-

Banks could be busy supplying credit to manufacturers, hotels, multifamily developers and other businesses that will be helping residents get their lives back on track after two fierce storms.

September 14 -

Chemical Financial's decision to shutter nearly 40 branches and cut more than 200 jobs is a result of improved technology and an effort to become more efficient after years of pursuing acquisitions.

September 13 -

A New Jersey politician has downplayed his Goldman Sachs career. The move shows that bankers have a ways to go rebuilding credibility with voters, though factors such as party affiliation, location and the type of banking career also matter.

September 12 -

The hurricane was expected by many to deliver catastrophe. Instead, bankers are largely looking to restore power and confirm the status of employees.

September 11 -

The agency has earmarked all funds from a Hurricane Harvey recovery package for direct relief, despite calls to get more bankers involved in the process. It remains to be seen how the agency will handle the cleanup for Hurricane Irma.

September 11 -

Associated's agreement to buy Whitnell & Co. comes just weeks after the company lined up its first bank deal since the financial crisis.

September 11 -

Texas bankers recovering from Hurricane Harvey are reflecting on their experiences, identifying what went right and what they could do better. Their views could prove useful to Florida bankers hurriedly preparing for the nation's next big hurricane.

September 8 -

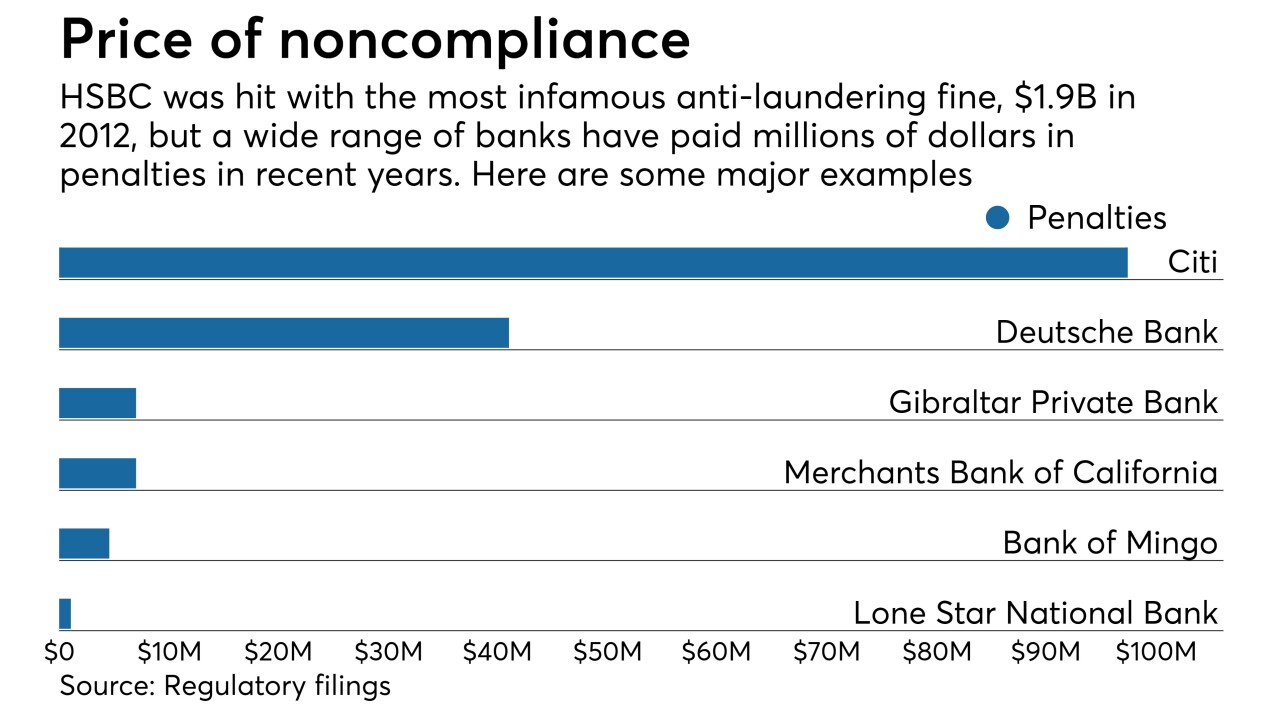

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

The Wisconsin company plans to shutter half of Bank Mutual's branches, including seven in Milwaukee.

September 1 -

The Houston company doesn't expect any material impact on its commercial-and-industrial book, though there is potential risk tied to residential mortgages. Management, meanwhile, has started rolling out programs to help customers recover.

September 1