Digital payments

Digital payments

-

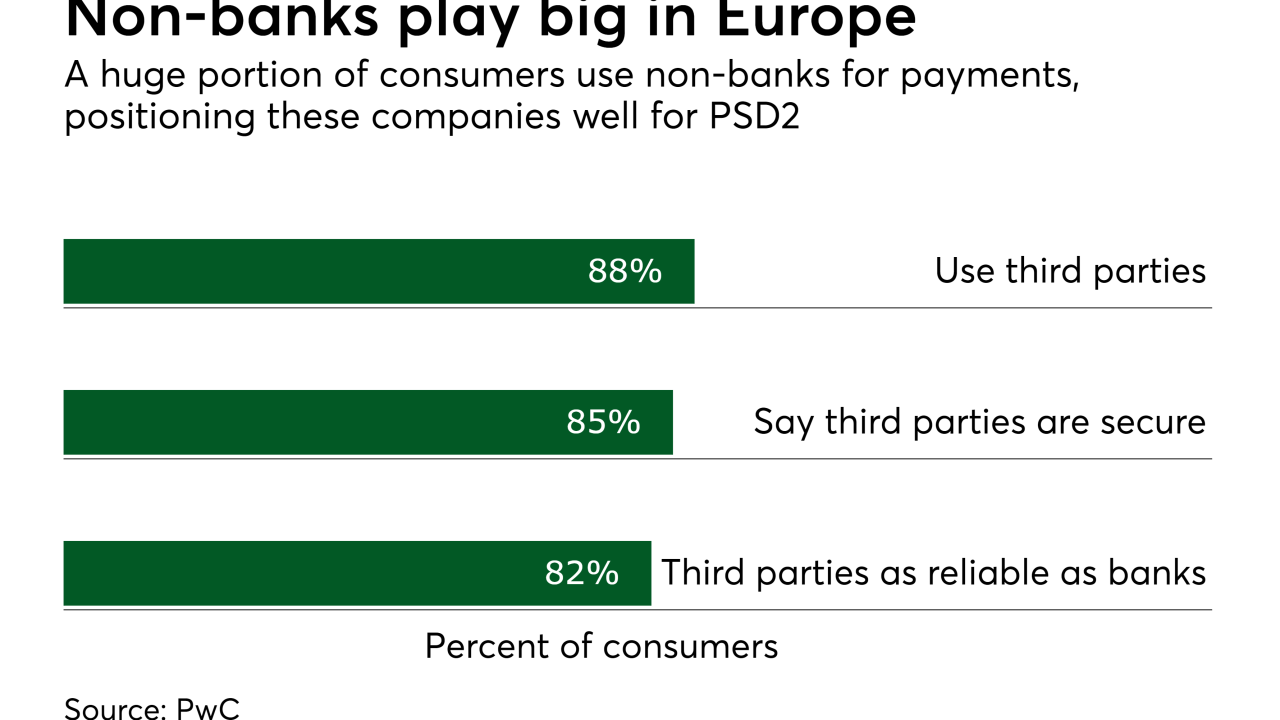

The question of upgrading to 3D Secure 2.0 authorization will become easier for European e-commerce merchants if it proves to be a path to compliance with a provision of PSD2, the revised Payment Services Directive.

August 2 -

Square has worked hard in the past several years to offer more than just mobile card acceptance, but not all of its efforts have paid off.

August 2 -

Younger consumers still like to go to the mall. Keeping them there requires a mix of easy payments, financing and shopping in multiple channels, says Nufar Segal, general manager of consumer financing for at Jifiti.

August 2 -

Square Inc. is selling its Caviar food-delivery app to DoorDash Inc. for $410 million, as the money-losing payments company searches for profits.

August 1 -

It’s not yet time to retire the notion that businesses favor checks for supply chains, but deployments in multiple markets signals a turning point in modernizing B2B payments.

August 1 -

The health care payments market is big – accounting for over one in six dollars of the U.S. GDP – yet it remains perpetually outdated with its heavy reliance on using paper statements for sending out bills.

August 1 -

Banks need to find quick wins; enhancements that make the most of their current strengths by maximizing revenues and offsetting rising customer attrition, writes Lars Sandtorv, CEO of MeaWallet.

August 1 -

JPMorgan Chase has become the first card issuer to join the Visa and Billtrust Business Payments Network in an effort to streamline the delivery of electronic B2B payments for its commercial card clients.

July 31 -

Community banks shouldn’t wait for the Fed to create a new real-time payments rail when consumers are already flocking to other options.

July 31 -

Amex's multi-merchant rewards coalition, Plenti, may have failed, but ExxonMobil never gave up on the program's potential.

