-

A Wells Fargo customer was interrogated, fingerprinted and mistakenly arrested for check forgery after a series of mistakes on the bank's part. He was cleared, and Wells says it made an error, but they are now fighting in civil court.

May 20 -

Ticketmaster has battled fraud in paper ticketing for years — but mobile technology introduced new ways for fraudsters to steal, resell and counterfeit high-priced digital tickets.

May 20 -

Police and city agencies can no longer use facial-recognition technology, which civil liberties groups say infringes on human rights. The measure may be an ominous sign for biometric login authentication.

May 17 -

Police and city agencies can no longer use facial-recognition technology, which civil liberties groups say infringes on human rights. The measure may be an ominous sign for biometric login authentication.

May 16 -

The Southeastern regional bank said Thursday that it had hired Lee Byrd to a new role dedicated to protecting customers and the company itself from fraud.

May 9 -

The Credit Union National Association has partnered with the group to help distribute the platform to financial institutions free of charge.

May 8 -

Not unlike consumers finding it convenient to make a one-click payment online, fraudsters want less friction as they steal payment or personal credentials.

May 8 -

Lenders say they are seeing a rise in synthetic identity and other types of attempted fraud. Here’s what they are doing to thwart it.

May 7 -

A recent study shows credit unions are likely to be increasingly reliant on vendor partners if they want to maximize efficiency and security in the account-opening process.

May 7 -

The investment money’s flowing into fintech that’s flexible and broad enough to build a bridge between issuers and merchants. For PayU’s investment wing, that’s a $500 million blanket covering cross-border commerce, open tools and markets in dire need of a digital revolution.

May 7 -

Worldpay is rolling out FraudSight, a new fraud prevention tool that uses machine learning to spot suspicious transactions across all in-store and e-commerce checkout points, according to a Tuesday press release.

April 30 -

Many banks rely on the location data they get from carriers through data aggregators to spot fraudulent transactions. With telecom companies shutting that source down, banks are worried it could significantly hurt their capacity to detect fraud.

April 29 -

-

-

Many U.S. banks, especially in Florida, are struggling to comply with U.S. sanctions against the Maduro regime. Some argue artificial intelligence can make it easier to distinguish between legitimate payments and illicit transactions.

April 8 -

MoneyGram is investing more time and technology in helping law enforcement agencies spot the scammers moving money on its network.

March 28 -

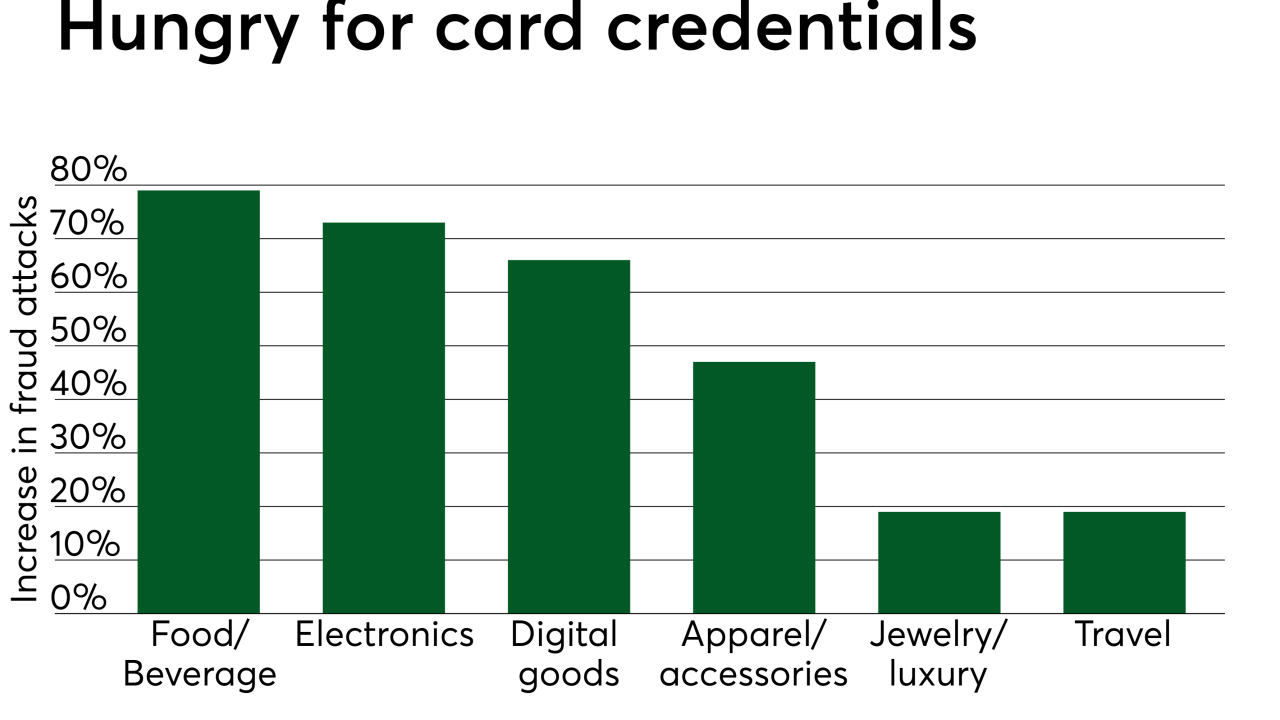

Fraud attacks against online food and beverage businesses in the U.S. increased by nearly 80 percent in the past year, as fraudsters have decided that dining establishments are the perfect places to test stolen card credentials.

March 20 -

Reports of improper charges by perpetrators who know the victim soared last year. Issuers and card networks are failing to tighten security, clearly label transactions and police chargebacks, critics say.

March 19 -

Given the size of the deal — which includes about $9 billion of Worldpay’s debt on top of a $34 billion bid — the pressure’s on to build a global powerhouse that can counter other major fintech mergers announced in the past weeks. FIS must also emerge as a nimble rival to the startups that threaten the old order.

March 18 -

Mastercard Inc. is concerned that India’s strict data localization rules could compromise its ability to detect frauds and money laundering in the domestic payments system.

March 18