-

In our recent Community Bank Tech Projects series, we looked at the way a handful of banks chose to invest their precious resources over the last year. Here is a roundup of those projects.

March 31 -

MySpend, the app created by TD Bank and Moven, is a hit in Canada. The companies have signed an agreement to extend exclusivity to the U.S.

March 28 -

Google Play and CFSI aim to improve use of financial health apps through a storefront organized by consumers' needs and by publishing a guide for app developers.

March 27 -

NBT Bancorp has spent the last few years introducing digital banking features intended to reach a broad audience.

March 23 -

With a hand from Geezeo, Jack Henry is rolling out a product that will guide consumers in managing their finances and is said to give banks better insights.

March 14 -

Qapital's funding round comes as banks are increasingly adding money management tools to their mobile apps.

March 8 -

The U.K. challenger bank will reportedly bring the singer on as a brand ambassador, with an option to acquire a stake in the company.

February 22 -

EQ Bank, BankMobile and solarisBank offer insights into how they built their digital-only banks with design thinking, new products and money management tools.

February 13 -

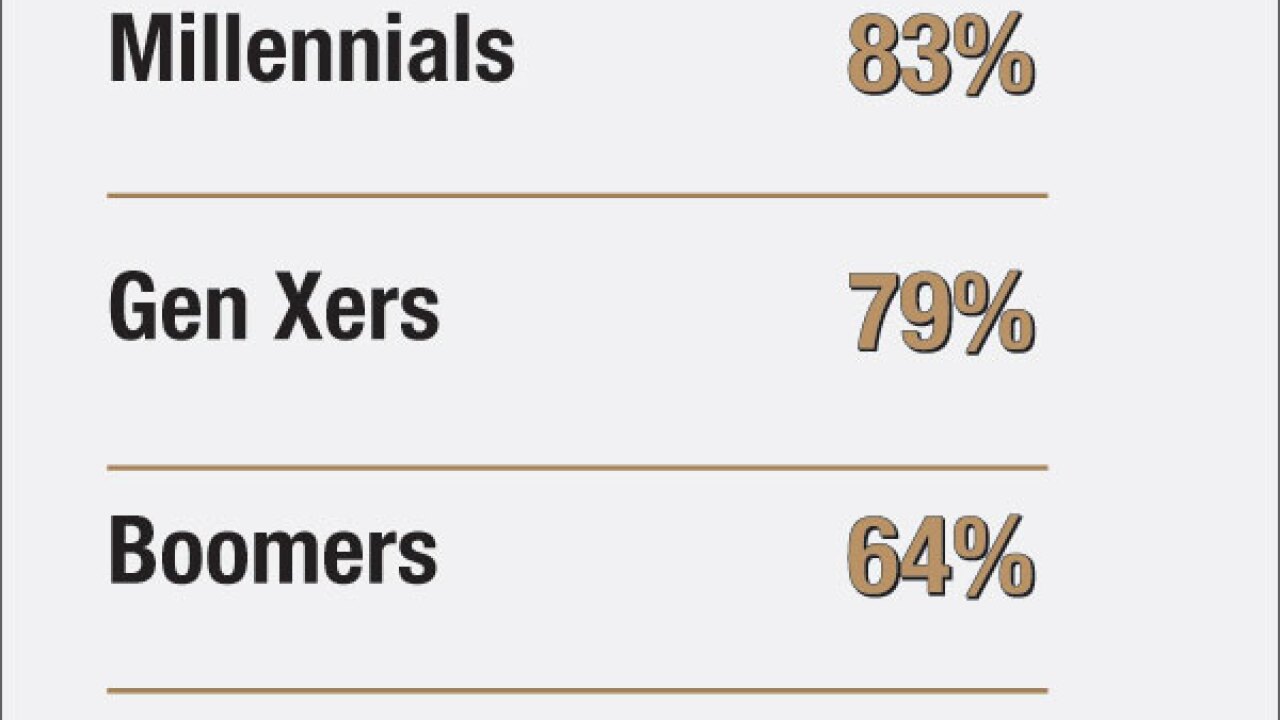

Banks are helping customers build healthy financial habits through their apps. The tools could also strengthen customer retention when rates go up.

