-

Wells Fargo must pay $97 million to home mortgage consultants and private mortgage bankers in California who didn't get the breaks they were entitled to under the state's stringent labor laws.

May 9 -

The initiative was rolled out during CO-OP's annual THINK Confernece, taking place this week in Chandler, Ariz.

May 9 -

Deputy Attorney General Rod Rosenstein thinks some companies are overpaying for their crimes, and he wants that to stop.

May 9 -

Kam Wong, chief executive at the high-profile, $2.9 billion credit union that serves the NYPD, among other municipal workers, has been charged with fraud.

May 8 -

Among the findings, credit unions may not be doing enough to protect against malware, which involved in nearly 40 percent of hacking incidents, as well as Trojan botnets and denial of service attacks.

May 8 -

For the second time in a year, the scandal-scarred bank has launched a brand campaign aimed at restoring trust with customers.

May 7 -

Auto lenders would be well advised to keep up their guard as states — particularly blue ones — take steps of their own to crack down on what they see as abusive practices.

May 7 -

Bank agrees to pay $480 million to investors related to the phony accounts scandal; Daniel Tarullo’s Fed departure called a turning point on oversight.

May 7 -

Trump-appointed regulators are making headway on easing regulations. But there's one critical voice missing.

May 4 -

The class-action lawsuit filed by investors alleged that bank executives deliberately failed to disclose the full nature of its cross-selling practices to shareholders.

May 4 -

China's mobile payment lessons for U.S. bankers; Steven Mnuchin's wishful thinking on GSE reform; unpacking Mick Mulvaney's CFPB relocation musings; and more from this week's most-read stories.

May 4 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

A new strain of malware that targets cryptocurrency users — but not users of mainstream payment options like bank accounts — highlights how much the cybercrime game is changing behind the scenes.

May 4 -

Attorneys for then-President Robert Harra said he is innocent and will file an appeal. The case centers on a scheme said to have been carried out during the crisis years, before the bank was sold to M&T.

May 3 -

Bankers have long complained that anti-money-laundering regulations impose an extra burden without really stopping major crime. D.C. is finally listening.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 3 -

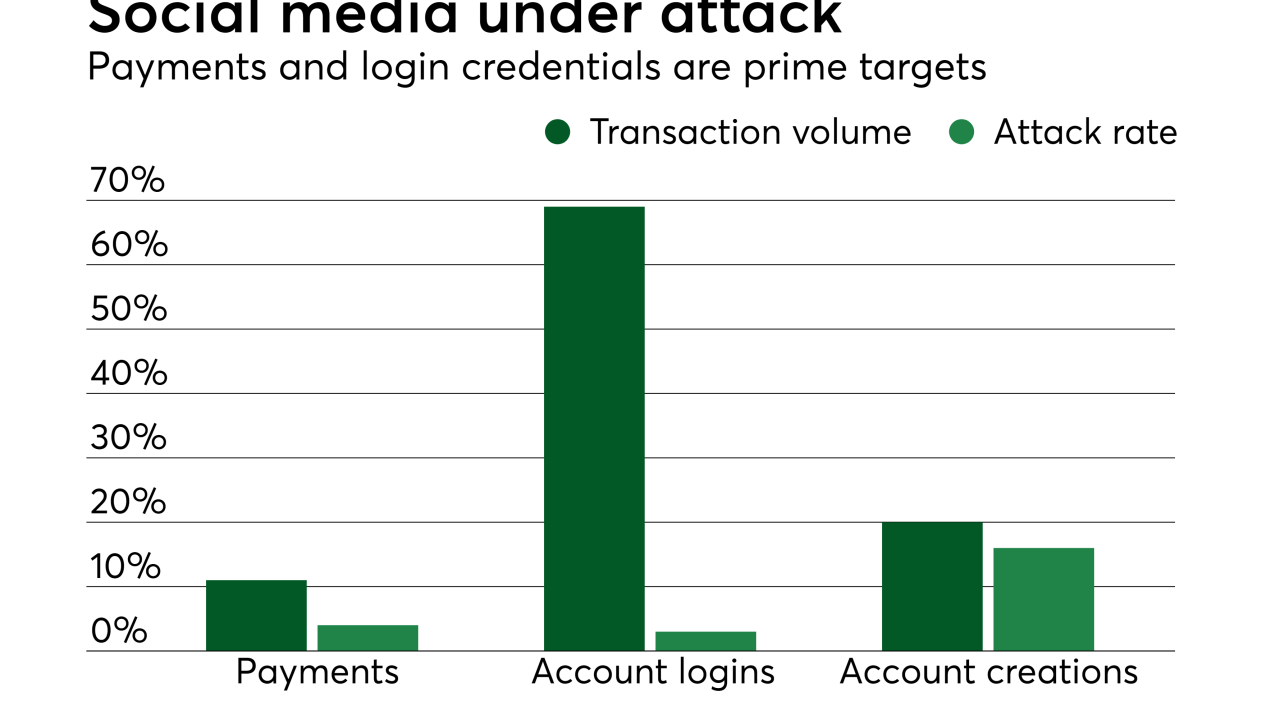

The spread of breached identity information has resulted in an outbreak of new account creation fraud with a new ground zero for the crimes pointing right at Latin America.

May 3 -

The provision would make it harder for criminals who use real Social Security numbers to create fake personas and then apply for credit.

May 2 -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2