-

The bank-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. financial institutions. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

This morning the bank owned P-to-P network, Zelle, is formally going live, enabling direct transfer of funds across thirty U.S. financial institutions over the course of the next twelve months. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and its parent company PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

Grocery shopping may not seem conducive to e-commerce due to the category's massive cart sizes and perishable goods, but many companies are trying to put a digital spin on the process. Here are a few of the latest innovations.

June 9 -

Hoping to convince e-commerce merchants to let Facebook target offers to customers, the social media giant is placing a strong emphasis on “dynamic ads” that include payment buttons.

June 9 -

ExxonMobil's contactless and mobile payment system, Speedpass, is well known as a way to help drivers accelerate the payment process after they fill up on gas. The system's latest updates focus less on the payment process and more on flexibility and rewards.

June 9 -

Amazon customers in Japan can now charge purchases to their mobile phone bill through a new deal with Bango.

June 7 -

Ant Financial's Alipay, the payments affiliate of Alibaba, broke into the U.S. last year through a deal with First Data, and now it's expanding in Canada—alongside Tencent's WeChat—through partnerships orchestrated by Canadian tourism authorities.

June 5 -

One MobiKwik Systems Pvt., one of India’s largest digital-payment providers, is pushing back its target for profitability by a year as it invests more in its business to capitalize on the government’s shock ban on high-value rupee notes.

June 5 -

As with anything high-tech, early predictions held that millennial men would be first to adopt mobile wallets. But two new research studies are casting doubt on the assumptions about the roles gender and age are playing in the mobile payments adoption curve.

June 2 -

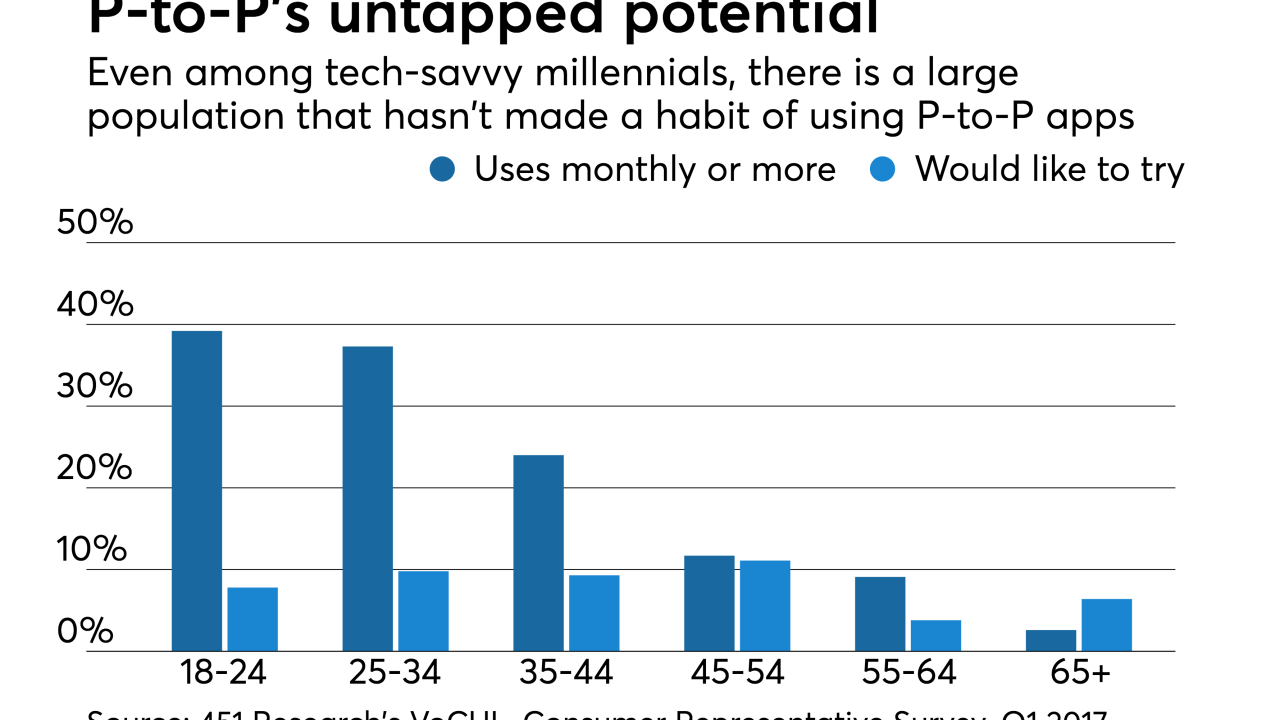

Here are some major ways that mobile banking, P-to-P payments and fintech are changing banking.

June 1 -

Advertising, marketing and payments are changing very quickly and traditional players will need to adapt quickly in order to survive, according to new data.

June 1 -

Pangea’s instant-transfer app serves six Latin American countries and it’s eyeing expansion to Asia, with a formula based on speed and simplicity.

May 26 -

As volume grows, fraud and security risk will expand as well. Merchants and issuers can't afford to avoid the extra work to secure the channel.

May 25 InAuth

InAuth -

The advantage of biometrics (what you are) over passwords and PINs (what you know) can be distilled to a single factor — what you know can be easily shared.

May 24 -

The company behind Android Pay is giving more tools to developers and inking more partnerships in the payments industry. Here are some of the biggest developments surrounding this year's Google I/O event.

May 19 -

Brick-and-mortar retailers are using technology to transform their physical stores into an Amazon-like digital experience.

May 19 -

3DS 2.0 is designed to vastly improve cardholder authentication, and in so doing, improve the digital checkout and payment process.

May 19 CardinalCommerce

CardinalCommerce -

Wells Fargo is expanding its fintech accelerator so it is better positioned to connect with customers through channels like the internet of things.

May 18 -

Paytm, India’s largest digital payments startup, raised $1.4 billion from SoftBank Group Corp. in the largest funding round from a single investor for the country’s technology sector.

May 18 -

One-time passcodes or more complex passwords are not enough, and add friction and potential frustration for the user. The solution is mobile identity authentication, writes Randy Vanderhoof, executive director of the Secure Technology Alliance.

May 18 U.S. Payments Forum

U.S. Payments Forum