February 10 -

The services that Kasisto, Personetics, North Side and Teller offer banks to automate interactions vary in their levels of personality and the workload they can handle.

February 9 -

The digital personal financial management company is eyeing Europe as it expands its geographic footprint.

February 7 -

By partnering with Intuit, Wells Fargo is continuing its journey toward API-based data sharing, and away from screen scraping.

February 3 -

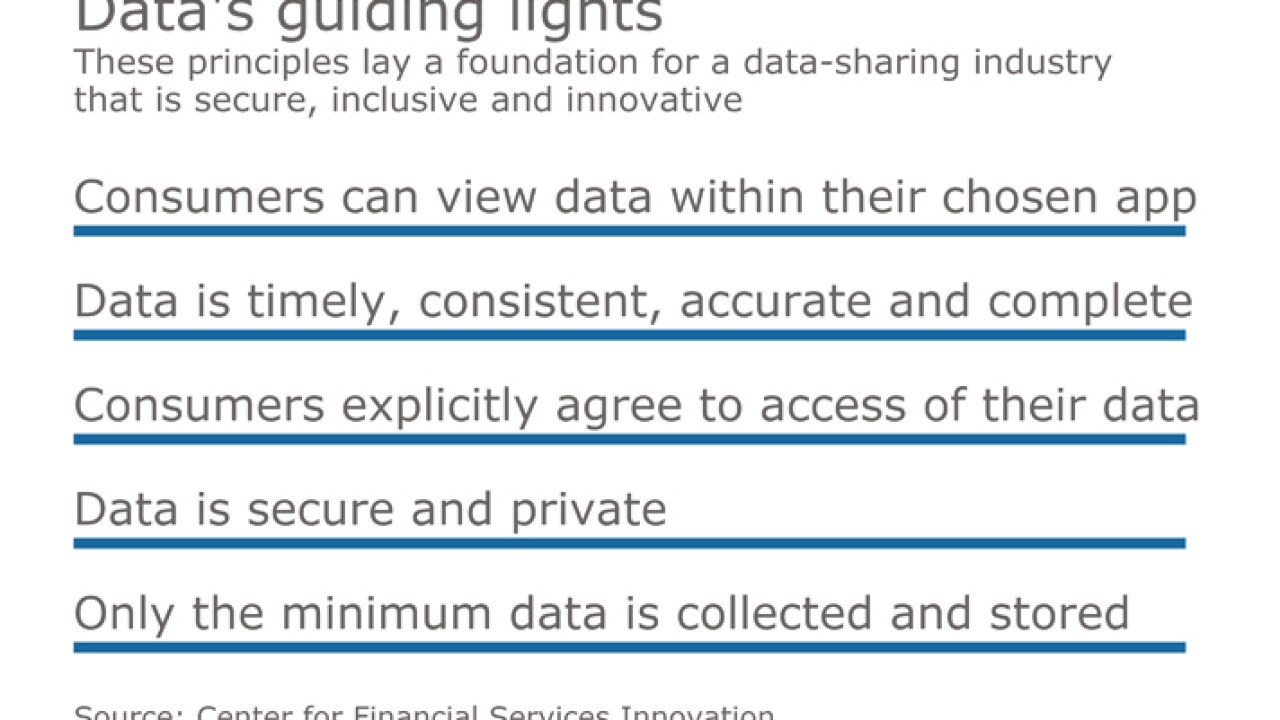

The long-running feud between banks and fintech companies over screen scraping is morphing into a more nuanced and important conversation about how to exchange consumers' financial data securely and fairly.

January 27 -

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25 -

Customers of JPMorgan Chase will no longer have to surrender their bank credentials in order to use Intuit products like Mint, TurboTax or QuickBooks.

January 25 -

The Cincinnati bank will be advised by QED Investors on its fintech strategy .

January 20 -

A consortium of fintech companies have formed a new industry group to advocate for better data sharing via open APIs.

January 19 -

Financial innovation will stall unless we, as an industry, collaborate on a universal data gathering standard.

January 12 Finicity

Finicity -

It is time for financial services to rethink retirement savings given changing work habits, customers' expectations of technology and the need for better transparency in 401(k)s.

December 15 -

Bank of America's forthcoming mobile app update will include personal financial management features.

December 13