-

David Rainbolt, who has been the company's CEO since the early 1990s, has handed the reins to a pair of longtime deputies. Rainbolt will stay at BancFirst as its executive chairman.

May 25 -

Timothy Antonition, the credit union's longtime EVP/COO, will succeed Doug Samuels, who passed away suddenly earlier this month.

May 25 -

CEO David Puckett will step down at the end of this year after 35 years with the $321 million credit union, with Martha Fuerstenau taking the reins Jan. 1, 2018.

May 25 -

His decades-long career in credit unions spans three different state leagues and was proceeded by 21 years of military service.

May 24 -

Bay Area CU launches Business Banking Division to increase, diversify loan portfolio.

May 24 -

The $3.2 billion-asset company is making a bigger push into northern Indiana with its agreement to buy Lafayette Community Bancorp.

May 24 -

Veridian CU announces new board, CUNA HR Council recognizes top professionals and other new hires and promotions.

May 23 -

Management reports assets, membership continue to grow into 2017.

May 23 -

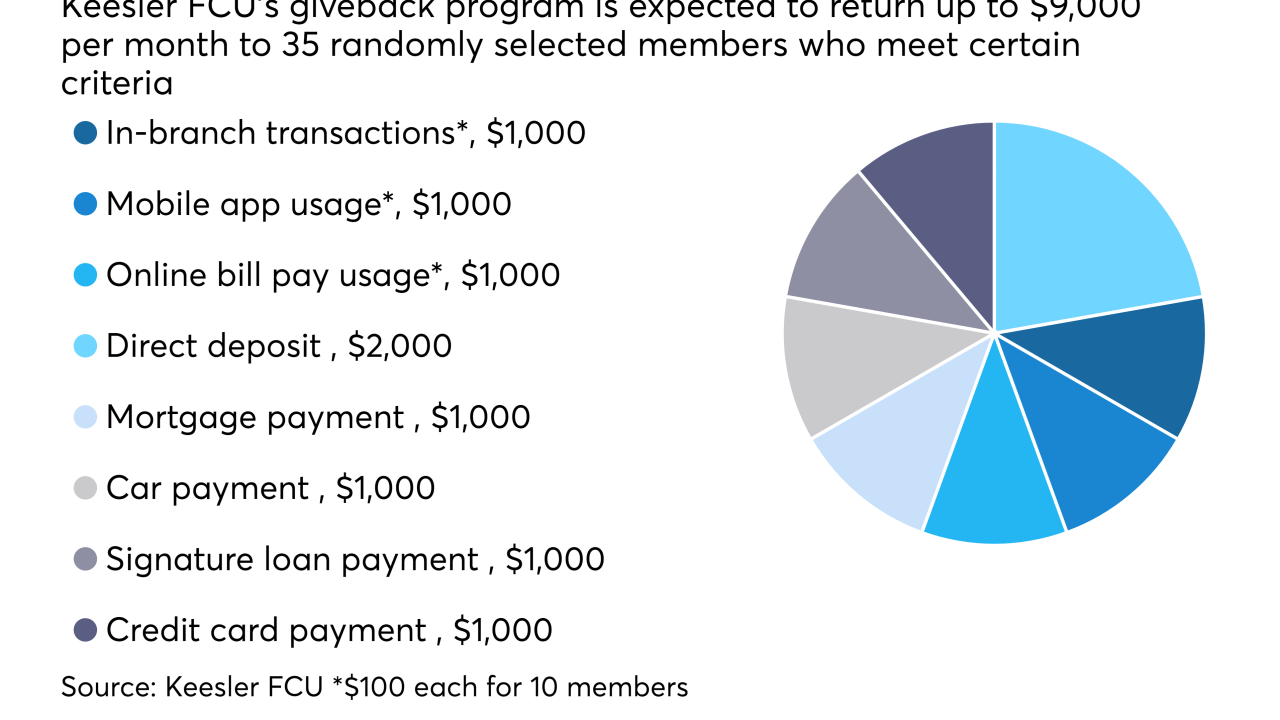

A new initiative at Keesler FCU will return as much as $108,000 in givebacks to members during its first year, but do CUs get any real value from returning that much money to their membership?

May 23 -

The rising regional player has also appointed new chairs for four board committees as it prepares for the retirement of several long-serving directors.

May 23 -

Bank of the West is using alternative data and the international expertise of its parent company to tap into the lucrative but difficult to underwrite market of middle- and upper-class immigrant mortgage borrowers.

May 23 -

Garden Savings FCU aims to boost brand awareness by focusing on some of the things that make New Jersey unique.

May 23 -

Users want more control over their data and more seamless integration with their financial tools. Banks and credit unions cannot wait for a regulation like PSD2 to move forward.

May 22 Narmi

Narmi -

The merger is expected to be completed by year-end, and the combined institution will have assets of more than $1.2 billion, serving more than 105,000 members.

May 22 -

In a world where confidence is rewarded more than indecision, businesses risk elevating confident leaders who overestimate their abilities. In banking, that can have harmful effects.

May 22 IBM Global Business Services

IBM Global Business Services -

The company agreed to buy Commerce Bancshares, which has three branches in Boston.

May 22 -

First Savings Financial in Indiana and Dime Community in New York are keen on making more SBA loans as a way to diversify revenue and generate fees through loan sales.

May 19 -

The time needed to close a mortgage improved nine days since the start of the year as the market has shifted to doing more purchase loans.

May 19 -

Financial Institutions in western New York withdrew plans to raise $40 million.

May 19 -

Readers opine on legacy core systems, the negative messaging around the Troubled Asset Relief Program, Jamie Dimon defending his Trump ties, and more.

May 19