-

Some benefits are materializing from Fannie Mae's pledge to limit servicers' exposure to principal-and-interest advances the way Freddie Mac does, but counterparties of both GSEs remain exposed to other concerns.

May 6 -

A surge in demand for home loans drove the increase, but the second quarter could see a slowdown in borrowing and more delinquencies as consumers contend with the economic fallout of the coronavirus pandemic.

May 5 -

Mortgage lenders have imposed steep pricing adjustments for cash-out refinancing as more borrowers seek forbearance.

May 4 -

Lenders implemented stricter underwriting across all loan types in the first quarter as the pandemic upended the economy, the Federal Reserve said in its survey of loan officers.

May 4 -

Lenders are throwing money at buyers with stable jobs while making it harder for weak borrowers to get loans; $50 billion in loss provisions may not be enough and could stifle lending.

May 4 -

Credit inquiries for auto lending, revolving credit cards and mortgages fell sharply in March as unemployment surged, according to a Consumer Financial Protection Bureau report.

May 1 -

Wells Fargo will temporarily stop accepting applications for home equity lines of credit, following a similar move by rival JPMorgan Chase.

April 30 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

Nearly 70% of U.S. adults between the ages of 26 and 40 said their earnings had been negatively affected by the outbreak, about 10 percentage points higher than other age groups.

April 30 -

The bureau issued an interpretive rule clarifying that consumers under certain conditions can modify or waive waiting periods required by the Truth in Lending Act and Real Estate Settlement Procedures Act.

April 29 -

The lenders are bracing for spikes in delinquencies or defaults on loans to a sector heavily punished by social distancing measures.

April 29 -

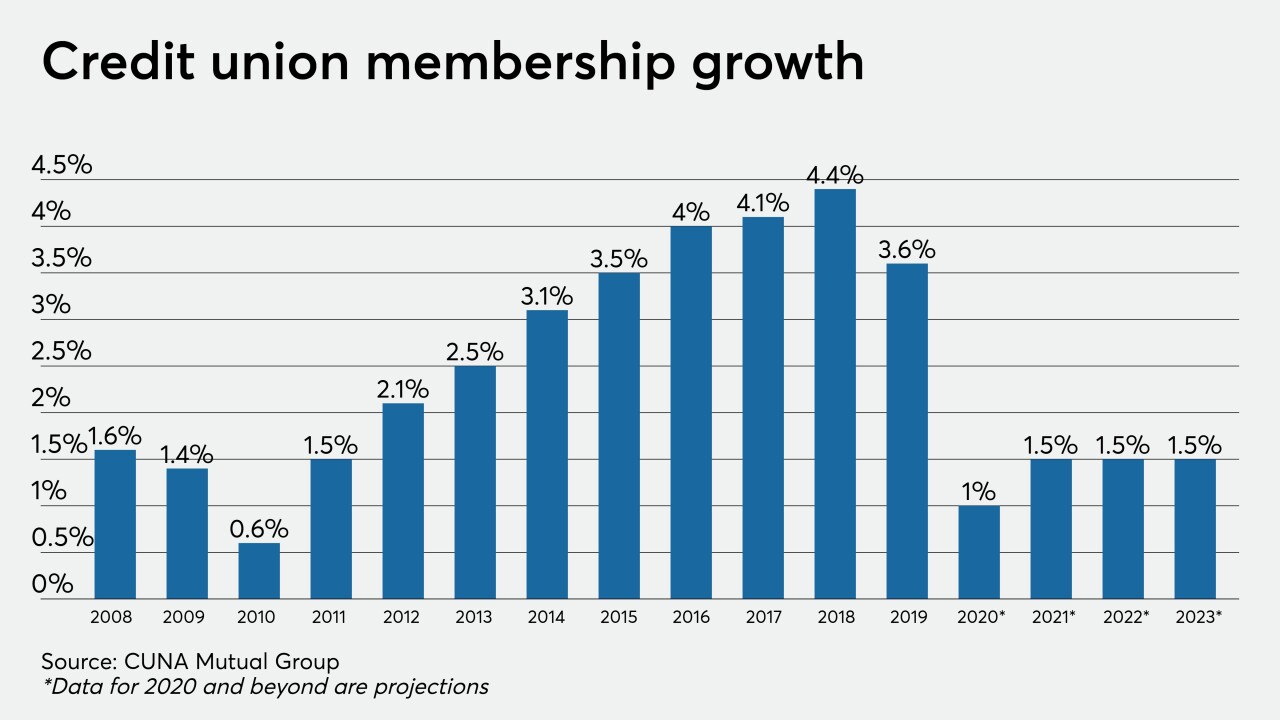

The company’s latest Credit Union Trends Report predicts that membership and lending will stall as job losses rise and consumer demand for loans dries up.

April 29 -

Fannie Mae and Freddie Mac are now able to buy loans in forbearance to alleviate pressure on the sector, but the fees charged by the mortgage giants to assume more risk could turn away some originators.

April 28 -

The FHFA's director said the announcement is meant to “combat ongoing misinformation” about efforts to let homeowners skip mortgage payments due to the coronavirus pandemic.

April 27 -

Lenders and small businesses are hoping this round goes more smoothly than the chaotic first one (and if it doesn't, Joe Biden warns, many mom-and-pop shops are done for); originators are adding staff, cutting marketing to handle massive uptick in refinance applications.

April 27 -

The bureau said it began developing the standards before the coronavirus pandemic. But more transfers may occur as some servicers struggle to meet their obligations during the economic downturn.

April 24 -

The former CEO at The Federal Savings Bank, who faces a bribery charge in connection with loans to President Trump's onetime campaign chief, is seeking to keep evidence from his phone out of the upcoming trial.

April 24 -

The Treasury secretary said recent government moves will help the firms get through the risk of millions of borrowers missing their loan payments.

April 24 -

The bill, which President Trump is expected to sign Friday, includes $310 billion more funding; the four largest U.S. banks took in $590 billion of the $1 trillion banks attracted.

April 24 -

The Federal Housing Administration has provided struggling homeowners with payment flexibility and explored other measures. At the same time, the agency is mindful of protecting itself against downside risks.

April 23

![“We want to make sure that our cash [inflows] exceed our cash outflows, so again, we’re looking at a lot of different things, and premiums being one of them, but there are other things that we’re considering as well," FHA Commissioner Brian Montgomery said.](https://arizent.brightspotcdn.com/dims4/default/15b0d4f/2147483647/strip/true/crop/1260x709+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fc0%2Fd2%2F5bd96a5a4a9eb632ac3bfd4b8da9%2Fmontgomery-brian-fha.png)