-

Some firms are investing in technology to help insurance clients shift to paperless payment processing.

December 14 -

Grupo Coppel and Insikt, an online lender, would appear to be cut from different cloth, but they share an expertise in providing credit to working-class, largely Hispanic consumers. The retail conglomerate also operates 1,000 bank branches in Mexico, mixing banking and commerce in a way that U.S. regulators have not allowed.

December 13 -

The case for real-time payments isn’t just about instant gratification. Truncating settlement times has enormous benefits to FIs, businesses and even governments.

December 13 -

Banks and fintechs are competing heavily to modernize cross-border payments, and Citi is using its upgraded treasury unit to add speed to its own international cross-border digital payments capabilities in more than 60 countries.

December 12 -

For merchants, a processor that’s a tad better, a bit more comprehensive, can make an enormous difference, writes Eric Grover, a principal at Intrepid Ventures.

December 12

-

Payment Rails is putting a tight focus on the emerging area of “influencer marketing,” where global brands are spreading money among individuals who use social media to promote products.

December 11 -

In the new role, Kenneth Montgomery will lead the Fed’s efforts to reduce fraud risk and improve the security and resiliency of the U.S. payments system

December 8 -

The concept is designed to free up workers to produce food and serve customers instead of handling payments.

December 8 -

Kenneth Montgomery will chair the Secure Payments Task Force, which is made up of more than 200 industry stakeholders who are working on a faster payment system in the U.S.

December 8 -

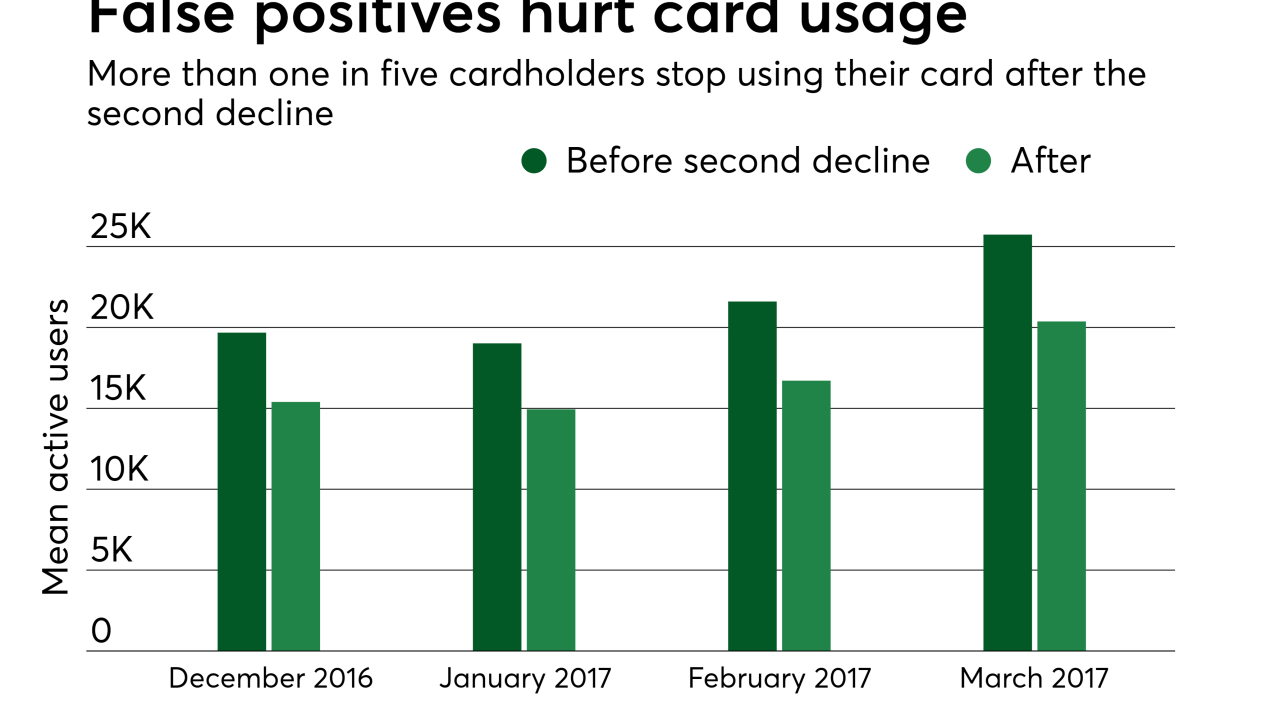

Card usage drops off fast after a false positive. In many cases, two false positives cause consumers to abandon a card permanently.

December 8