-

AI-driven customer insights, mortgages and small-business loans are among the features in the app, which the bank is rolling out Friday.

March 24 -

Reports of improper charges by perpetrators who know the victim soared last year. Issuers and card networks are failing to tighten security, clearly label transactions and police chargebacks, critics say.

March 19 -

Shari Van Cleave, head of digital labs at the bank, discusses customer-facing technology it's testing, including wearables and the so-called internet of things.

March 12 -

For years Carter Bank in Virginia had resisted technology of all kinds — even ATMs. But a leadership change, rising rates and a thirst for low-cost deposits finally led to a change in philosophy.

March 6 -

It may take several more months of testing before it is deployed in a payments application, but a new money transfer specification the NFC Forum has developed carries the organization's promise of becoming an alternative to QR-code technology.

March 5 -

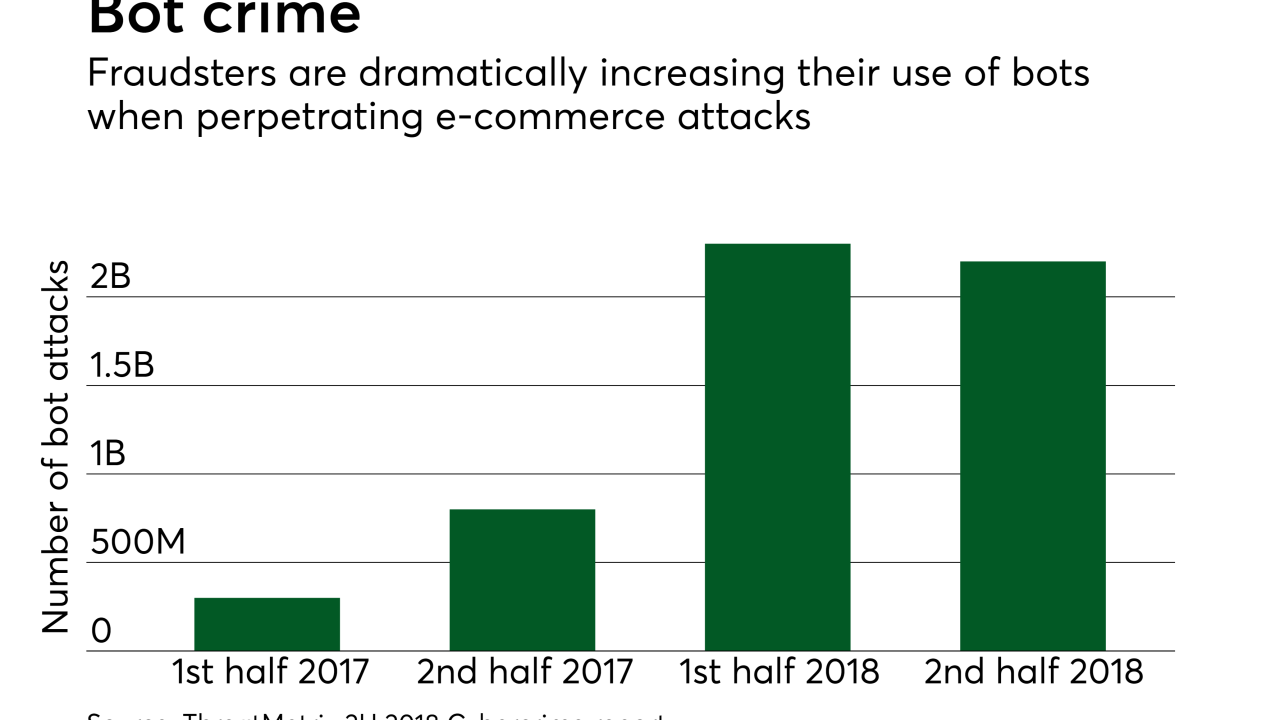

As companies invest heavily in artificial intelligence and other high-tech defenses, it is becoming more apparent that criminals are investing in equally powerful technology.

March 5 -

Page views and sales results don't explain which customers do what, and why they do things (or don't do them), in online and mobile banking.

February 20 -

The rise of Uber, Lyft, Etsy, Kaggle and other forms of freelance work has sparked a new generation of specialist fintechs.

February 19 -

The rise of Uber, Lyft, Etsy, Kaggle and other forms of freelance work has sparked a new generation of specialist fintechs.

February 19 -

The Salt Lake City company, which connects small-business owners with lenders like JPMorgan and BofA, plans to use the funds to expand its partnerships and customer base.

February 12 -

Gatsby, which has built an app to let novice investors buy puts or calls, has received funding from Barclays, Radius Bank and others. Radius is considering offering the service to its customers.

January 31 -

Its savings, budgeting, spending and goal-setting tools, combined with artificial intelligence to add smart insights and advice, are a good example of how regional banks are trying to distinguish their mobile products from those of bigger banks with larger tech budgets.

January 14 -

One bank's push to use Ripple's XRP in cross-border payments; LendUp spins off credit card business, names new CEO; a worrisome resurgence of rivalry among the banking agencies; and more from this week's most-read stories.

January 11 -

As consumers continue to migrate to banking apps, it may be tempting for banks to focus solely on improving that channel experience. But doing so would be making the same mistake as focusing only on cards or cash at the point of sale.

January 7 -

As consumers continue to migrate to banking apps, lenders may be tempted to focus solely on improving that channel. But new data suggests consumers aren't abandoning other platforms just yet.

January 4 -

A partnership between the mobile carrier and BankMobile could help stripped-down banking and deposit transfer services find a footing among U.S. customers.

January 2 -

Even if used to decorate your home with ideas before you purchase anything, the technology will completely change your perspective on reality-altering technology, writes Michael Volkmann, an entrepreneur who focuses on business operations and finance.

December 27

-

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

Digit, Chime and Pluto are among those said to be stepping into a void left by the banking industry. But designing helpful enough, yet flexible enough, financial safeguards for consumers is easier said than done.

December 18 -

Augmented devices and automation will push banking services beyond the current mobile phone delivery model into a virtual world — but how, exactly? Bank of America, Wells Fargo and others are trying to find out.

December 13