July 31 -

Brexit seems more likely than ever, as the U.K.'s new prime minister, Boris Johnson, has committed to meeting the October 31 deadline for a deal to leave the EU. But despite the lingering uncertainty over how that will happen, Mastercard is not abandoning its bullish stance on Europe.

July 30 -

If the Federal Reserve doesn't maintain an active role, Wall Street megabanks could take over the payments system.

July 29 -

Banks and fintechs such as payment apps depend on one another a lot more than their marketing messaging would lead you believe. The question is no longer whether they can partner, but how they can work together to optimize those synergies for one another, writes Flywire's Mike Massaro.

July 29 -

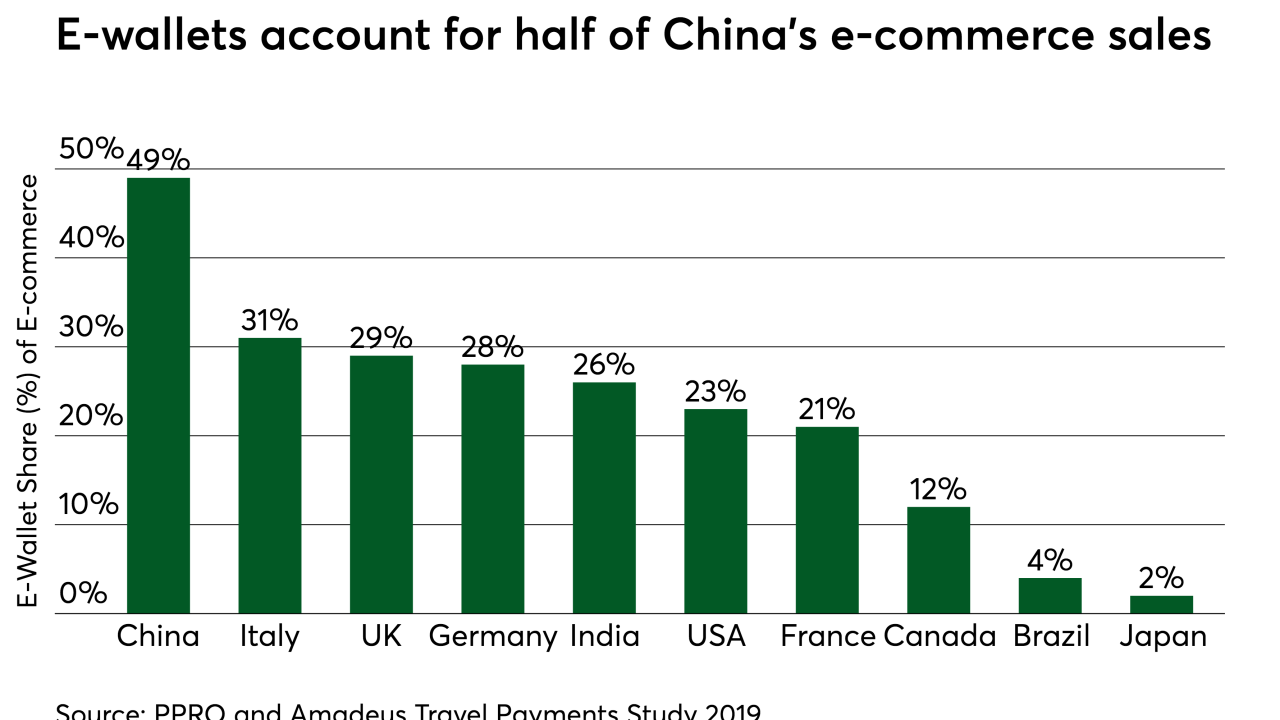

As the e-commerce channel expands its share of total retail sales worldwide, it’s often thought that credit and debit cards are the primary beneficiaries. However, cash still remains a viable payment option for e-commerce transactions — with the help of a third party to handle the payment.

July 26 -

By offering Prime subscribers one-day shipping instead of the standard two, Amazon saw a dramatic change in shopping behavior — and a corresponding rise in costs.

July 26 -

Top technology innovations in digital banking you need to see

July 26 -

The mobile point of sale market has grown far beyond its roots as an off-the-shelf dongle for smartphones. The category is now driving major acquisitions, collaborations and international deployments.

July 26 -

Readers react to BofA defending reverse mortgage borrowers, support the Federal Reserve creating a real-time payments system, advocate for consolidating federal bank agencies and more.

July 25 -

Giant Eagle’s supermarkets go back a century, literally, making the Pittsburgh chain one of the best tests yet for how the supermarket experience can adapt to mobile technology and the de-emphasizing of traditional checkout.

July 25 -

The brokerage expects customers will use conversational tech to check accounts and perform other financial transactions while stuck in traffic.

July 24