account opening, says Entersekt's Jennifer Singh.

August 9 -

Apple's massive user base, fully digital enrollment system, merchant reach and partnership with Goldman Sachs threaten retail banks on multiple fronts.

August 9 -

InComm has partnered with the Los Angeles County Metropolitan Transportation Authority (Metro) to more than quadruple the number of retail locations at which customers can purchase and reload its contactless TAP transit fare cards.

August 8 -

Apple's new credit card isn't just another virtual card in its virtual wallet. It borrows a lot of features from the most successful brands in payments and technology.

August 8 -

CU Payz has six founding credit union members, including Coastal Credit Union, and will be open to the entire industry.

August 8 -

Virtual assistants are being brought forward into a variety of other internet-of-things devices such as automobiles and appliances, with the goal of finding new moments where consumers are willing to spend money — sometimes guided by machine learning.

August 7 -

As Apple Card’s public test begins this week with a limited number of consumers, details are emerging about how the tech giant is differentiating its product from other cards.

August 6 -

In a bid to help small businesses whose transaction volumes don’t warrant acquiring a dedicated POS terminal, National Australia Bank is partnering with Visa and Quest Payment Systems to pilot a tap-on-phone solution that provides secure contactless card acceptance using the business owner’s smartphone.

August 6 -

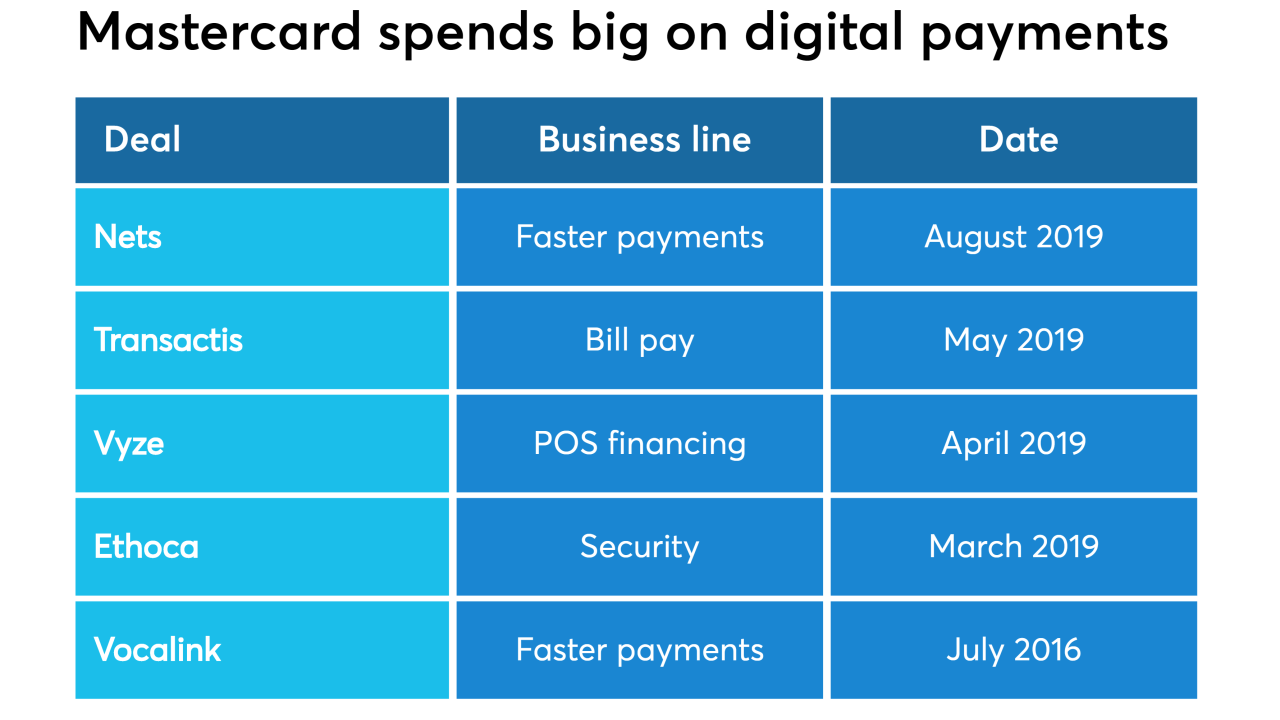

Mastercard has spent more than $4 billion on investments so far in 2019 to thread a needle between several must-haves in the digital payments market.

August 6 -

David Marcus spent more than 15 years climbing the ranks in the mobile sector before becoming PayPal’s president and then moving onto Facebook, where he now leads the blockchain team that launched the controversial Libra cryptocurrency project.

August 6 -

The Jacksonville, Fla.-based credit union is the initial investor in PayverisCU, which will help members with financial wellness and money management.

August 5 -

Community banks shouldn’t wait for the Fed to create a new real-time payments rail when consumers are already flocking to other options.

August 5 -

Investors are making bets on checkout-free retail, a category that is just as challenging as it is innovative. But it's payment technology's race to the moon, a chance to seize a favorable position in the struggle to save retail.

August 5 -

Walmart has filed a patent application for a digital currency that, like Facebook's Libra, would be a stablecoin backed by traditional currencies. And it envisions a very specific use case where its coin could stand in for cash — or even for a bank account.

August 2