-

Analysts were expecting Capital One’s marketing spending to slow significantly after it surged to nearly $1 billion at the end of the year.

April 27 -

The past two weeks have seen a flurry of deals wherein Truist, Capital One and others pitch their brand alongside professional teams and their stadiums.

April 12 -

Super Bowl ads' impact, another overdraft-fees ouster, and more in banking news this week.

February 18 -

The fintech-turned-bank has bet big on pro football marketing. Sunday’s game at SoFi Stadium should give its customer acquisitions a boost, analysts say.

February 14 -

The bank is working with a tech company to personalize customer communications using proprietary data. It's an alternative to cookies, which are becoming less viable as data privacy laws become stricter.

January 28 -

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

The social network, now called Meta Platforms, is buying the South Dakota bank's name for $60 million.

December 17 -

The tax preparation company, which is building out its own financial services business, says Square's new brand "would improperly capitalize on the goodwill and consumer trust cultivated by [H&R] Block since 1955."

December 16 -

An industry expert shares key takeaways on how institutions can implement sophisticated technologies to attract a younger generation of customers.

December 15 -

The basketball star Kevin Durant and his company Thirty Five Ventures have signed a multiyear deal with Coinbase Global to promote the cryptocurrency platform across his businesses.

December 15 -

The National Association of Federally-Insured Credit Unions' new campaign highlights $243 billion in fines slapped on Wall Street banks. The group says it's responding to political attacks, but the banking industry says NAFCU is trying to distract from criticism of its tax exemption.

December 13 -

The company says that marketing its deposit products could help build deeper customer relationships, particularly with student loan borrowers. “We're not just a credit card issuer,” CEO Roger Hochschild told analysts.

December 9 -

Lincoln Parks at Heritage Bank in Georgia built from scratch its social media following, a digital-only way to open accounts and (in 48 hours) a Paycheck Protection Program lending system. For these and other efforts, Parks is a runner-up for American Banker’s Digital Banker of the Year.

November 16 -

-

The credit card issuer benefited from consumer loan growth in the third quarter, but investors seemed spooked by increases in its marketing and technology costs.

October 27 -

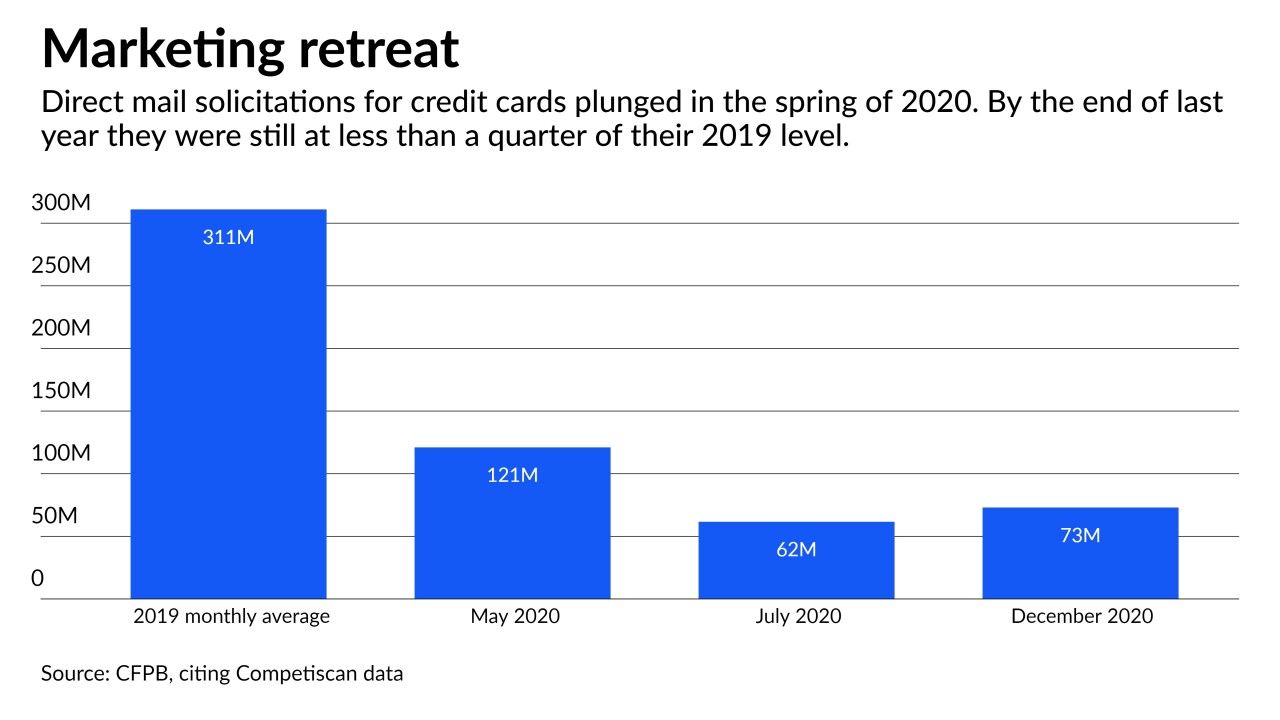

Banks generally did not curtail loans to existing cardholders last year despite mass unemployment, according to new research by the Consumer Financial Protection Bureau. The results contrasted with what happened during the Great Recession.

October 1 -

The banking industry is now enjoying a "strong" reputation overall, after building on gains made at the height of the pandemic. Here's who stood out and why.

September 1 -

Pro basketball sponsorships have long been the domain of banks and other traditional advertisers. But now companies like Chime, LendingTree and FTX.us are making their names known through partnerships with NBA teams.

July 19 -

The agreement will likely end a three-year-old dispute over allegations that the company misled borrowers by promising no hidden fees on its consumer loans.

July 15 -

While most financial institutions have been focused on upgrading their digital channels, Andrews Federal Credit Union in Maryland listened to its customers and modernized its newest branch. Among the new features are video teller machines, touch screens offering online and mobile banking tutorials and a game area for children.

June 15