-

The value of serving a specific employer or a limited field of membership has diminished over the years. COVID-19 is just the latest crisis that shows how dangerous this concentration can be.

April 23 -

The Ohio company, which bought United Community Financial in February, will start operating as Premier Bank this summer.

April 22 -

The credit union regulator created its Office of Ethics Counsel after two high-profile incidents tarnished the agency's reputation.

April 22 -

Once it starts reopening offices around the world, it "will continue to prioritize the safety of our employees, customers and communities," Citigroup President Jane Fraser said.

April 21 -

"One of the advantages is that we can hear from shareholders in faraway places," John Dugan said at Tuesday's annual meeting, which was held entirely online as most of the country remains on lockdown to help stop the spread of the coronavirus.

April 21 -

Renee Christoffer will take over leading the institution when Monte Berg, the current president and CEO, steps down at the end of July.

April 21 -

First Horizon still plans to complete its merger with Iberiabank on time, CEO Bryan Jordan said during the Tennessee company's earnings call.

April 21 -

Major national and international summer shows were all canceled within 24 hours of one another, and many smaller state-level events have already been called off or postponed.

April 21 -

Southwest HealthCare Credit Union agreed to merge into Canyon State because of increased competition and regulatory demands.

April 20 -

Executives say they can still meet their goal of $480 million in cost savings this year from the combination of BB&T and SunTrust despite unexpected expenses, unless the economy fails to rebound quickly.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

Stress and exhaustion are catching up to lenders and call center employees helping customers grapple with the coronavirus pandemic.

April 17 -

Despite limiting branch access and embracing social distancing, member-facing employees at some institutions have contracted COVID-19, and those few could be the tip of the iceberg.

April 17 -

Federal Reserve Bank of Minneapolis President Neel Kashkari says that large U.S. banks should raise $200 billion from private investors and stop paying dividends so they can support the economy.

April 16 -

Reports from the Singapore office, a coronavirus war room and a hardworking IT staff all helped TD Bank Group get nearly all employees ready to work from home and able to handle a tripling of remote deposit capture activity.

April 15 -

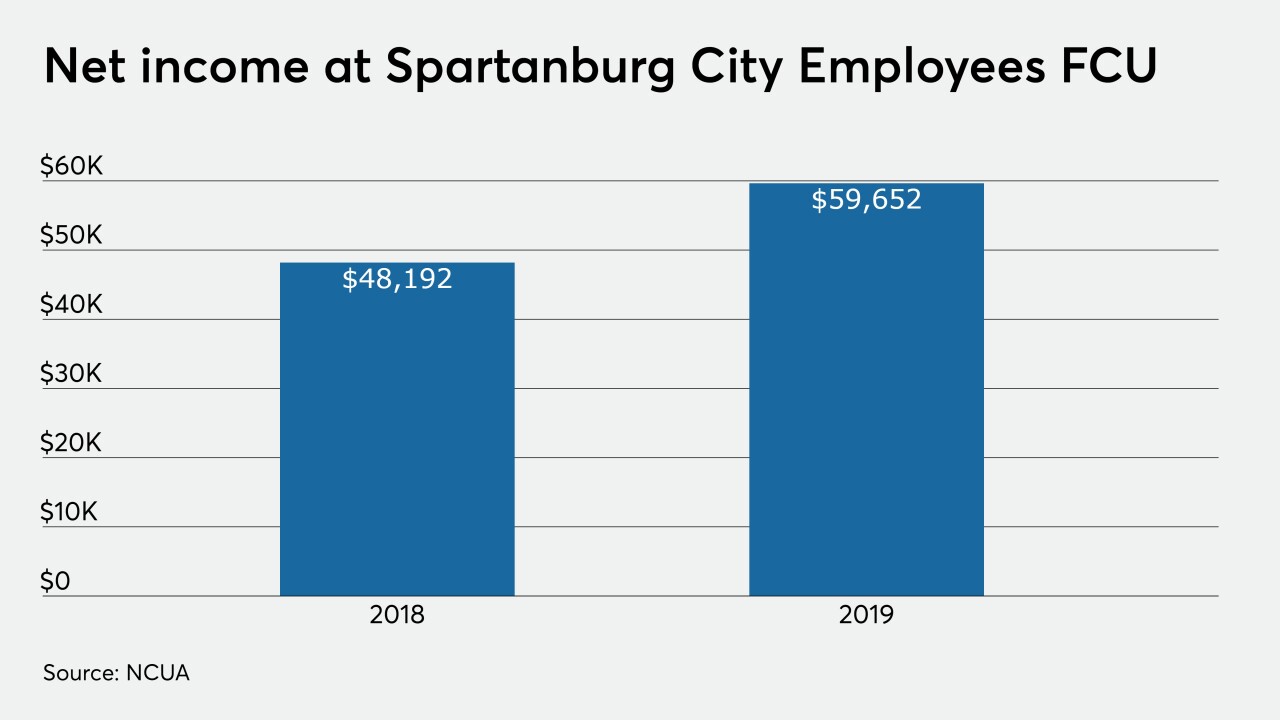

The $1.8 billion-asset institution will likely absorb Spartanburg City Employees FCU later this year, following a vote of that CU's members next month.

April 15 -

The industry was already on a path toward increased digital services, but the global pandemic is showing why CUs need to speed up that process.

April 14 nCino

nCino -

The heads of two congressional committees are requesting a briefing from the agency after a watchdog recommended improvements in how it prepares for crises.

April 14 -

Unlike in 2008, banks have become a steady force during the coronavirus pandemic.

April 14IntraFi Network -

Dean Bass, chairman and CEO of Spirit of Texas Bancshares, had taken a leave of absence after contracting COVID-19.

April 14