-

Under the bill, regional banks may eventually be able to shed the systemically important financial institution designation that subjects those with more than $50 billion in assets to tougher regulatory requirements.

September 28 -

The island's largest bank has reopened a portion of its branch network while rushing cash to ATMs and consoling clients and employees in the first week of recovery from Hurricane Maria. But it and other banks are likely months away from normal operations.

September 26 -

Chemical Financial and Fidelity Southern are the latest banks to curtail auto lending, blaming trends in auto sales and overheated competition.

September 25 -

Jennifer Smith is overseeing a core conversion that is the largest tech project in Zions' history.

September 25 -

It's not just big banks. Even U.S. community banks may be subject to the General Data Protection Regulation given the boundlessness of digital commerce.

September 20 -

The agency and the National Association of Federally-Insured Credit Unions plan to boost efforts to get more credit unions involved with SBA lending.

September 20 -

The Oregon bank has expanded the role of its chief credit officer to include oversight of risk management.

September 20 -

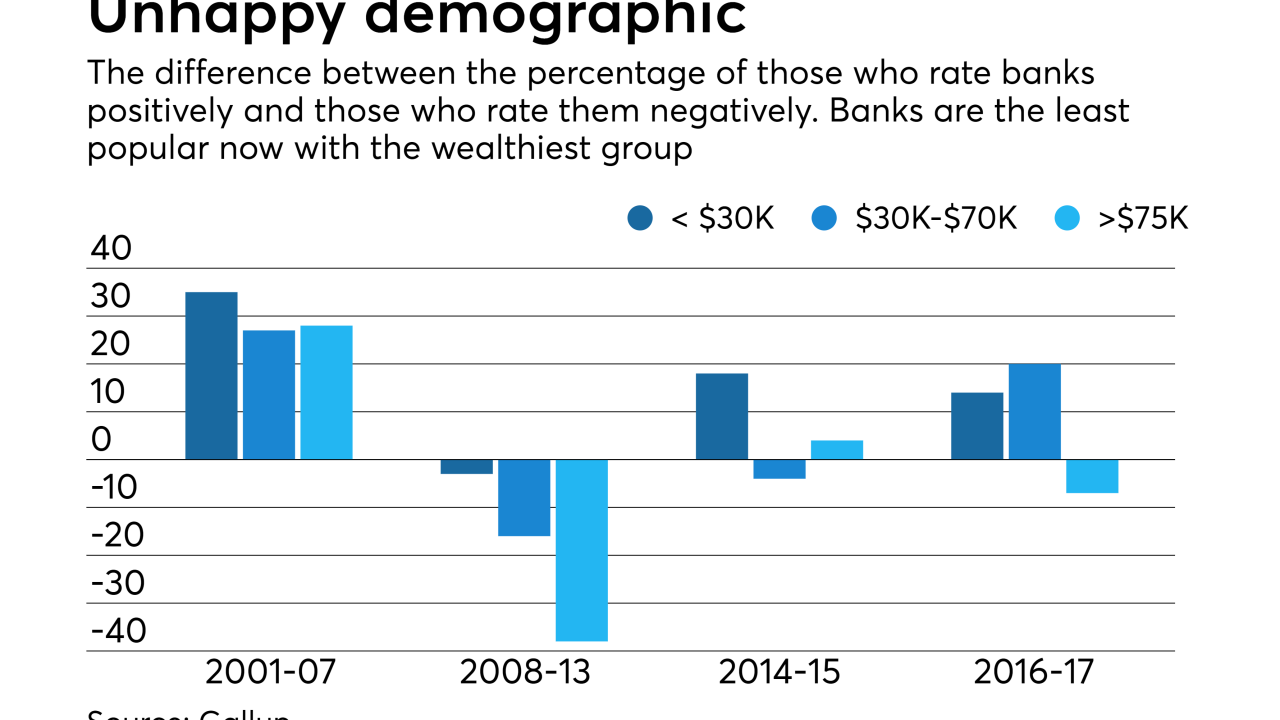

While the banking industry is winning over low- and middle-income groups, it is still trying to regain the trust of high earners who were stung during the financial crisis.

September 19 -

The Connecticut bank's president, John Ciulla, will succeed longtime CEO Jim Smith, who is retiring after three decades on the job.

September 19 -

Florida and Texas are normally major sources of mergers, but bankers in those states likely will take a break to assess damage from the hurricanes before returning to dealmaking.

September 18