Fintech

Fintech

-

R&D capabilities at Interac got a boost last month when Interac Corp. was created by merging Interac Association and Acxys Corp. It brought together a payments network handling nearly 5.7 billion debit transactions annually with a company specializing in payments development, management and consultation.

February 15 -

The investment continues a trend of banks focusing on commercial payments technology.

February 14 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

February 13 -

Neptune Financial plans to use technology to improve the efficiency in making loans to companies with $10 million to $100 million in annual revenue.

February 13 -

In what could be seen as a mea culpa for CEO Jamie Dimon's disparagement of bitcoin five months ago, the Wall Street megabank has released a big and relatively bullish report on cryptocurrencies.

February 12 -

Fintech firms and industry watchers hope the pilot program will help fix a balkanized chartering system, but getting enough states on board to expand the plan's reach could be a challenge.

February 9 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

Cambridge Bancorp in Massachusetts is looking to prove to entrepreneurs that it is in the business for the long haul.

February 9 -

For many newcomers to the U.S., establishing credit is a big challenge. A handful of entrepreneurs are developing tools to help verify their financial histories.

February 9 -

It’s not just hourly workers who struggle to make ends meet — many managers also often find themselves short on cash each month. To help employees cope, the retail chain is using a tool developed by the fintech Even to give them access to their wages before the next pay period.

February 8 -

Banks are capitalizing on changing consumer habits - and satisfying a pressing need to diversify their loan portfolios - with a spate of instant point-of-sale loans for everything from iPhones to home improvements.

February 7 -

Breaking Banks producer Rachel Morrissey visits the Mastercard Innovation Lab in Nairobi and reports on ideas under development there.

February 6 -

Overstock will offer automated investing to its millions of shoppers. Some financial advisers reacted with a shrug, but are they underestimating the move?

February 5 -

Digit, which launched as an automated savings app in 2015, has decided chatbots are a flawed interface. Now it’s redesigning its popular app to reflect its new vision.

February 5 -

The few U.S. banks embracing data sharing say the industry is moving toward the standard.

February 1 -

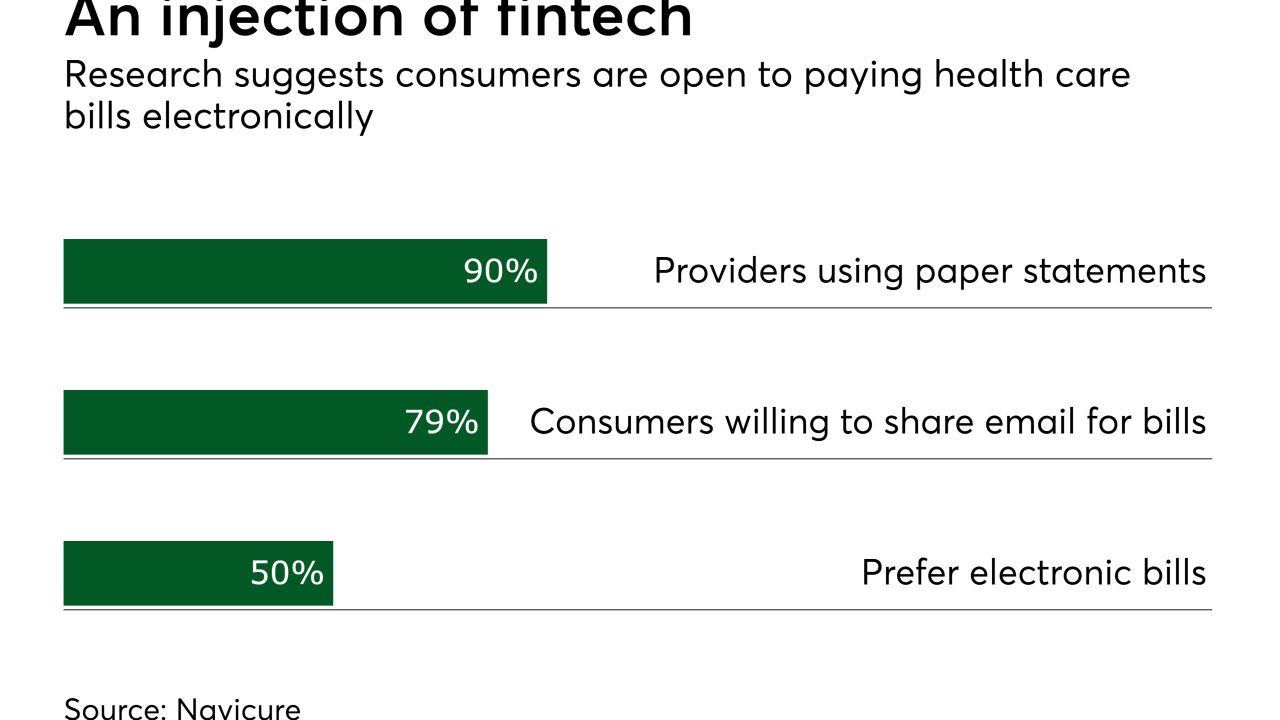

The fintech revolution is now touching almost every market in the payments space. Some are still further ahead than others, so expect 2018 to be a year of consolidation in more mature sectors, but one of rapid change in those with some catching up to do, writes David Yohe, vice president of marketing at BillingTree.

February 1 -

As it secures new funding and creates a joint venture in Japan, Moven says it is close to becoming a full-fledged U.S. “challenger” by purchasing a traditional bank.

January 31 -

The House Financial Services Committee held a hearing Tuesday on the fintech industry as Congress is still beginning the conversation about what a legislative approach should look like.

January 30 -

The pioneering brand re-enters a market where fintechs now account for over 30% of personal loan originations.

January 30 -

Nano Financial will offer new technology to Commerce Bank's commercial customers as it considers ways to license it to other financial institutions.

January 25