Fintech

Fintech

-

Payment processors and fintechs are rapidly consolidating in a series of M&A deals, and Canadian payments company Nuvei is making its bet via a $889 million deal to acquire SafeCharge.

May 22 -

The biggest deal in more than a decade has sparked debate about the pressure for more bank consolidation and whether consumers will be hurt.

-

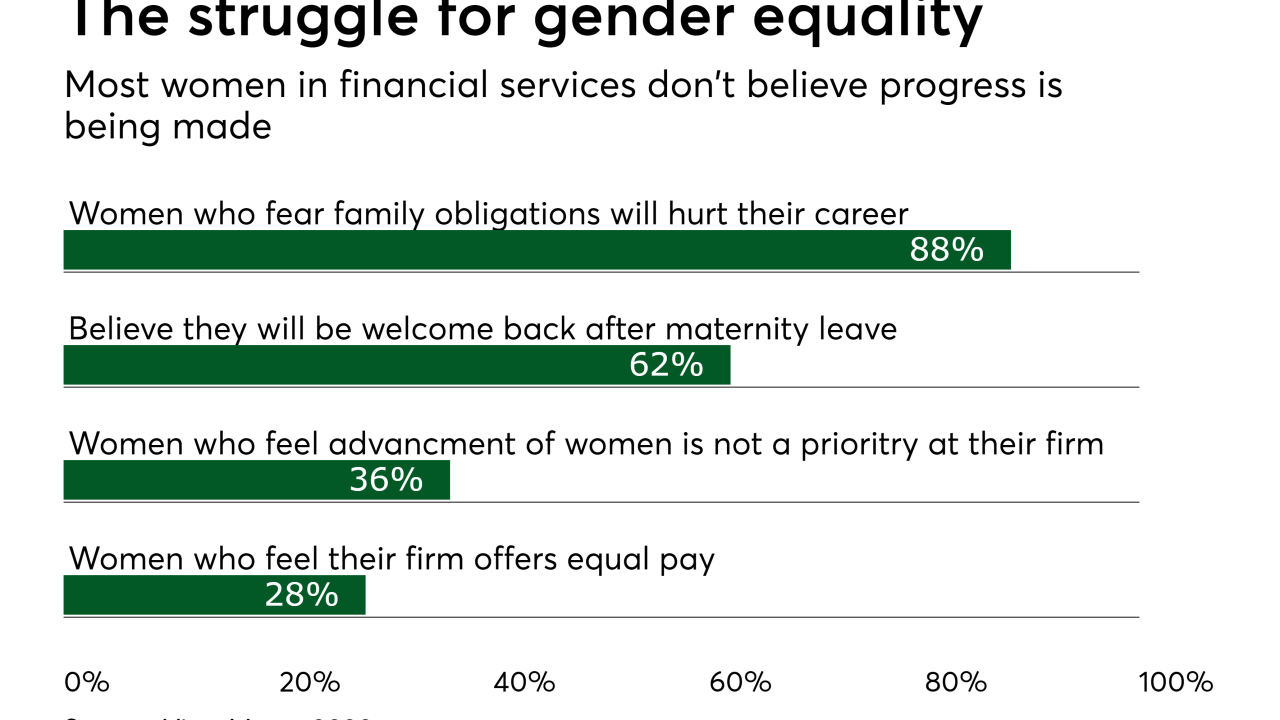

Most women who reach the executive level in the payments industry didn’t get there alone. Finding the right mentor, developing a voice and taking positive lessons from negative experiences often are keys to success.

May 22 -

While some of the biggest institutions are already rapidly developing new technologies, it’s important that community banks also tap the power of artificial intelligence and machine learning.

May 22 -

Apps need to give customers confidence in ease of use, speed, aesthetics, credibility and user experience, as well as the ability to receive tailored communications through favored channels from their financial institution of choice, writes James Brown, CEO of Smart Communications.

May 22 -

A German fintech firm that counts PayPal Holdings Inc. among its investors wants to expand its internet platform for bank-savings products to the U.S.

May 21 -

Raisin GmbH has hired Wealthfront’s Paul Knodel to expand its internet platform for bank-savings products to the U.S. If all goes to plan, the operation will go live within 12 months.

May 21 -

Banks would be better able to comply with anti-money-laundering laws if all 50 states collected information on the owners of new corporations and published it in a national database, Comptroller Joseph Otting said Monday.

May 20 -

The fintech M&A wave is sweeping over the dining and fast-food industries, with major companies like Amazon, Walmart and American Express spending on smaller firms that focus on digital food delivery and payments.

May 17 -

Regions Financial said Thursday that it will not renew its contract with GreenSky — a move analysts say could prompt other banks to re-examine their lending arrangements with the fintech.

May 16 -

Presidential candidates aren't talking much about banking now, but that's likely to change as the Democratic primary heats up.

-

The total includes donations to community groups helping low-income people, support for the development of financial coaching programs and investment in the creation and testing of fintech tools that can help underserved people.

May 15 -

The Clearing House's Real-Time Payments Network has been slow out of the gate, but it's getting some much needed adoption via a collaboration between personal financial management fintech Digit and JPMorgan Chase.

May 14 -

We must challenge ourselves with transparency by neutralizing gender-specific language in company job advertisements to reach a more diverse pool of candidates and drive responses, writes Nicole Baxby, an account director at Featurespace.

May 14 -

Petal's getting aggressive with its incentive marketing by approaching consumers with limited credit histories, and it's betting artificial intelligence can handle the higher risk.

May 14 -

The forces reshaping small-business lending are also leading to “a moment of reckoning” for small banks, says former SBA head Karen Mills.

May 14 -

Manuel Alvarez, who became commissioner of the Department of Business Oversight on Monday, is the former general counsel and chief compliance officer at the online lender Affirm.

May 13 -

Banks must remain accountable for their use of artificial intelligence by continuing to employ a level of human oversight.

May 10 -

The Financial Stability Oversight Council first wanted to target individual nonbanks that are economically risky. Now it wants to target activities instead. Is that a good idea or a political ploy?

-

Plinqit, led by a former banker, was developed specifically for community banks as a way to appeal to young customers.

May 9